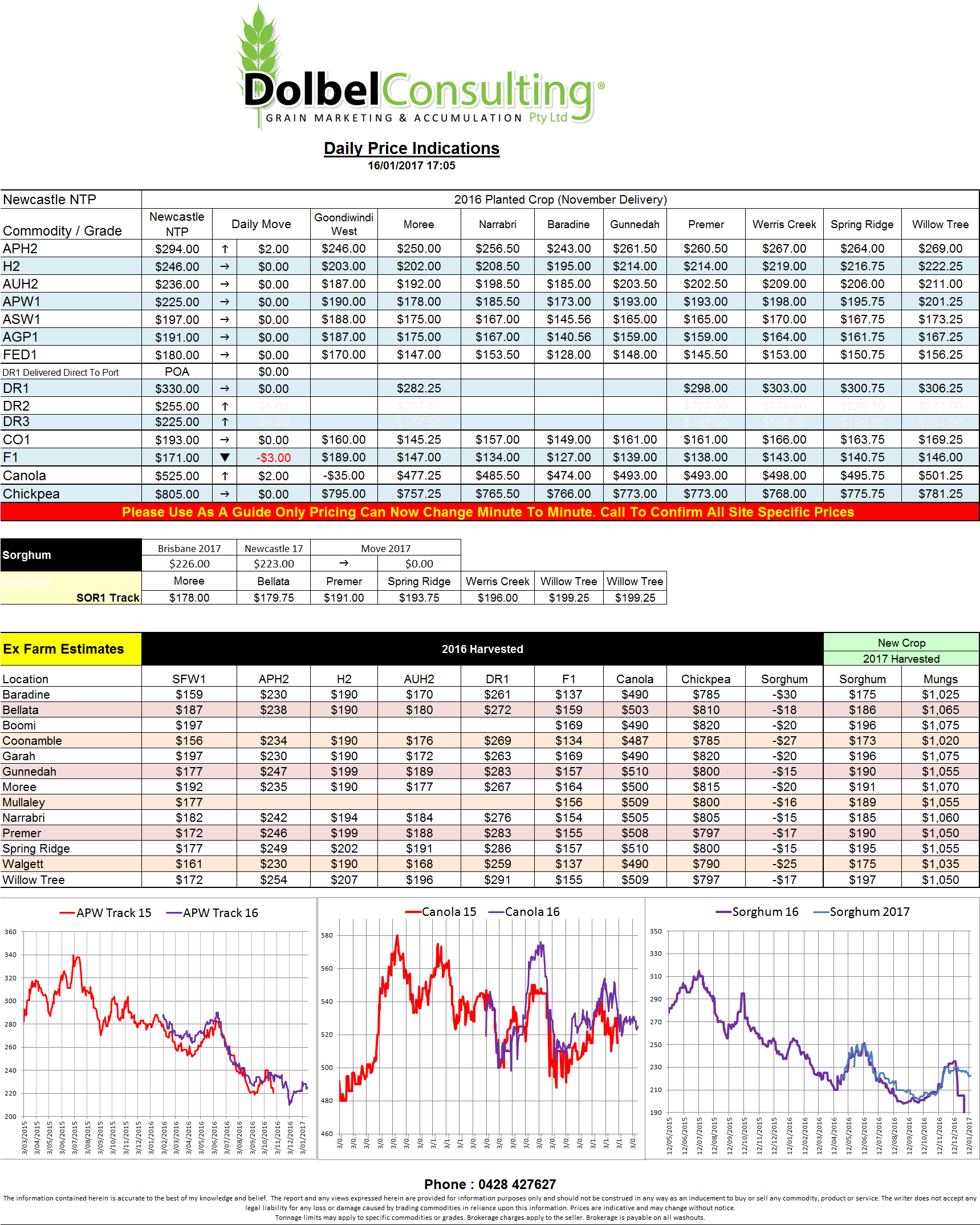

Prices 16/1/17

US hard red wheat and spring wheat futures saw good gains in the outer months as carry over buying from yesterdays bullish USDA report kept markets alive. Nearby closes were not as strong as the outer months which is to be expected considering the huge stocks to use ratio for global wheat leading into this years crop.

The lower US winter wheat acres will probably not have a huge impact on prices for a few months yet. There’s a good chance we will see a little more volatility than normal leading into the northern hemisphere spring and thaw / grain fill period in March & April though. This may play out well here for those looking to market sorghum and stored wheat or barley.

To put the level of world stocks into perspective we need to look at stocks to use ratios. In 2015/16 the stocks to use ratio came out at almost 34% and has since climbed above that number. I’ll attach a chart to show you. Now if we project world wheat production at 28mt lower than last year the stocks to use ratio comes in at 32.5% if consumption remains the same. Now if we were only to produce the average global wheat crop of the last seven years, which is still over 704mt and left consumptions the same, which it potentially would not be, than the stocks to use ratio would drop to around 29%. In 2013-14 it was about 28% and the average NTP price for APW1 was roughly $100 more than today’s numbers with a much higher AUD rate.