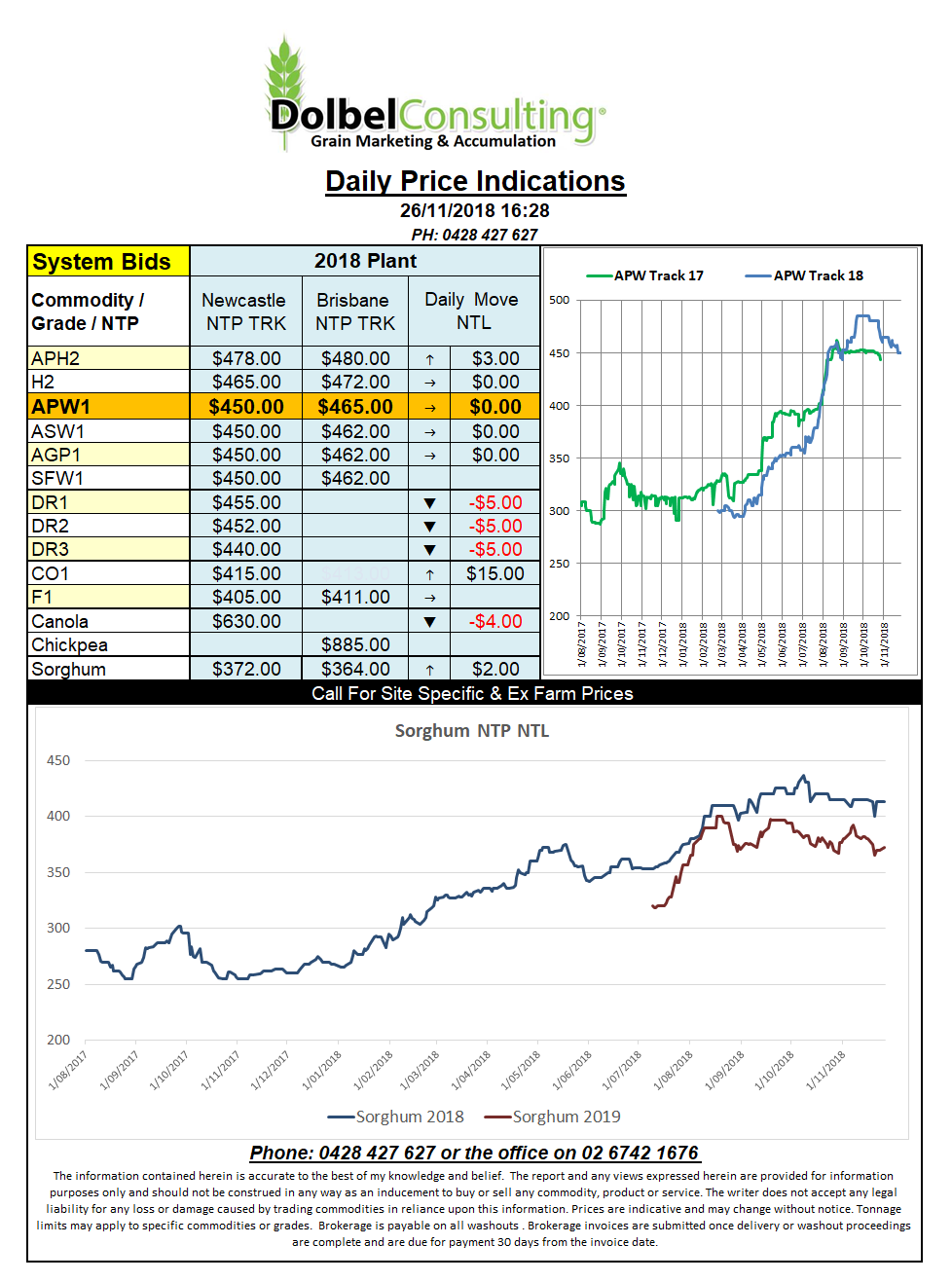

Prices 26/11/18

The US futures market, for wheat at least, is starting to find fundamental support as the States combined with Russia and Romania to fill the latest Egyptian tender. This is starting to let a few more analyst come to the conclusion that the USA may indeed fill the void left by Russia if and when Russia decide to ratchet back wheat exports during the first quarter of 2019.

Weekly US exports for wheat did fall well short of what is required though. At 330kt the US still have a lot of work to do.

The International Grain Council have 2019 world wheat pencilled in at 728.8mt (767.1mt ly). Annual consumption is pegged at 740.2mt, a couple higher than last year. The net result after the smoke clears and the mirrors are put away shows ending stocks coming in at 262mt, a year on year decrease of about 11mt.

As a stocks to use ratio it is still less than inspiring at just over 35%, we really need this ratio to be at least into the 20% for any sustainable upside and into the lower 20% area to see good international price growth. China does continue to be the dark horse though with about half the world wheat stocks stored there, a country that will not let those stocks into the international market.

Drilling down into world wheat stocks data we quickly come to realise that stocks in many of the major exporters have taken a hit this year and are approaching critical levels in some countries. Major importers though are in a better position than in 2007/08 for instance. The winter thaw in April / May 2019 maybe one of the more volatile thaw periods we will see in quite a while.