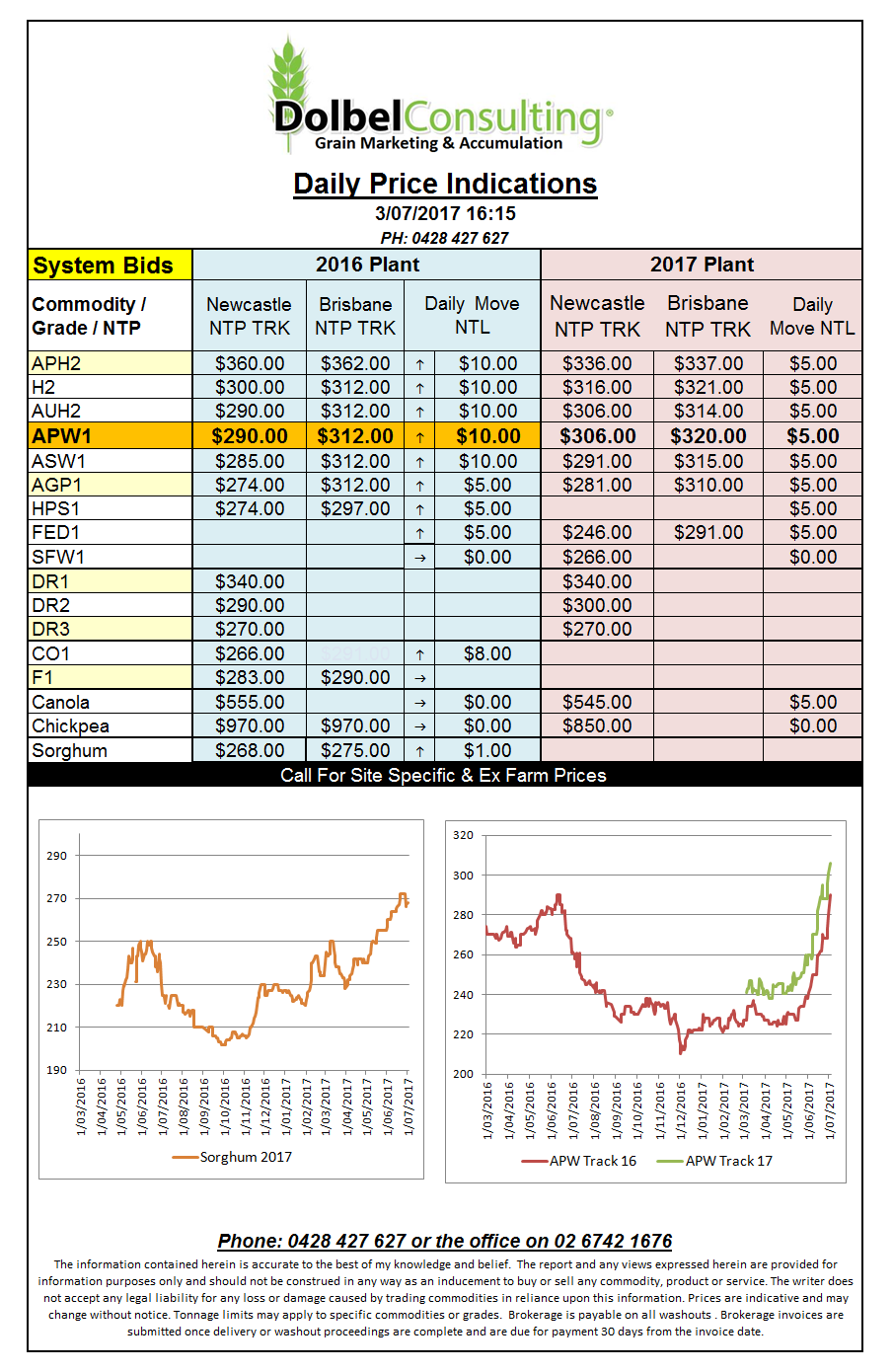

Prices 3/7/17

A mixture of USDA data and a bleak looking weather map for the Dakotas and the Canadian Prairies made for an interesting night for US futures traders.

Even corn got in on the action. When the USDA Acreage and Stocks report came out showing greater corn acres than expected everyone was thinking some downside but spill over buying from the soybeans and wheat pits helped corn move against the negative data.

The big winner was the wheat complex yet again. The USDA confirmed the size of the US wheat crop is indeed small with all wheat coming in a 45.7 million acres down 9% on last year, the lowest area since 1919. Spring wheat area is 10.9 million acres and durum area is 1.92 million, down 20% on last year. When you realise that both the spring wheat and durum wheat are also both currently slipping into drought conditions it does send the message to the US futures punter that maybe the short side isn’t the side to play from in 2017. With the US markets shortened on Monday and closed on Tuesday it will make for an interesting week.

Soybeans rallied when the USDA report showed less acres than expected, this rolled through to the ICE canola market which put on some useful gains against what was basically a bearish StatsCanada report early in the week.