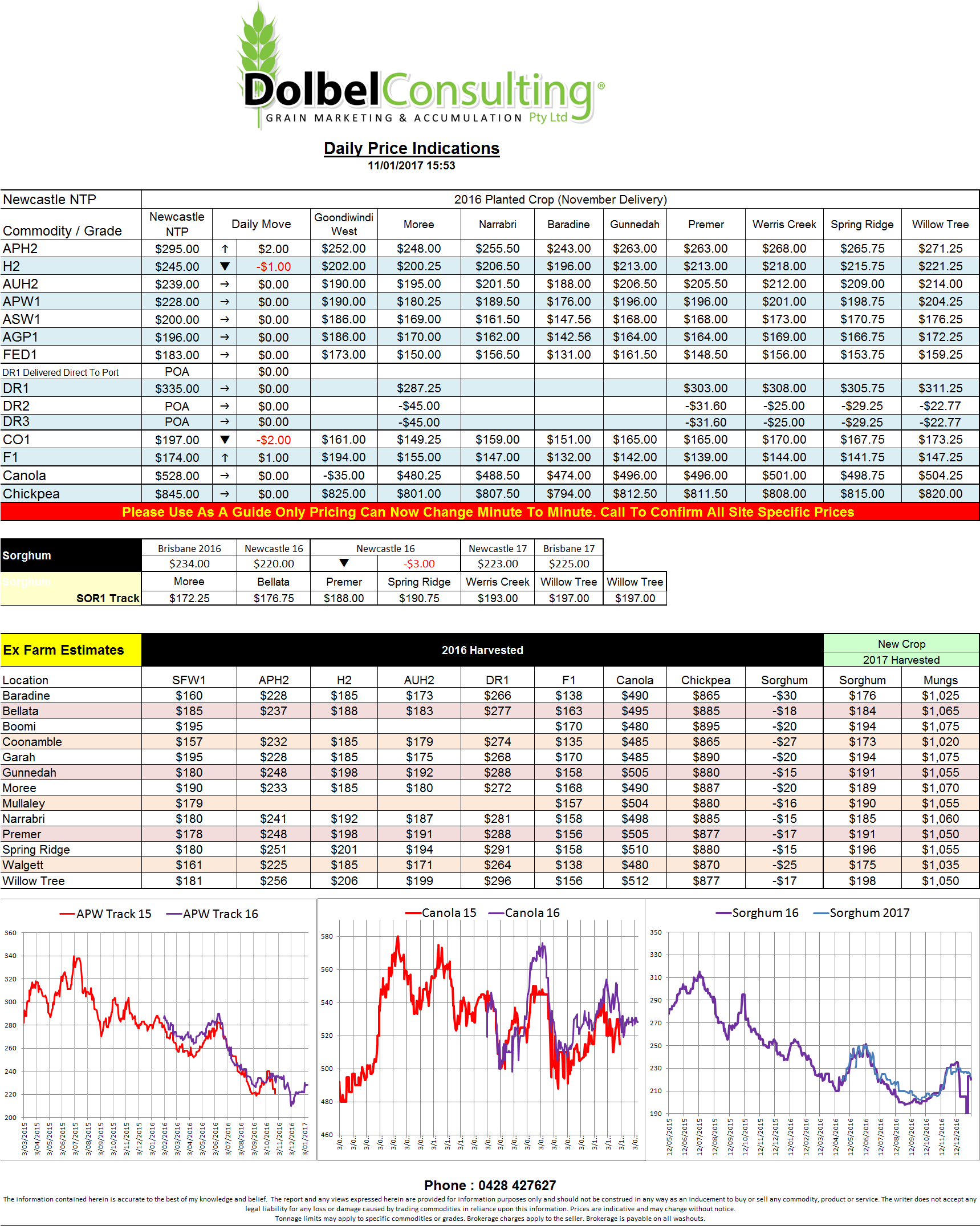

Prices 11/1/17

The Aussie dollar is stronger against all our major trading partners except the Yen this morning. With only miner moves in US grain futures overnight the stronger Aussie dollar may put pressure on export grain values today. With nearby wheat basis as low as it is though we may see local prices remain flat as the basis does have the potential to absorb any minor moves.

Stronger metal prices and better numbers out of China are expected to keep the AUD firming in the short term.

Lower US soybean futures were probably the major weakness in US grain futures overnight. The lower open in beans put pressure on wheat and corn, although wheat maybe suffering from a bit of “buy the rumour, sell the fact” type of business at present. An increase in Malaysian palm oil stocks and a 1.35mt upgrade to the Brazilian soybean crop put pressure on US soybean prices. Brazil also increased corn production estimates which will no doubt continue to cap any upside in global feed prices.

For tomorrow night’s USDA report a Reuters survey has the average trade guess on US winter wheat acres at 34.14 million, the smallest planting since 1913. Other predictions are also suggesting similar numbers. If this is not the case we will probably see wheat sold off hard on Friday. Will Friday be the day the funds step in as buyers.