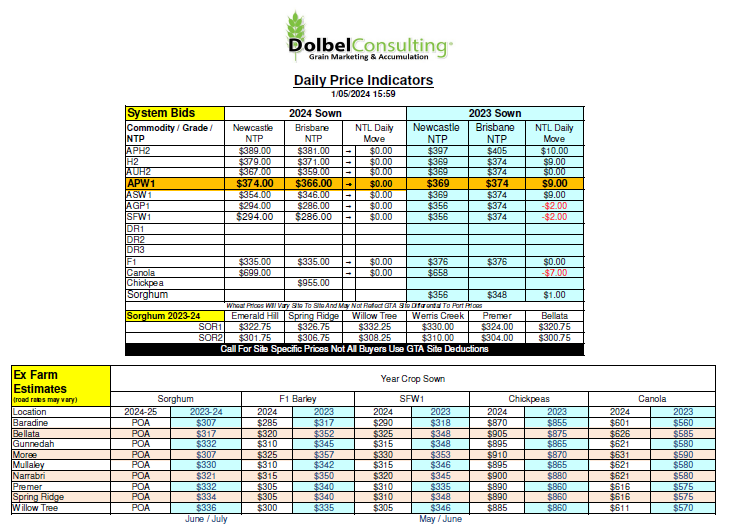

1/5/24 Prices

A sharp decline in the value of the Aussie dollar will help counter the general slump in both grain futures and cash markets overnight. The 7 day forecast for the US HRWW belt looks mostly beneficial to the southern and eastern half. This may be a matter of too much too late in the south, stripe rust is already a problem in parts of Oklahoma. Western Kansas is expected to see some light showers, so conditions remain poor there but the rain is likely to counter any further downside potential in the USDA crop progress report next week.

The slippage in wheat values is partly fundamental, a good sowing pace for US spring wheat and rain on developing heads in winter wheat won’t hurt.

The funds have been big buyers leading up to the 1st of May. Last nights drop in US wheat futures may simply be signalling that the funds have cleared / rolled what they wanted too and are now it’s back to business as usual and are taking profit after the recent surge higher.

Chicago soybean futures were caught up in technical selling, pressure in beans spilled over into rapeseed and canola futures. Paris rapeseed saw E8.25 peeled off the May24 contract, while the Feb25 slot closed down E5.25. Winnipeg canola was back C$12.50 nearby and back C$13.30 in the Jan25 slot. The weaker AUD will help counter the softer close at both Paris and Winnipeg but not 100% of it.

The weaker AUD was attributed to a combination of the market expecting more rate hikes in the US and poor retail sales in Australia. As someone who has a retail store in Australia all I can say is, no shit Sherlock. What rock have these analyst been hiding under, possibly one dug up by their bosses. My April 2024 turnover is the 2nd worst month I’ve experienced since 2016, only being beaten by the March figure leading up to the convid fiasco in 2020. I’m more than happy to talk to anyone looking for an off farm business to drought proof their enterprise. And what has the population done over this last 12 months ??

Turkey tendered for sale 100kt of durum, the highest offer was US$371.71 FOB, no sale confirmed yet. These values are much higher than their March tender.