6/11/20 Prices

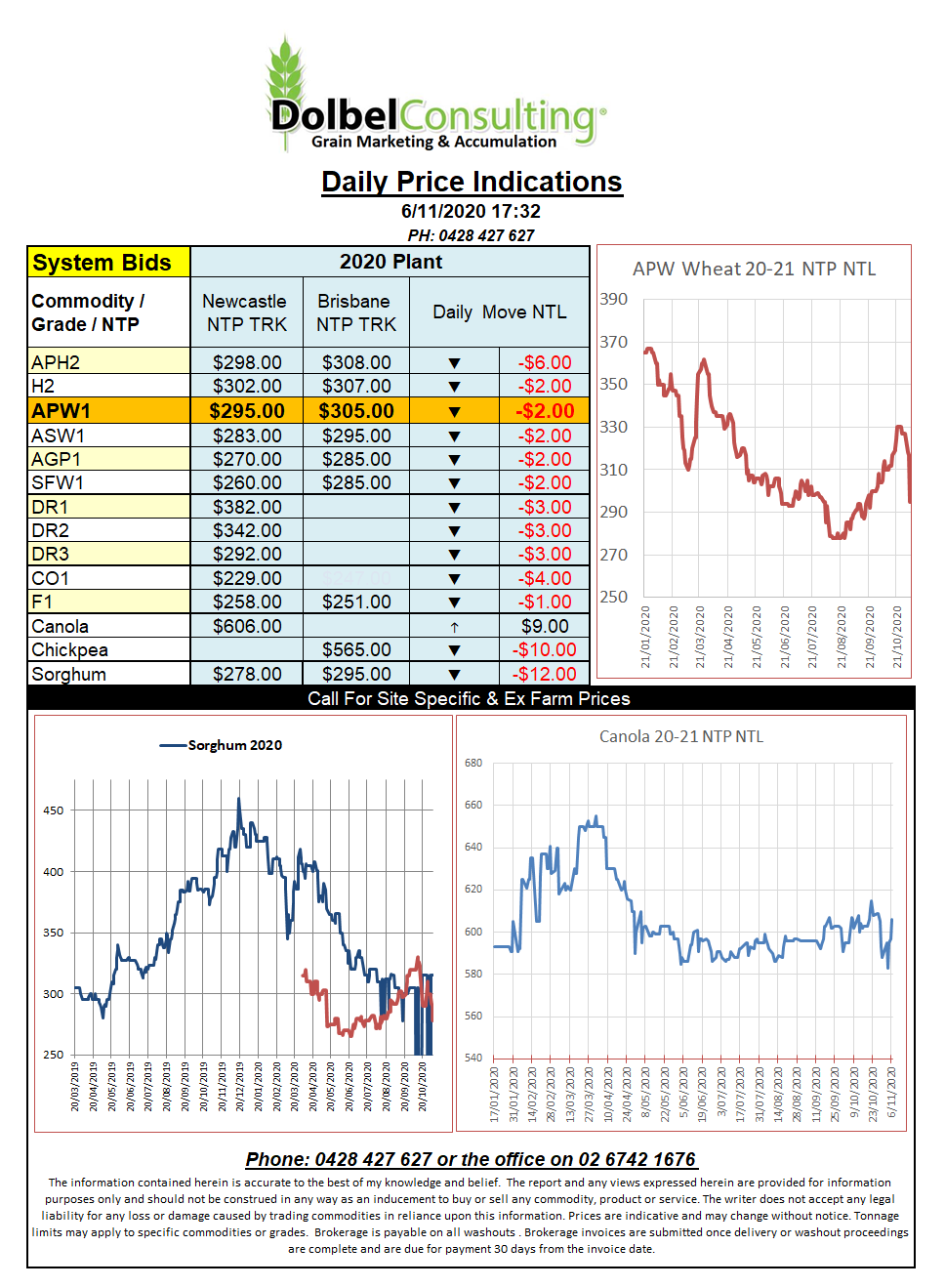

Chicago soybean futures had another good night closing 22.75c/bu higher on the nearby with both the Nov and Jan21 contract now over 1100c/bu. The move in beans rolled through to both the ICE canola market and the Paris rapeseed futures contract. The stronger AUD will take some of the potential upside out of today but there’s a good chance we could see some firmer bids if basis is sustained.

Wheat and corn at Chicago enjoyed further technical support. December wheat has bounced off the bottom of the stochastic but is still technically over-sold so could see continued support going into next week. Last night’s close was towards the lower end of the day’s range, the session high coming in at 626.25c/bu, well above settlement value.

A stronger Aussie dollar will probably stand in the way of a Friday rally, it’s hard enough to get a rally out of flat fundamentals on a Tuesday let alone a Friday. The US dollar weakness is expected to persist in the short term, at least until the US declares a red or blue tie in the white house and some stimulus measures are introduced by the new leader. The punters expect to see a big COVID plan revealed, let’s just hope the US senate is keen to make this work. I’d like to see 600c/bu wheat futures and 65c currency for Christmas thanks Santa.

Black Sea wheat was back US$3.00 per tonne according to the latest 300kt sale to Egypt. The Ruble continues to fall against the USD.