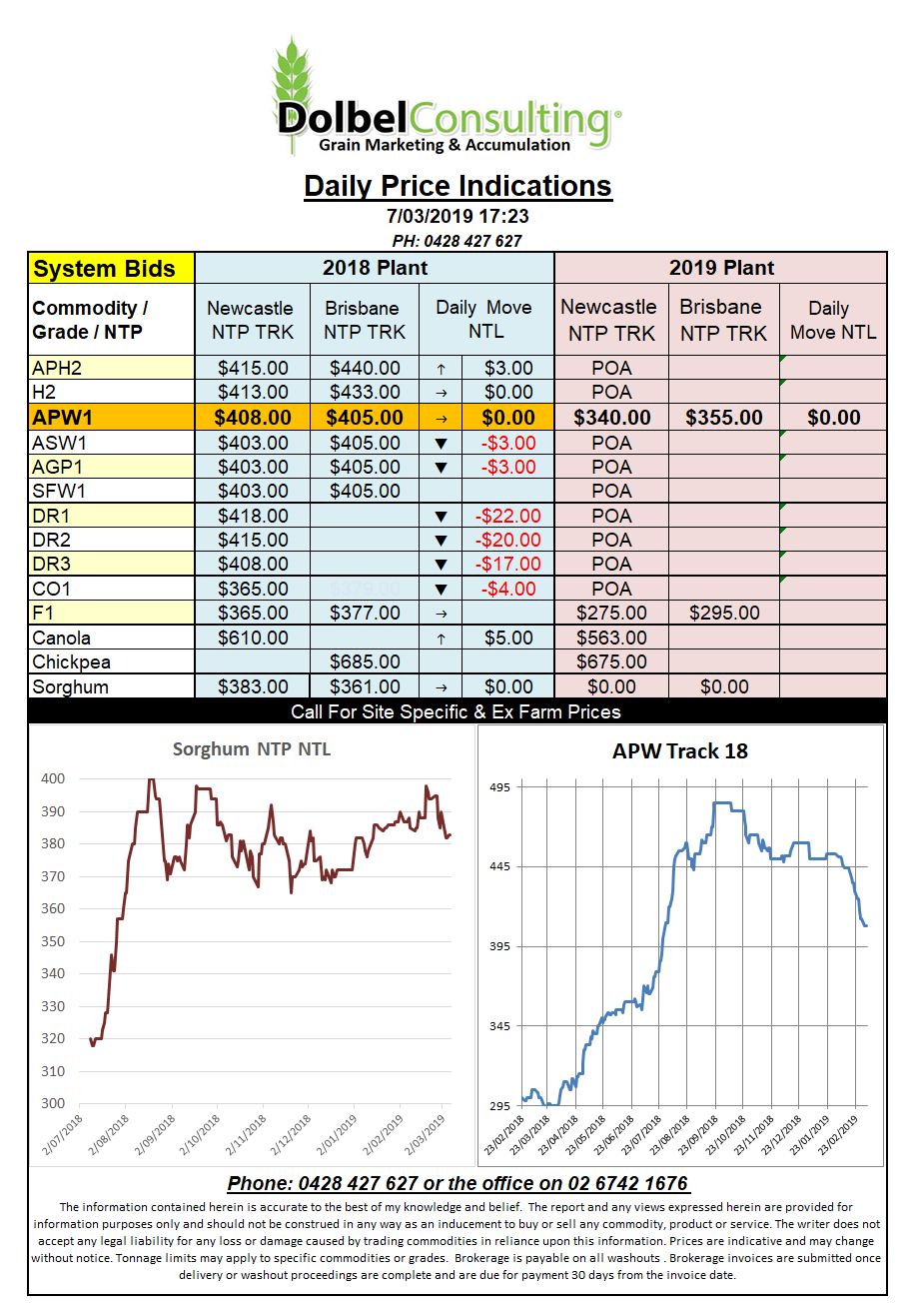

Prices 7/3/19

CME soft red wheat futures in the USA set a 13 month low in overnight trade. The funds were not as completed with their massacre of wheat futures as what the analysts had expected and managed to crush nearby wheat another 2.5% last night.

The pessimism is generally US centric with most believing we’ll see a significant uptick in US wheat ending stocks in tomorrow night’s WASDE report.

A lack of fresh news on the US / China trade deal continues to be an anchor on sentiment. This resulted in both corn and soybeans also falling further. The weaker soybean market also rolled across into ICE canola which in turn is having its own issues with a trade problems developing between Canada and China on further and existing canola imports.

Paris rapeseed futures actually saw a slight recovery in values overnight. It will be interesting to see if the local new crop market decides to follow Canadian values or Paris values, maybe a foot in each camp.

The US markets are not the only wheat futures market being crushed by the funds. In Paris milling wheat futures have also seen a net increase in fund shorts.

It looks like it will take a very significant failure of production in one of the major importing nations to trigger a turnaround in wheat. We’ve seen smaller crops in Europe and Australia have little sustained impact on world ending stocks and values in 2018-19.