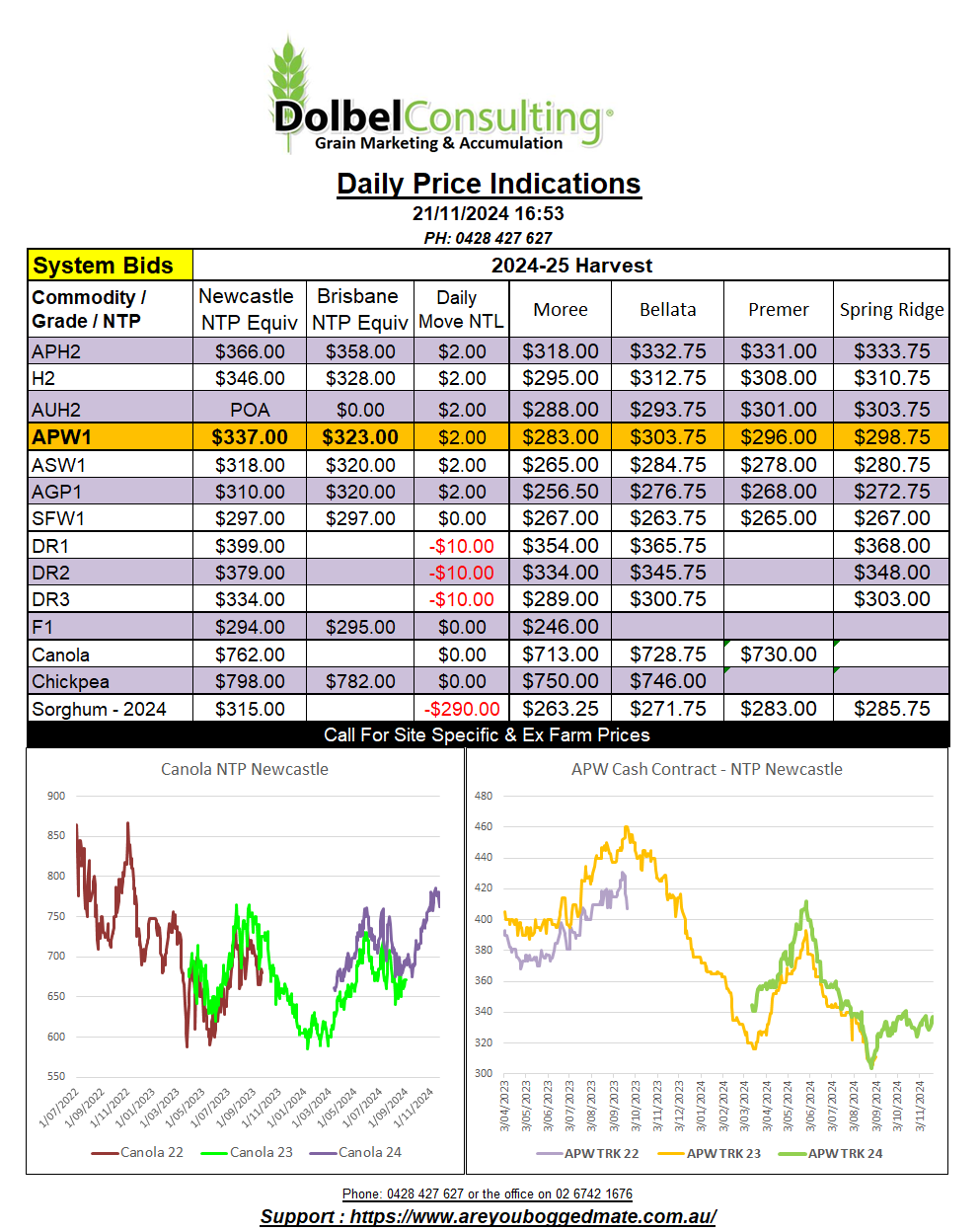

21/11/24 Prices

International Commentary

International wheat futures were firmer in overnight trade. Chicago SRWW and HRWW futures made small gains, as did spring wheat futures at Minneapolis. Paris milling wheat closed higher across all months, the March 2025 contract putting on €3.00 / tonne. Corn closed a smidge higher at Chicago and a smidge lower at the Dalian exchange. The move in corn futures and the softer AUD should roll across to support sorghum today. Both FOB US sorghum values and C&F China values were slightly higher in AUD per tonne this morning.

There was no support for Chicago soybeans, the nearby contract shed 8c/bu (AUD$4.52/t). The weaker bean price at Chicago and lower palm oil futures weighed heavily on both Winnipeg canola futures and Paris rapeseed futures, both closing sharply lower.

Algeria was said to have bought 350kt to 390kt of durum by tender at US$348 C&F (+US$12 for smaller vessels). On the back of an envelop this roughly converts back to AUD$410 to $413 Newcastle port equivalent. Yesterday local merchants were bidding $425 delivered Newcastle port for DR1. Quality of the NNSW crop remains very good but protein is mixed. There are areas of good protein but generally protein has been lower than average this year, often making DR2 grade or just spilling into DR1. The weaker AUD will help today but the tender business does appear to be a little lower than expected. the lions share of this tender is expected to originate from Canada. This may help explain the sudden C$5.00 drop in Canadian values on Tuesday. Overnight cash bids out of SE Saskatchewan were flat. French values were back just under a dollar when taking the weaker AUD into consideration.

Cash wheat values out of the US Pacific Northwest were higher by roughly AUD$2.00 to AUD$5.00 overnight. The weaker dollar helping a slightly firmer close in US futures look a lot better than it should have. H2 type wheat into the Asian market is roughly AUD$30 above US HRWW, a sustainable spread for quality.

Domestic Commentary

Volume on the offer side, the sell side, withdrew a little yesterday. Harvest operations picking up again late in the day. With little to no rain in forecast between today and next Tuesday, and temperatures creeping higher, 35C on Sunday / Monday / Tuesday, we should see a large slice of the LPP crop in the bin before the next rain event on Tuesday / Wednesday next week.

Quality remains excellent across the plains, there’s little wheat coming off below H2 grade at present. H2 on the track pushed a little higher yesterday but there wasn’t a huge volume hitting the market as offers to test the upside. H2 delivered Graincorp Spring Ridge was bid at $308.75 but the previous day did see firm offers to sell above this number get set. H2 for direct delivery to Newcastle port found a public bid of $367. Again, a firm offer to sell may have seen this bid trade at $370+. This would make H2 ex farm C-LPP roughly equivalent to $330 ex farm. H2 XF is well above system bid, and well above the ASW / SFW1 market on the plains, which closed the day trading at $320 delivered for either grade, roughly $300 XF, Dec / Jan.

Barley remains poorly bid and poorly supported on the demand side. There’s been no prompt homes pop up this week. BAR1 is bid at $280 delivered LPP feed lot for the Jan / Feb slot or $260 XF at present. This is still some $10 or more below many producer selling intentions, and some $40 below where SFW1 wheat is trading. Barley is very cheap. When stacked up against new crop sorghum at $345 delivered Newcastle port ($305 XF LPP), it’s still very cheap. Export parity for BAR1 is somewhere around $305 delivered Newcastle port when compared to cash offers into the Chinese market. Aussie C&F offers were up a little on the international market last night. Across most markets international barley values were some AUD$2.75 higher on average.