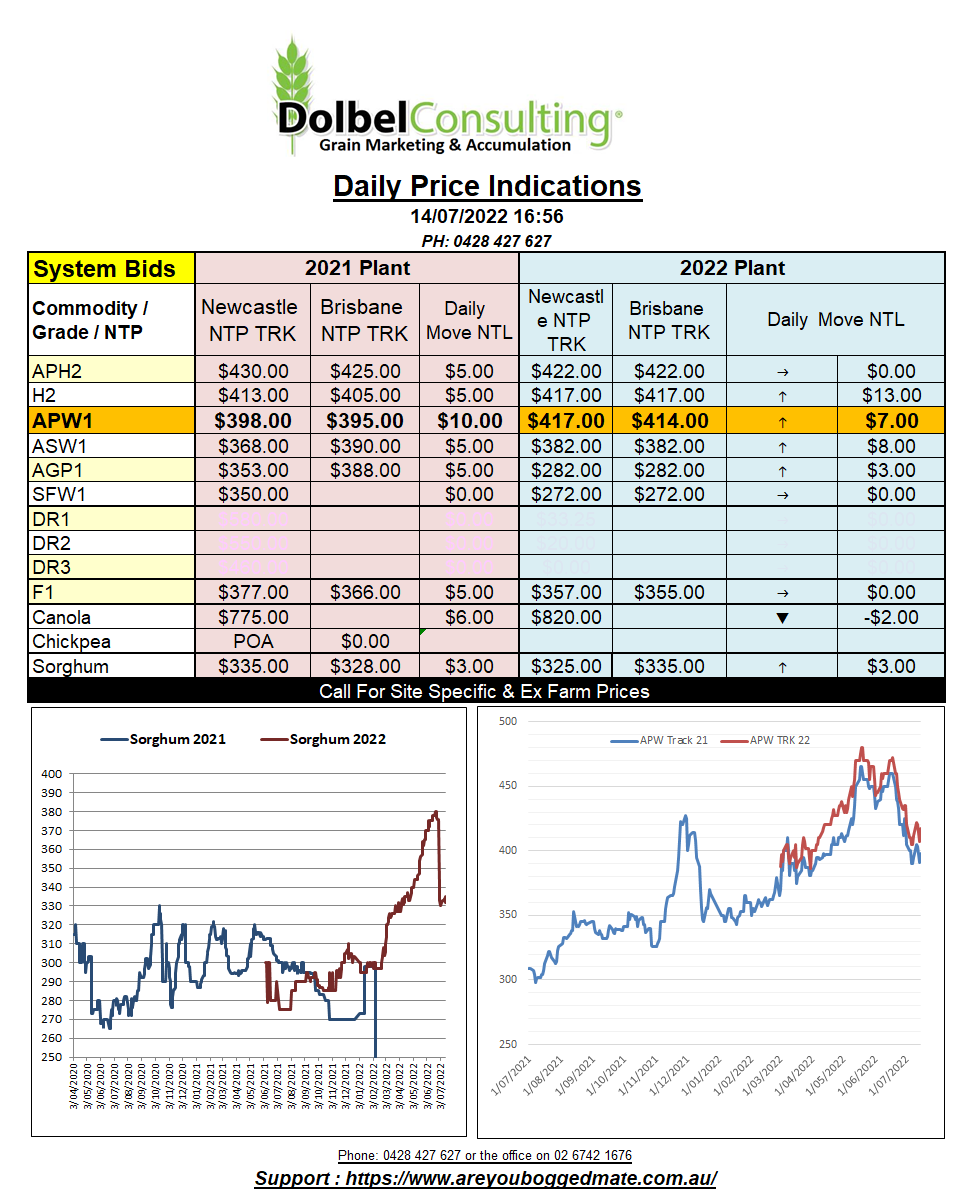

14/7/22 Prices

The bargain hunters were in the mix last night picking up “cheap” corn and soybeans at Chicago. Wheat found support but still struggled and closed a little lower in all three grades.

Talk of potential weather damage to the wheat crops in the Baltic region assisted the bulls. A closer look at that region shows wheat production in Sweden is currently predicted at 5.3mt, about average and 400kt better than last year. So, it is not so much the volume as the problem, but the quality according to some reports. Further west across the Baltic Sea rainfall during harvest is also threatening to down grade wheat fields from far NW Poland through Lithuania, Belarus, and Latvia, none of which produce enough wheat to really have an impact on wheat markets. The bigger issue in Europe remains the conflict between Russia and Ukraine.

Russia is roughly 10% through their wheat harvest now. As of July 11th, Russia had reaped roughly 11.6mt. Russian wheat exports are a little behind average but are expected to be between 2.0 and 2.6mt during July. The weaker rouble is helping local prices firm at a time wheat farmers are sellers. The reduction in export taxes is also seeing the buyers actively meeting the offer, so supply for nearby loading should not be an issue. With a projected 2022-23 export tonnage of 43mt the export pace will need to pick up. The last thing we want to see is sharply higher Russian stocks leading into the new year.

Odessa port is not yet able to export wheat, greatly limiting Ukrainian export capabilities. Danube channel access is good but the volume possible through this route to the Black Sea is not huge.

France reduced both the area sown and the average yield of soft wheat, the dry spring taking its toll. At least the current conditions in France should allow for a rapid harvest.