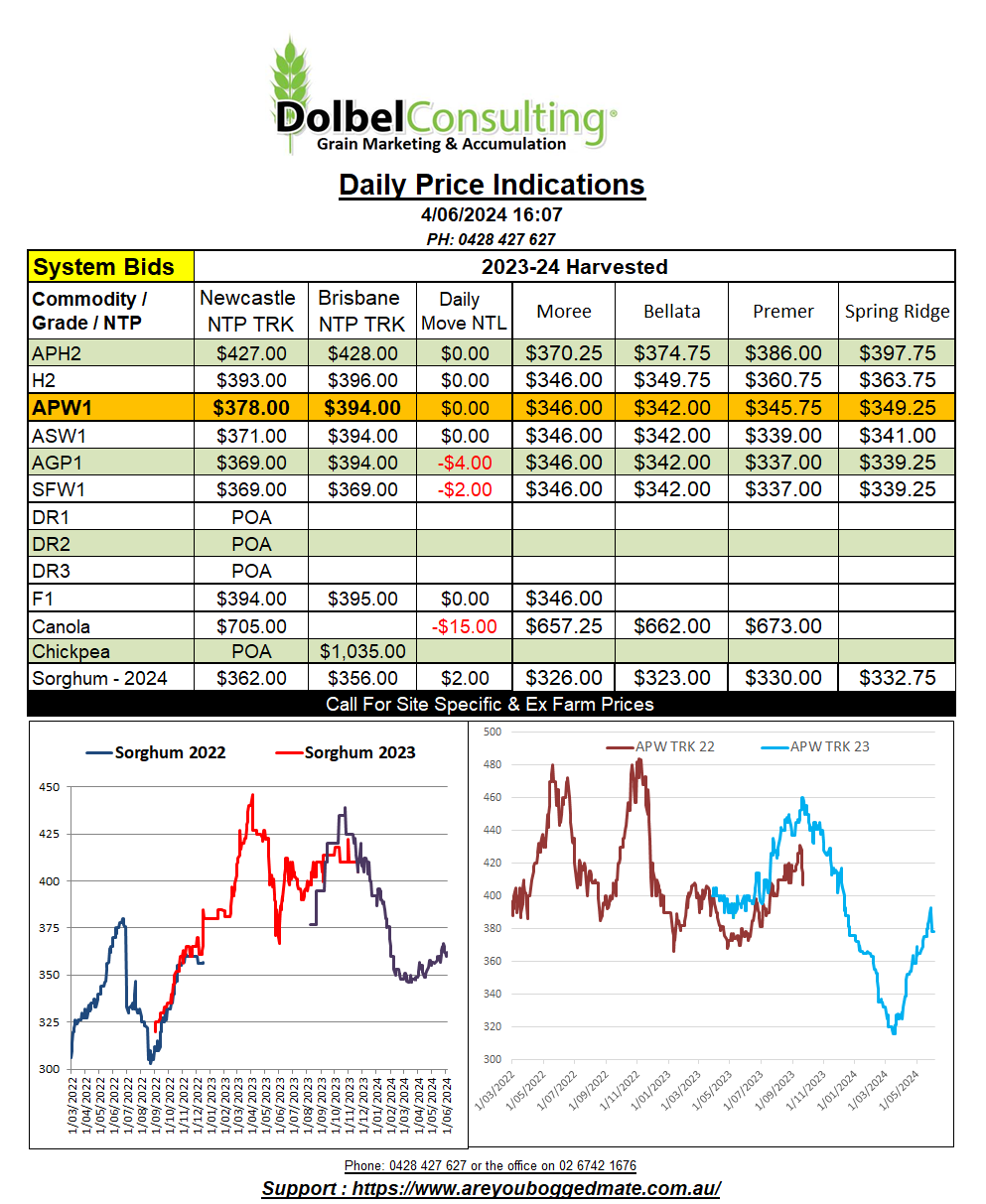

4/6/24 Prices

Rabo bank has announced that Australia is expected to sown a larger area to wheat than last year. Given the timing of rain across the eastern and western states over the last week or so a slightly larger area just might turn out to be a bit of an understatement. Too late for canola, barley’s not really paying a premium, durum is like a merino lamb and spends most of its life trying to find something to kill it, and chickpea seed is running out. That doesn’t really leave a lot of alternatives crops to wheat for most.

The futures markets continue to try and determine what drought and frost has done to the Russian wheat crop and if larger production across Australia is likely to counter their losses. Australia is a large wheat exporter, it’s not a huge wheat grower when compared to Russia, China, India, the EU of the USA. A 10% increase in production here over last year would only equate to an addition 2.5mt to 3.0mt. Not exactly enough to counter a possible reduction of 6mt to 7mt from Russia. World wheat stocks will need to be watched closely this year. I can’t see the global S:U ratio slipping under 30%, but increased international demand for quality, and additional product for N.Africa, could put demand on both Canadian and Australian supplies.

Winter durum is starting to be harvest across SE Turkey, yields are good and their domestic prices have come off significantly since the new crop durum began to appear on the market. This happened last year too. The Turkish crop is likely to limit the upside potential of world durum values in the short term and could possibly push prices lower. Possibly closer to milling wheat values in the mid to longer term according to some analyst.

Canola and rapeseed futures saw significant losses overnight. Double digit losses in Chicago soybean futures didn’t help. Bean planting is progressing well, 78% sown, this, and the progress in canola sowing and development across the Canadian Prairies is generally more bearish than bullish.