12/11/20 Prices

There was some profit taking in the wheat and corn pit after yesterday’s rally at Chicago. Soybeans managed to hold onto gains and add some more. The ICE canola market was closed in observation of Remembrance Day, so no canola data from there this morning but the Paris exchange saw rapeseed futures slip a smidge in the Feb21 slot and rally a little in the May 21 slot, later months were softer. This continues to indicate that global demand is more focused on the nearby 2-3 months.

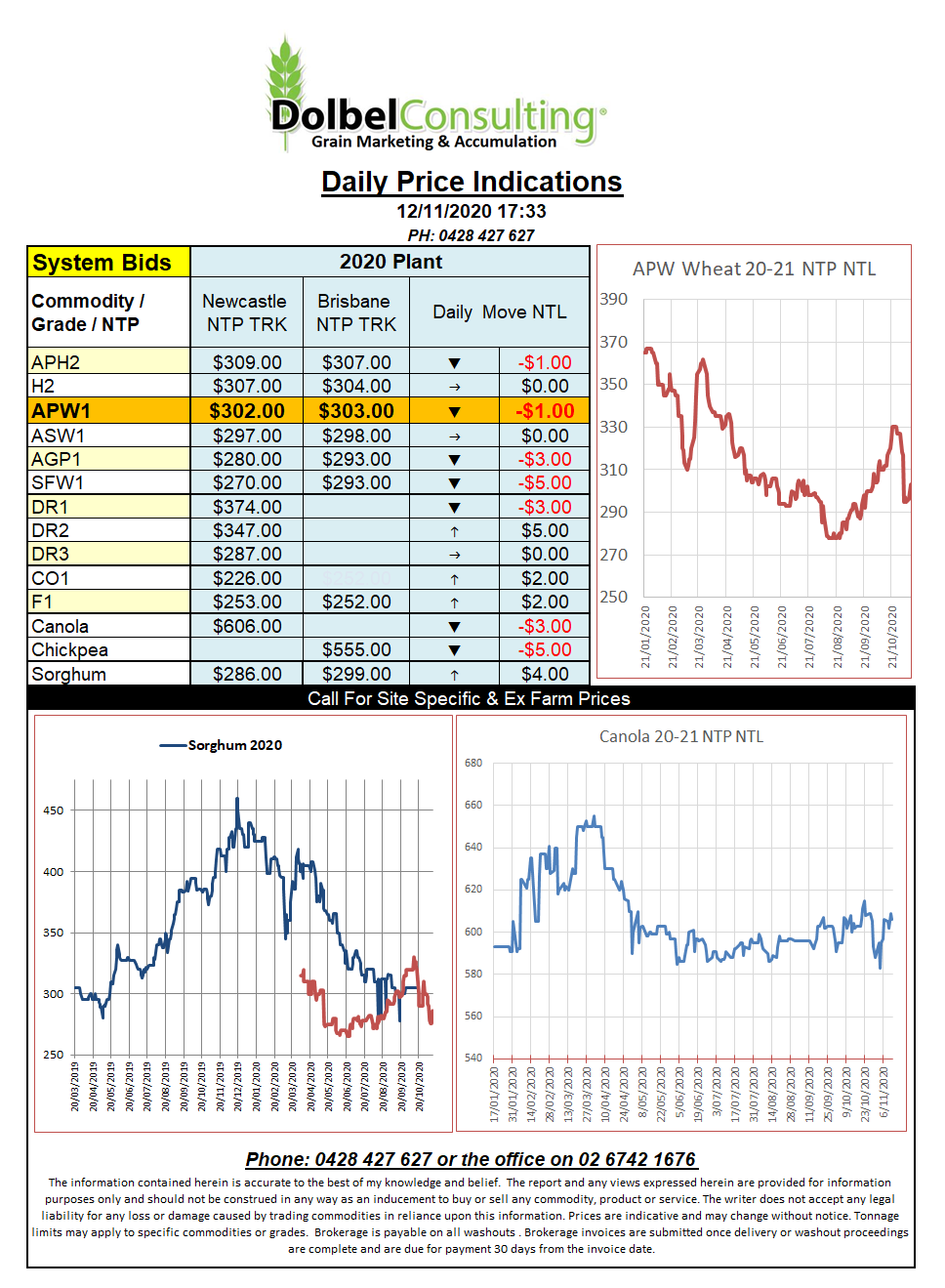

Chicago wheat futures gave back a big slice of the WASDE rally last night. Local markets didn’t follow the rally dollar for dollar so hopefully local markets will continue that trend and not follow it dollar for dollar today.

Looking at wheat bids out of the Pacific North West of the USA we see Club White Wheat was unchanged to firmer, basically taking no notice of the move at Chicago. This would compare to a value close to AUD$300 delivered port Newcastle. The Aussie FOB APW Platts wheat contract at Chicago rose US$2.00 per tonne overnight, settling at US$260.75 for the Feb21 slot. On the back of an envelope this converts to something close to AUD$284 XF LPP for APW1. Yesterday APW1 cash bids into Newcastle were at AUD$318 delivered, this does compare favourably to the Platts conversion.

Cash bids for 1CWAD13 durum across SW Saskatchewan were flat to firmer at C$294.94 for a Jan21 lift. Interesting to see a June lift paying C$299.51. The Jan21 value compares roughly to $405 port Newcastle for DR1, cash bids at Newcastle were closer to AUD$389.