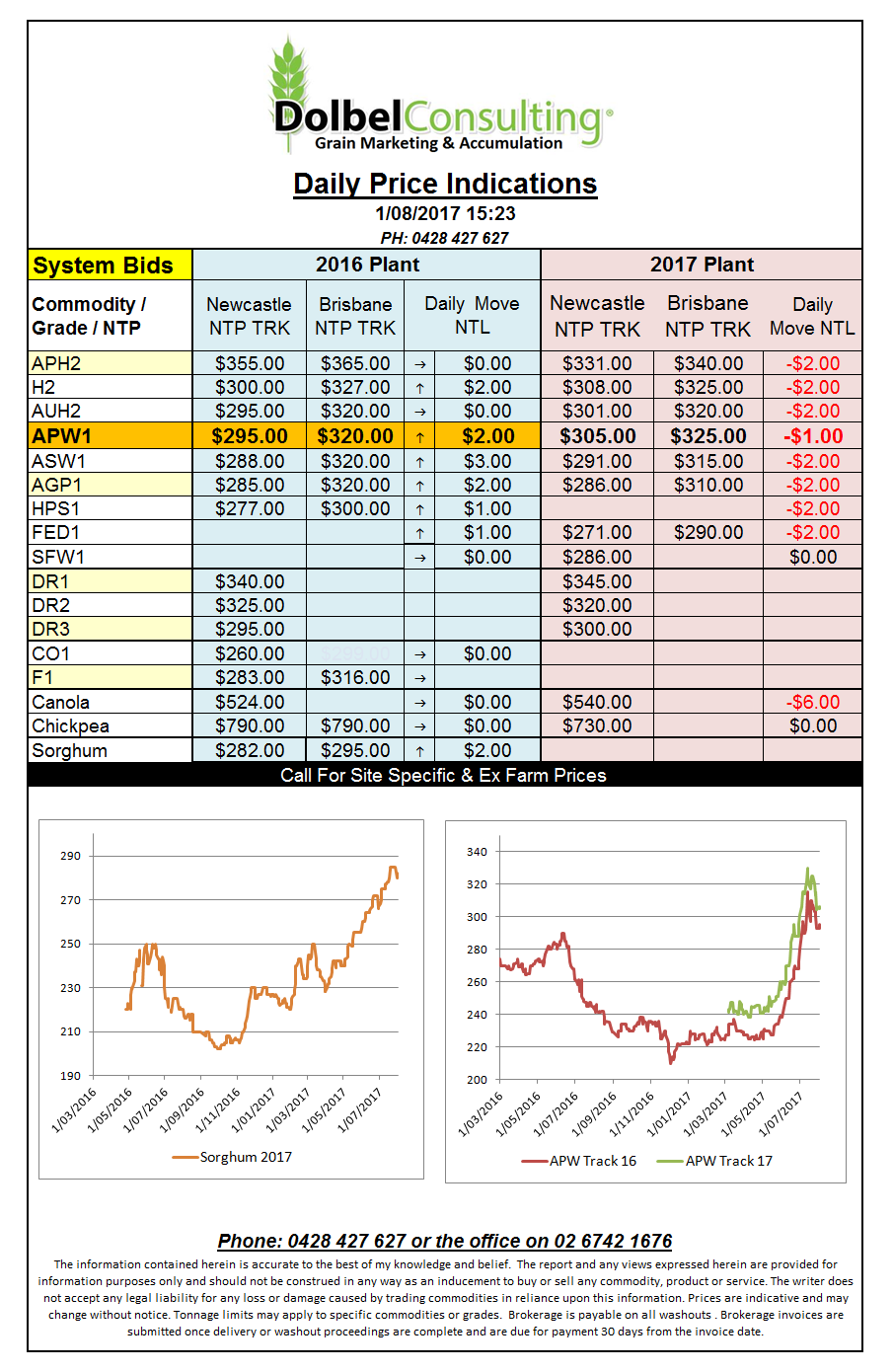

Prices 01/8/17

It’s more of the same on the US weather map. The spring wheat belt is expected to remain hot and dry as harvest starts there while the lower Midwest and the hard red winter wheat states see cooler conditions and some good rain in the week ahead. This lack of a weather threat to corn and soybeans was perceived as bearish by the funds who continued to liquidate longs in the row crops thus wheat was lower on the back of spill over selling.

Record low prices in Brazil are expected to put a cap on corn prices in the US midterm. Reports of corn as low as US$53 / tonne in central Brazil has some punters happy to sell US product lower. Last year we saw nearby US corn futures set the seasonal low on August 31st at 301.5c/bu.

After the close USDA crop ratings were released showing a 1% decline in corn G/E, soybeans +2% G/E, cotton +1% G/E and spring wheat back another 3% to just 31% G/E with a massive 43% of the spring wheat crop rated very poor / poor.

There are reports of cash durum bids for 1CWAD reaching as high as C$349 ex farm Saskatchewan. New crop values are also sharply higher with reports of C$367 / tonne ex farm. PDQ, another price reporting agency shows durum values are flat in SW-SASK at C$294. There’s a lot’s of muddy water out there. I do see a registered buyer bidding AUD$413 / tonne 1CWAD around Fargo.