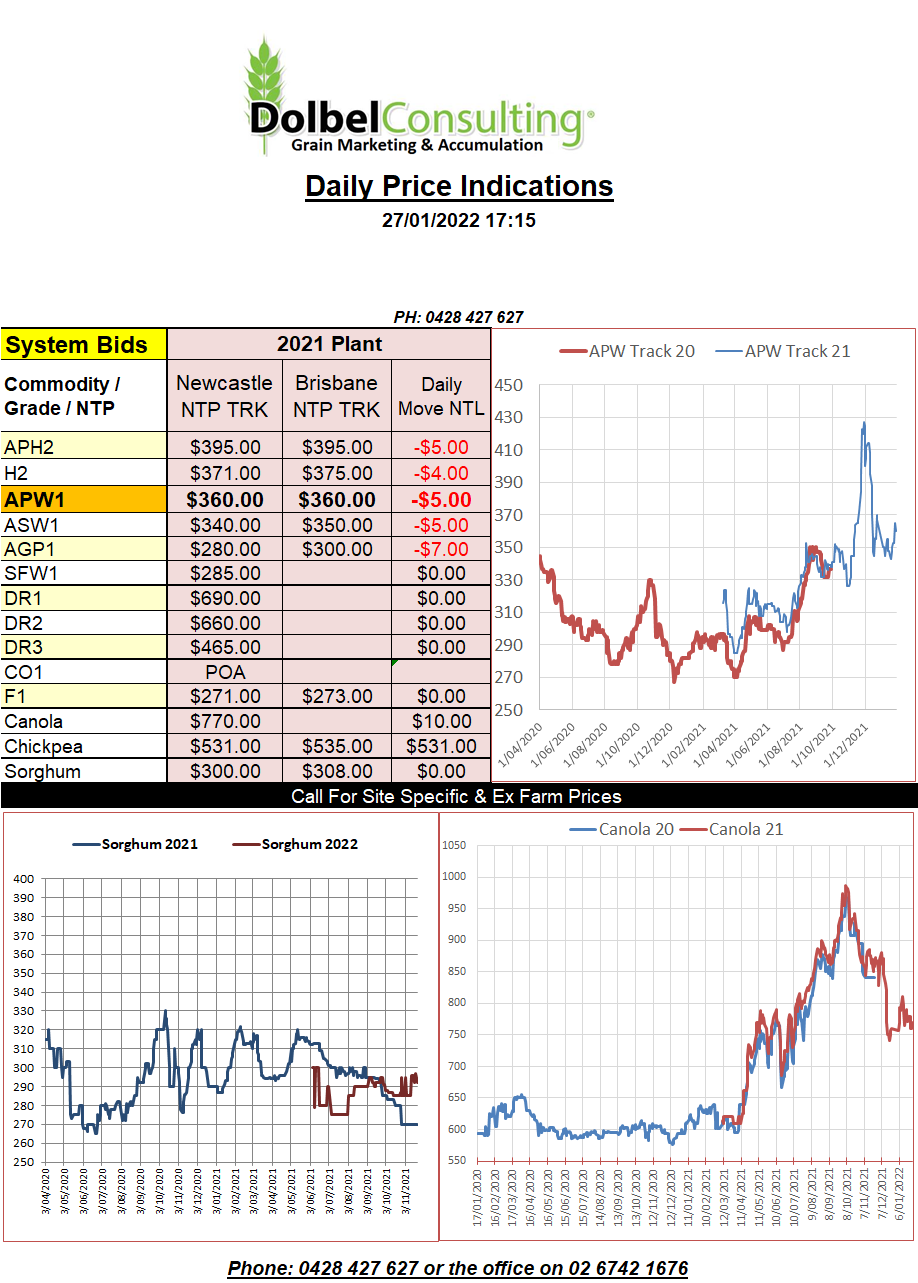

27/1/22 Prices

Sell wheat, buy corn / soybeans seemed to be the cry at Chicago last night.

The punters are quickly coming to the realisation that the Russian / Ukraine situation, although worthy of a mention in a news articles, is probably not the catalyst for WWIII as the US media was portraying it to be. In the past, for example when Russia took back their bases on Crimea, grain exports from Ukraine and Russia were unaffected. With this in mind speculative money moved away from wheat and back into soybeans. China is expected to increase purchases of US soybeans in the near term as Argentina toys with export levies and Brazil gets closer to harvest but appears to have its own issues regarding production.

The strength in Chicago soybean futures spilt over into the canola and rapeseed futures market, stopping the decline noted in Tuesday’s session. Paris rapeseed was up E8.50 per tonne on the nearby, Winnipeg +C$2.30 with the outer months generally flat. Cash bids across SE Sask were generally flat to slightly firmer.

The sharply lower wheat futures at Chicago pulled port prices lower with both US and Canadian offers out of the Pacific North West shedding value. Internal bids for 1CWRS13.5 wheat out of SE Sask were also sharply lower, down C$12.66 for the March slot ex farm.

S.Korea picked up 54kt of feed wheat overnight, the price was expected to be about US$332 C&F. Roughly equivalent to AUD$355 XF, indicating local SFW1 could well fit the sale, it is an optional origin purchase.

The Philippines also confirmed the purchase of 35kt of Aussie feed wheat for shipment in April.