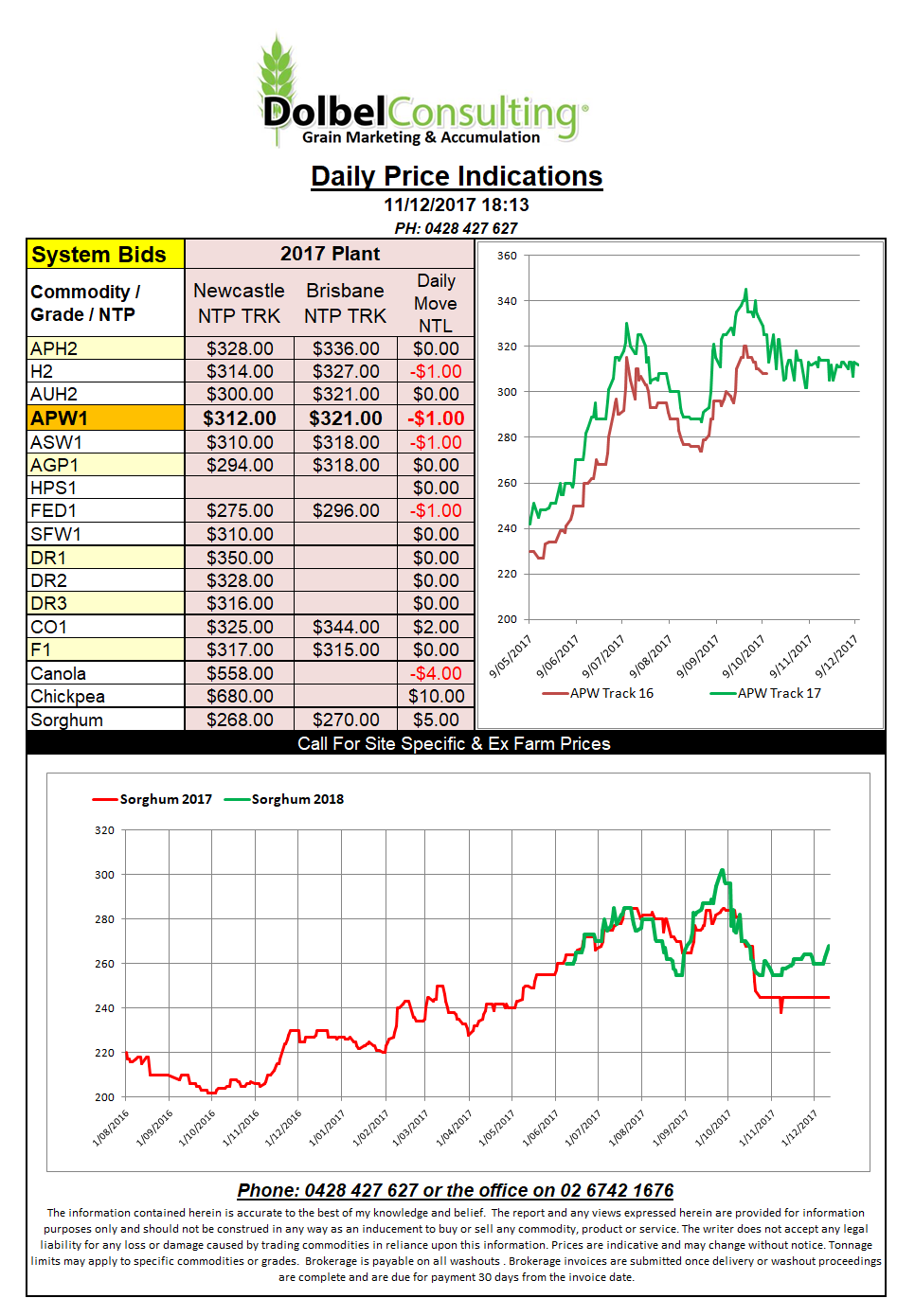

Prices 11/12/17

US grain futures were flat to lower in yet another uneventful session.

There is simply nothing but stale news and speculation feeding this market at present, why is that different to normal I hear you ask, well the news is particularly uneventful and the speculation is generally focused around the weather which the entire world is also split on at the moment. The development of the La Nina is seeing the punters think that corn and soybean yields / area in S.America will slip in 2018. While in Australia wheat production that was already pretty low on the east coast is getting downgraded.

Meanwhile we have Russia producing US$34M in subsidies to encourage faster exports out of the Black Sea to try and move some of their record wheat crop onto the world market. As you can imagine this may well result in short term pain and longer term gain as stocks reduce quicker than expected. Or it could simply mean some port officials have a very handsome Christmas present this year, we are talking Russia after all.

While on markets made of smoke and mirrors we see NCEDX chickpea futures continue to slip away. The difference between the January and April contract is now down to just over AUD$50 / tonne this morning. So that’s about $25 in premium and $25 in carry. They have all but managed to converge two markets 4 months before convergence. I’m not saying the CBOT guys should take a leaf out of the NCDEX book by any means but it’s good to see convergence can actually happen…….. it’s just a little disturbing the way it is happening. Makes you wonder if the little break the chickpea contract had a while back due to speculative activity solved anything at all.