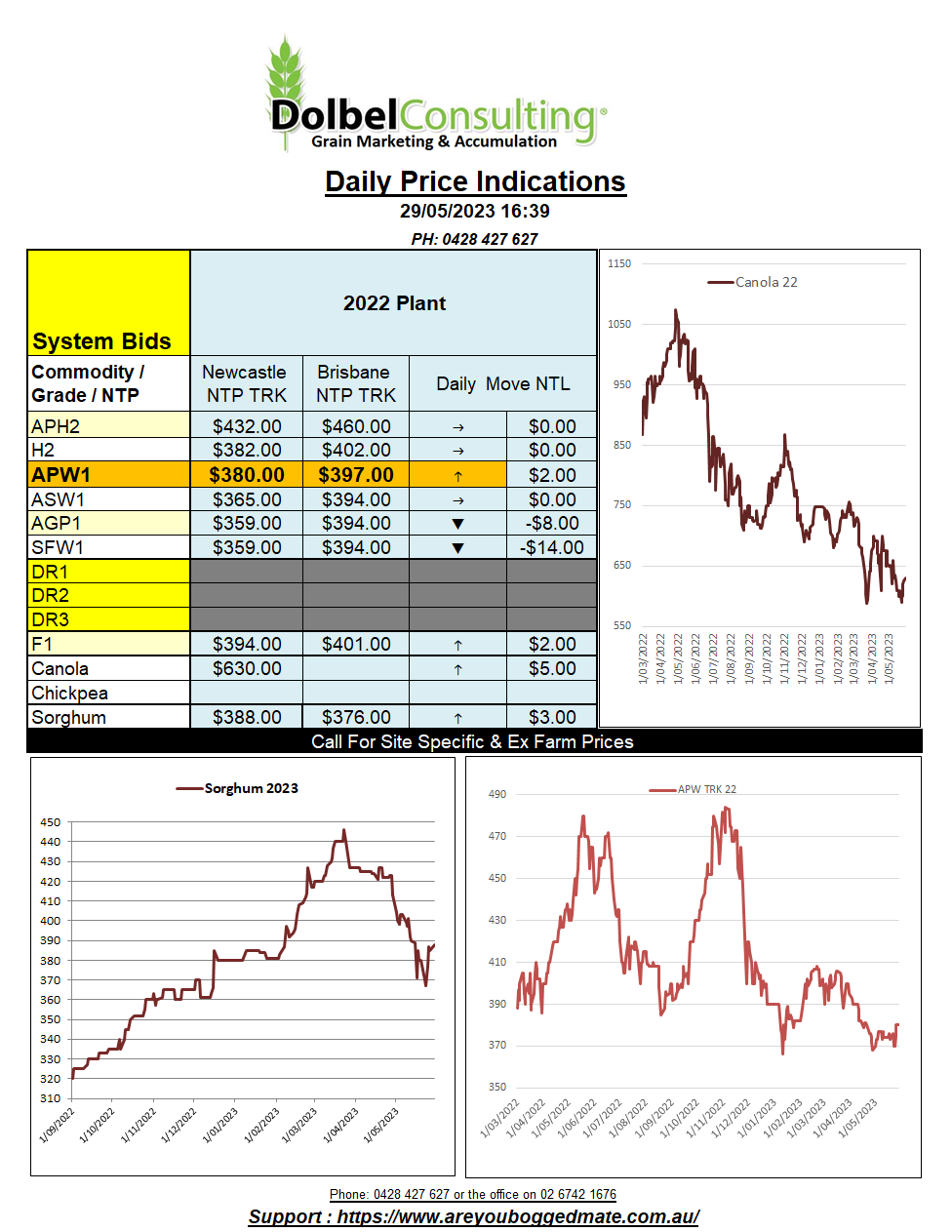

29/5/23 Prices

US and European grain futures were firmer in overnight trade. Chicago SRWW played catch up to the HRW and spring wheat markets. Both CME corn and soybeans were also higher. It was good to see both Winnipeg canola and Paris rapeseed futures closing higher. The move in Paris rapeseed futures is roughly equivalent AUD$5.50 upside here on Monday given no decline in basis.

Cash wheat prices out of the US Pacific Northwest were mixed, white wheat values were a little lower and HRW and DNS wheat were firmer.

Spring wheat values there are now higher than HRWW values FOB PNW for the first time in ages. That’s a little hard to explain given the outlook for the US HRWW crop and the average sowing pace of the US spring wheat crop. Possibly the PNW spring wheat price is reflecting the dryer state of Saskatchewan and the HRW price is trying to remain competitive into the Asian markets prior to the headers starting, regardless of whether the US is importing HRW from Europe or not, doesn’t make much sense to me.

Milling wheat if priced at US$239 FOB France, is worth maybe US$269 C&F USA. Currently we see US HRWW offered out of NOLA at about US$360 FOB. The difference between import and export parity is usually somewhere around US$100 as a real rough guide. The FOB values out of NOLA are actually higher than the FOB values out of the PNW for HRWW. The current PNW HRWW numbers being reported by the USDA don’t make much sense to me.

Rain is expected to fall across the drier parts of the Russian winter wheat regions next week, eastern Ukraine may also benefit from some showers. Drier weather across northern France is expected to persist while the SE of France and Spain finally see a few decent showers. Italy remains too wet.