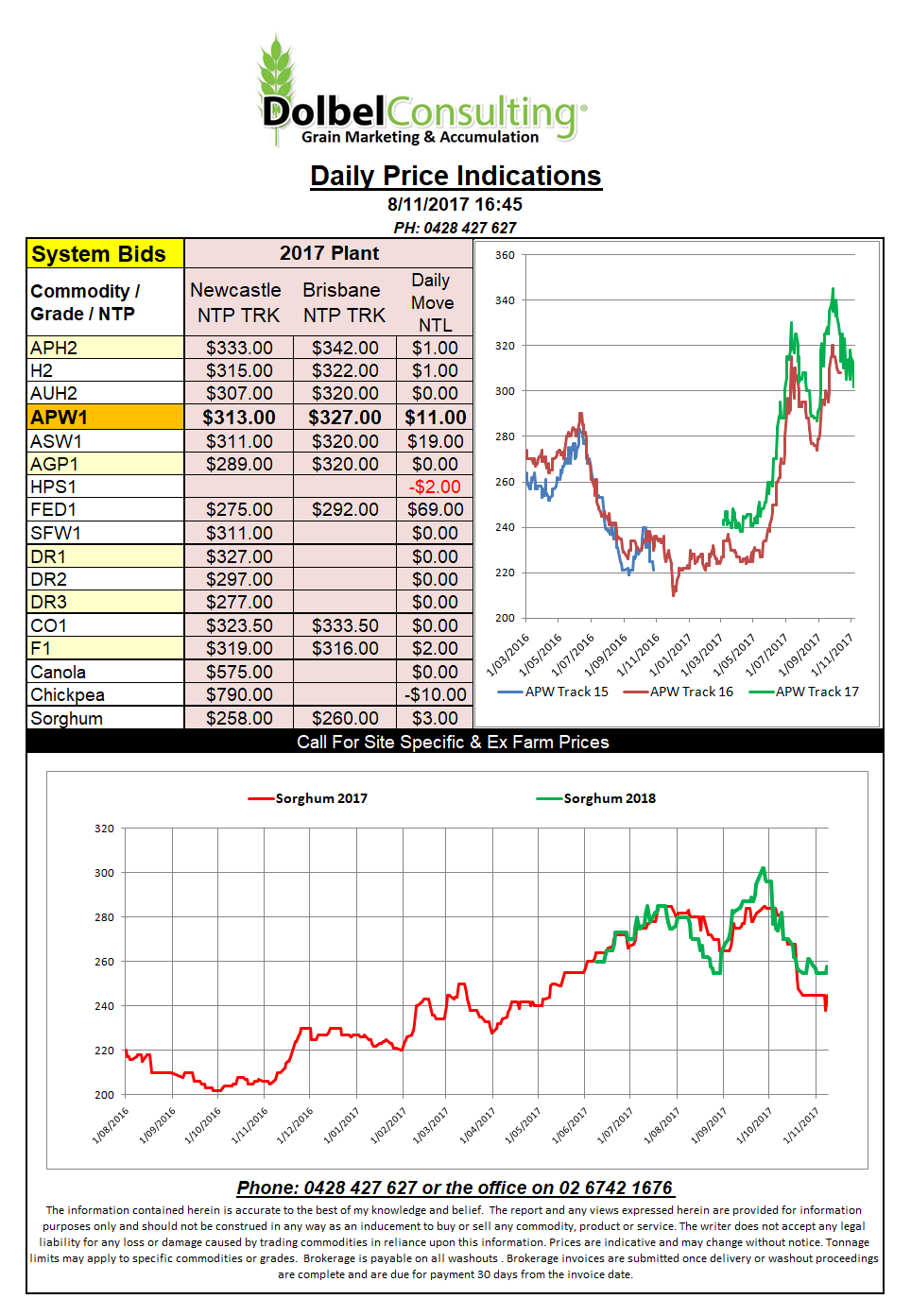

Prices 8/11/17

US corn futures traded sideways overnight with routine sales being reported and US farmers generally choosing to store corn rather than deliver or price it at current levels thus basis is firming in the corn belt.

Soybean futures at Chicago and ICE canola futures both saw a little upside in overnight trade. The move higher was also reflected in Paris rapeseed futures. Thoughts that world canola stocks will still fall to critically low levels prior to the northern hemisphere harvest in 2018 should keep canola values well supported into the beginning of next year.

In Australia lower yield estimates due to the realisation of the severity of late frosts and the poor oil content of those crops that avoided the damage in the north are all pointing towards lower exportable stocks in 2018. Flat priced feed values in Australia continue to compete well with the export market. Aussie wheat production estimates range from 18mt to 22mt. What will tomorrows WASDE offer ?

With a USDA report out this week the market is expected to remain dull until the data is public. Generally the trade are not expecting any big surprises from this report. Possibly corn yields may be increased but most other numbers are not expected to change much.

The dry weather that decimated the US spring wheat crop has also resulted in lower Canadian winter wheat acres being sown. Granted the winter wheat area is much, much smaller than the spring wheat area in Canada but every tonne out helps at present.