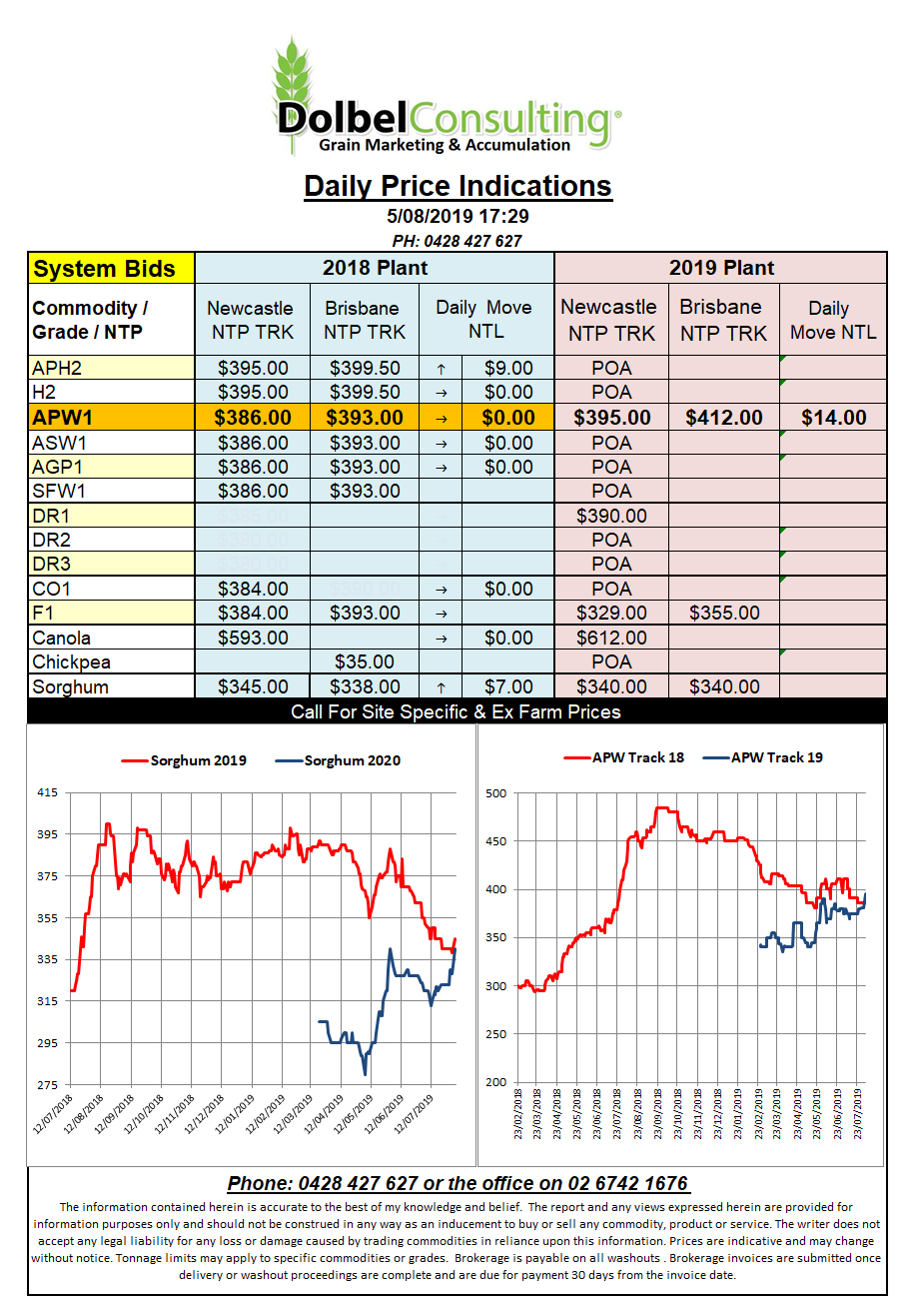

Prices 5/8/19

The bargain hunters came out from under their rocks to buy cheap US grain futures overnight. Wheat, corn and soybean futures at Chicago pushed higher against flat to weaker fundamentals. The China deal with the US continues to be a major concern and the weather in the US is pretty much ideal too. The major driver from a speculative perspective is corn acres.

The international market is keeping its eye on production across Europe and India at present. A hot summer is expected to prune summer crop yields in parts of Europe possibly increasing feed demand. With a good quality wheat crop coming off in Russia and Ukraine this year feed supplies maybe a little more difficult to find. The US corn crop is expected to be lower than average but export demand hasn’t really increased yet.

In India we see a lighter than average monsoon reducing summer crop plantings. Corn area is back almost 7% but the major one to watch is rice production. Although the rice crop will be back on last year it is by no means a small crop at 112mt. Another large wheat crop (100mt) may go some way to countering the 4mt drop in rice production.

So fundamentally we need to see confirmation of US corn acres and some final yields in Europe. Rising offer values for Black Sea wheat is promising too. Technically Chicago wheat is oversold and had been for most of July. Export pace is about the only thing that will fix that.