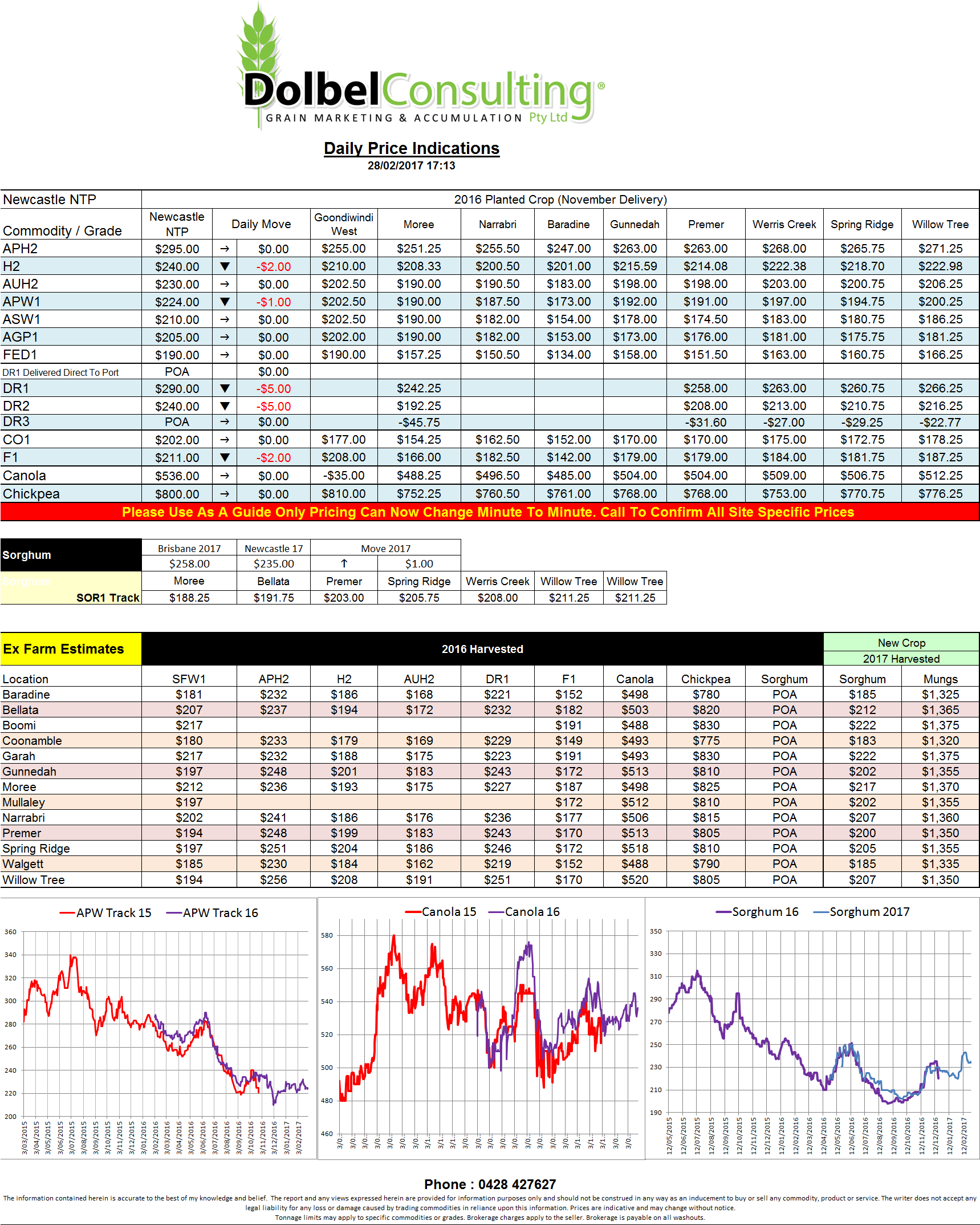

Prices 28/2/17

With the expiry of the March contracts just around the corner we are seeing funds roll and liquidate positions as usual. This is not boding well for wheat at present resulting in some sharp losses in overnight futures.

As you know a fund manager is unlikely to own a silo or have any desire to actually own physical wheat. The analyst suggest there is still a large number of open contracts at Chicago so we may see a scramble for the door in the short term. Keep in mind the funds and speculators can move some serious volumes in a hurry. With the funds holding small longs in both SRW and HRW we may see further losses tonight. So basically last night’s falls have probably got more to with end of month profit taking and fund rolling than anything the fundamental market has thrown up.

Most of the talk at the moment is to do with US and European summer plant acres and how big the soybean plant will be if corn prices don’t improve. There is expected to be a big swing away from corn to other crops, mostly soybeans, in both the USA and Europe this summer. This may sit well for the feed grain markets like barley and sorghum going forward into next year but it may also come at the expense of canola prices this year particularly if Canada sown the area to canola they are predicting. We will need to wait until at least mid June to confirm if the US and Canada have reduced durum area as most punters expect them too.