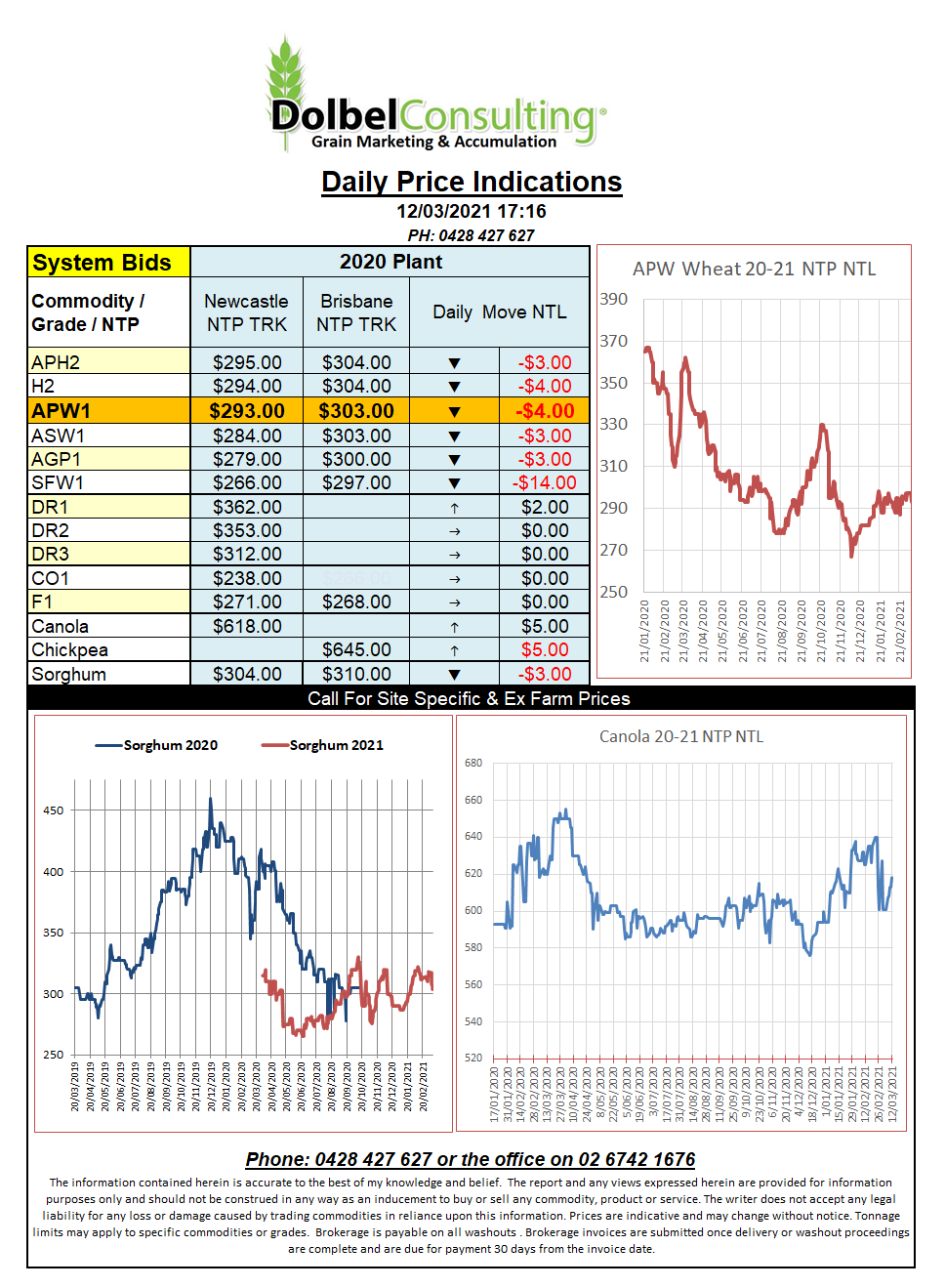

12/3/21 Prices

Chicago wheat failed to follow corn or soybeans higher overnight, instead closing not far off the sessions low. The stochastic for May21 SRWW at Chicago continues to indicate a very oversold market. This kind of chart often signals some buying and a price recovery is just around the corner. So it may just be a case of waiting to see what the crop condition is like in the northern hemisphere as we move into April, a crucial month in determining final production.

Most of the move higher in corn and soybeans was to do with production potential in S.America. A recovery in US ethanol demand is not hurting row crop values in the US either. Some US policy changes in the pipe line could also increase ethanol demand in the US as blending limits are in theory increased under the Biden administration.

Soybeans saw a push / pull market. Production issues in S.America eventually winning over the potential downside from another ASF outbreak in China. The rain in Brazil that is causing some serious bean harvest and quality issues, is also delaying the late corn plant. Keep an eye on US soybean shipping and sales volume to confirm if China are walking away from a poor Brazilian crop.

What drives beans drives canola. The surge in palm oil prices, firmer bean futures all combined to drive ICE canola and Paris rapeseed higher. The May21 Paris contract jumped E9.75/tonne to close at E519/t. Cash prices in SW Saskatchewan moved sharply higher with ex farm bids for a April lift at C$782/t. On the back of an envelope this would equate to an AUD port price in Newcastle of something close to AUD$896 / tonne. That should see Aussie basis back to -$200 again today after recovering to -$182 yesterday -_- .