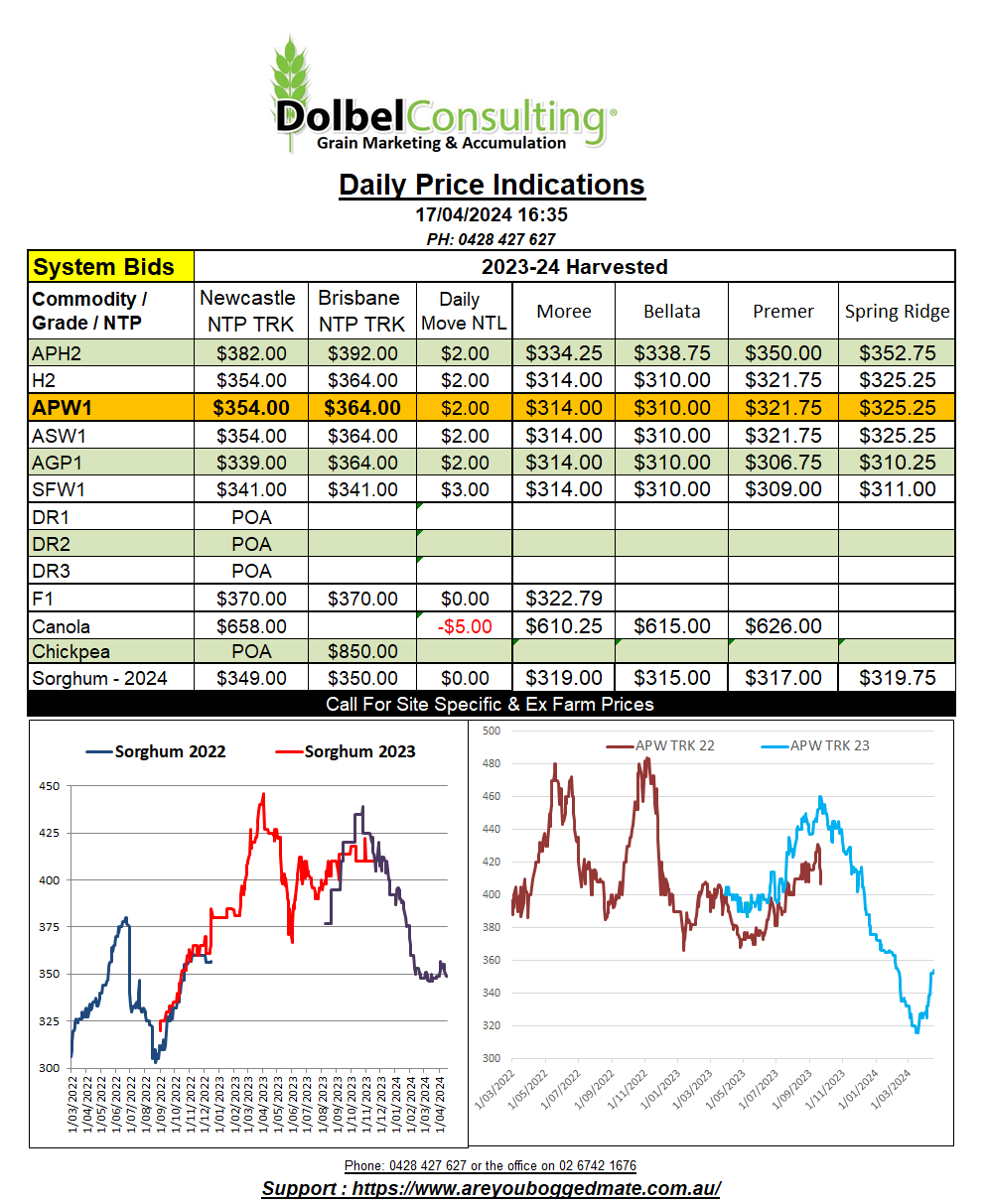

17/4/24 Prices

The AUD continued to push lower overnight, attempting to break through the 64c mark but failing to, bouncing off 64.01 a few times only to close at that level this morning. Current and proposed policies in place in Australia only appear to be fanning the flames pushing us towards a currency crisis. The US FED finds itself with continued inflation all the while seeing the signs of recession persisting with the working class. While watching the biggest CEO’s in the US continue to sell shares in the companies they run…………. is that a light or a train at the end of the tunnel.

The world economic situation is starting to make the grains industry look like a cinch to interpreted at present.

Egypt picked up 120kt of milling wheat overnight. GASC paid between US$220 – US$221.25 for late May shipment. Origination appears to be Ukraine at present. FOB values for both Russian and Ukraine wheat were lower overnight. The weaker AUD managed to counter the move lower from most major exporters once converting international wheat values to AUD / tonne.

Crop condition ratings on the US winter wheat crop didn’t change much in the this weeks USDA report, but there has been some significant declines in conditions ratings from other forecasters. Keep an eye on this in next weeks USDA crop condition report. Further declines in the US should underpin global values as conditions in Russia and eastern Ukraine are also less than ideal. Romania, which has also been dry over the last 30 days, is expected to see some good falls over the next 7 days.

Paris milling wheat futures were about as volatile as the Chicago market, neither moving much overnight. Cash values out of the US Pacific Northwest were mixed, white wheat values trending lower while HRWW and spring wheat firmed. Spring wheat and durum values out of SE Saskatchewan were relatively unchanged to slightly firmer. Both ICE canola futures and Paris rapeseed futures were lower. The AUD will most likely be unable to cover the fall in canola.