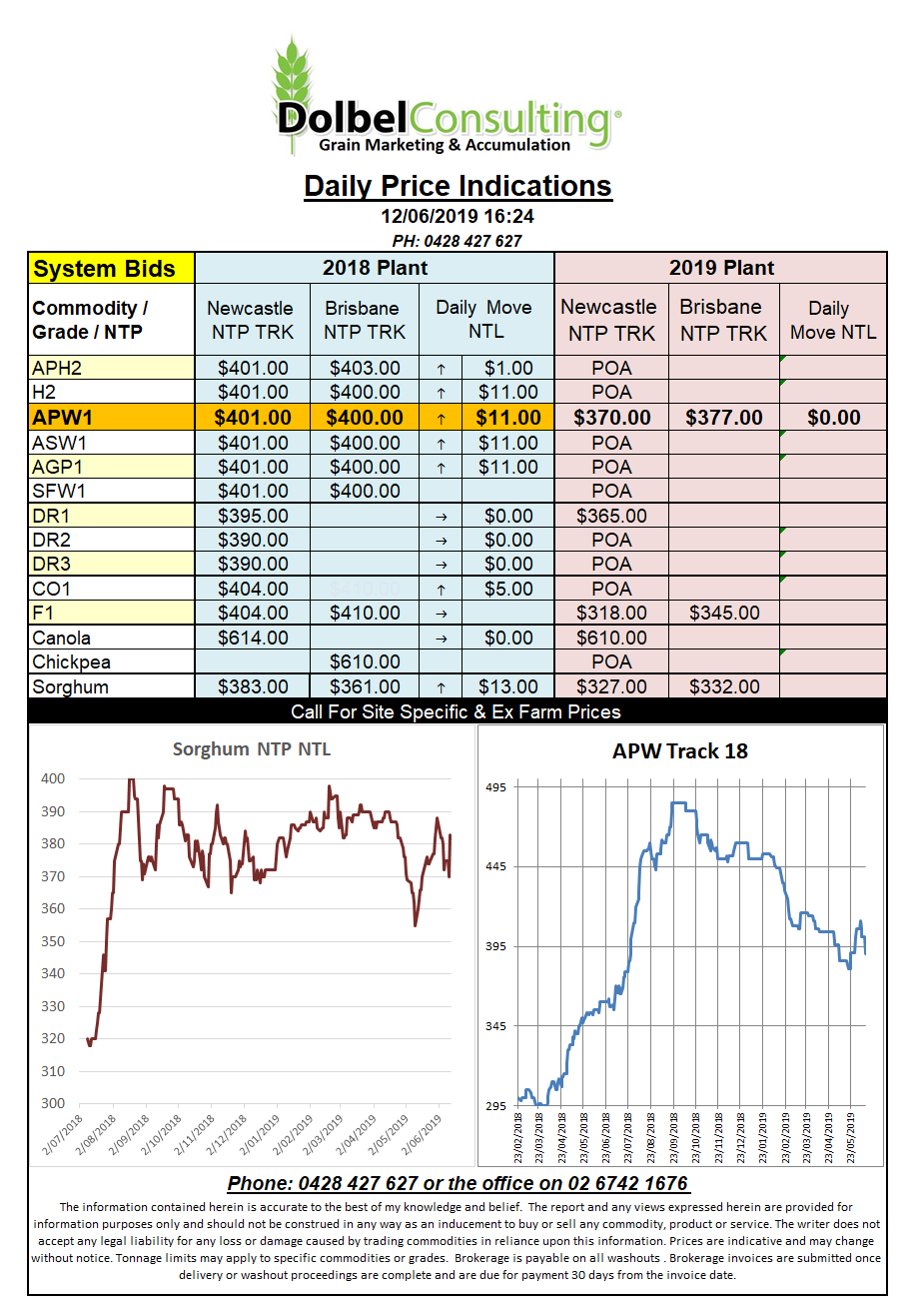

Prices 12/6/19

The USDA report: Projected US corn acres sown has been reduced by just 3mt to 89.8mt. The big move was in the projected yield. Last month the USDA had pegged an average yield of 4.47t/ac, this month we see the yield estimate lowered to 4.22t/ac. The final production estimate comes in at 347.49mt, a month on month decrease of 34.29mt, so probably a little better than a yawn. For the US, domestic consumption and exports were both reduced but the final ending stocks number still fell leaving a respectable stocks to use ratio of just 11.8%. When this stocks to use ratio falls below 10% usually things get very interesting. I’d put money on further reductions, maybe up to another 10-15mt to come out of that production estimate over the next couple of months, depending on the finish.

As for wheat the saying rain makes grain may have had an impact on the punters sitting behind the desks at the USDA. US yields were increased a smidge bringing total production estimates up a little from last month to 51.79mt. A slight decrease in opening stocks, an increase in US domestic use, thank you expensive corn, took care of any additional production. The net result is a month on month decrease in projected ending stocks but a very high stocks to use ratio still exists in the US, 51.7%.

Hard, soft and spring wheat in the US all saw adjustments to usage and exports.

The USDA increased world wheat production for 2019-20 to 780.83mt +3.34mt, ending stocks were increased 1.33mt, big call. There were mainly increases, Russia, Ukraine, India and the USA all higher. Australia was left at a 22.5mt, a number that looks very optimistic.