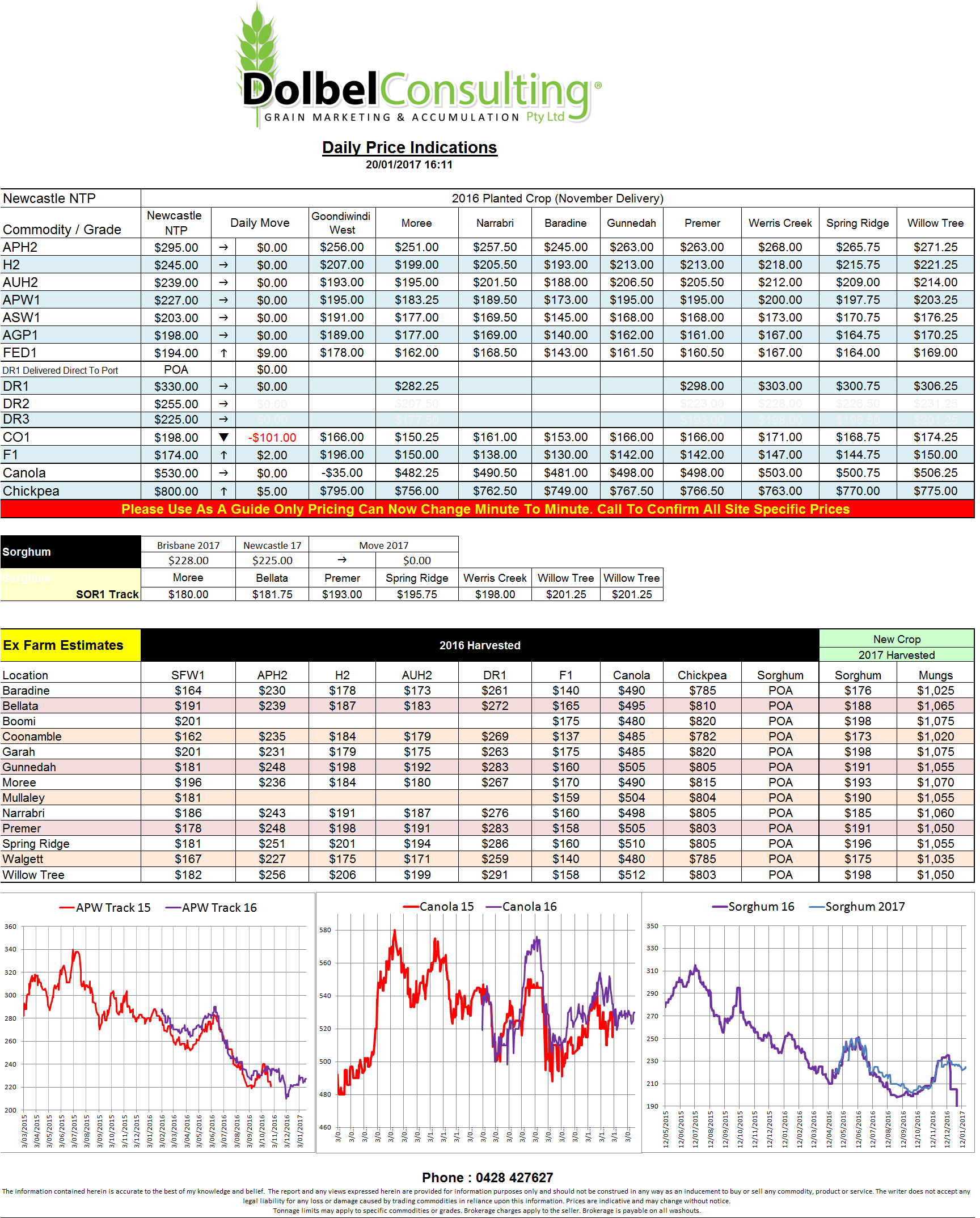

Prices 20/1/17

The Aussie dollar hit 75.74 in overnight trade as the greenback continues to weaken ahead of Trumps inauguration this evening. Apart from the dollar everything else seemed to be weaker in overnight trade. The punters became a little risk adverse leading into this evening and were not willing to leave positions vulnerable over the weekend.

The market leaders for this week, soybeans and wheat, were both lower in US futures markets while canola at the ICE found some support and managed to close up C$3.10 per tonne. Last night’s higher close at Winnipeg equates to a weekly rally of C$18.30 per tonne for canola there. Our stronger dollar and moves in local basis has meant that local values here are only up AUD$5.00 / tonne.

The IGC released their monthly grain market report last night, the IGC is a bit like the USDA equivalent in Europe but without any authority. In last night’s report they increased world wheat production to 752mt compared to the USDA 752.69mt, carryover stocks were left unchanged at 235mt almost 20mt lower than the current USDA estimate, this is a result of a 20mt lower carry in tonnage, otherwise there isn’t a lot of difference between the two projections.

The IGC pegged new crop wheat at about 735mt but also stated that the northern hemisphere crop is in favourable shape. With world demand and supply very close only a small draw down on the massive global stocks is expected.