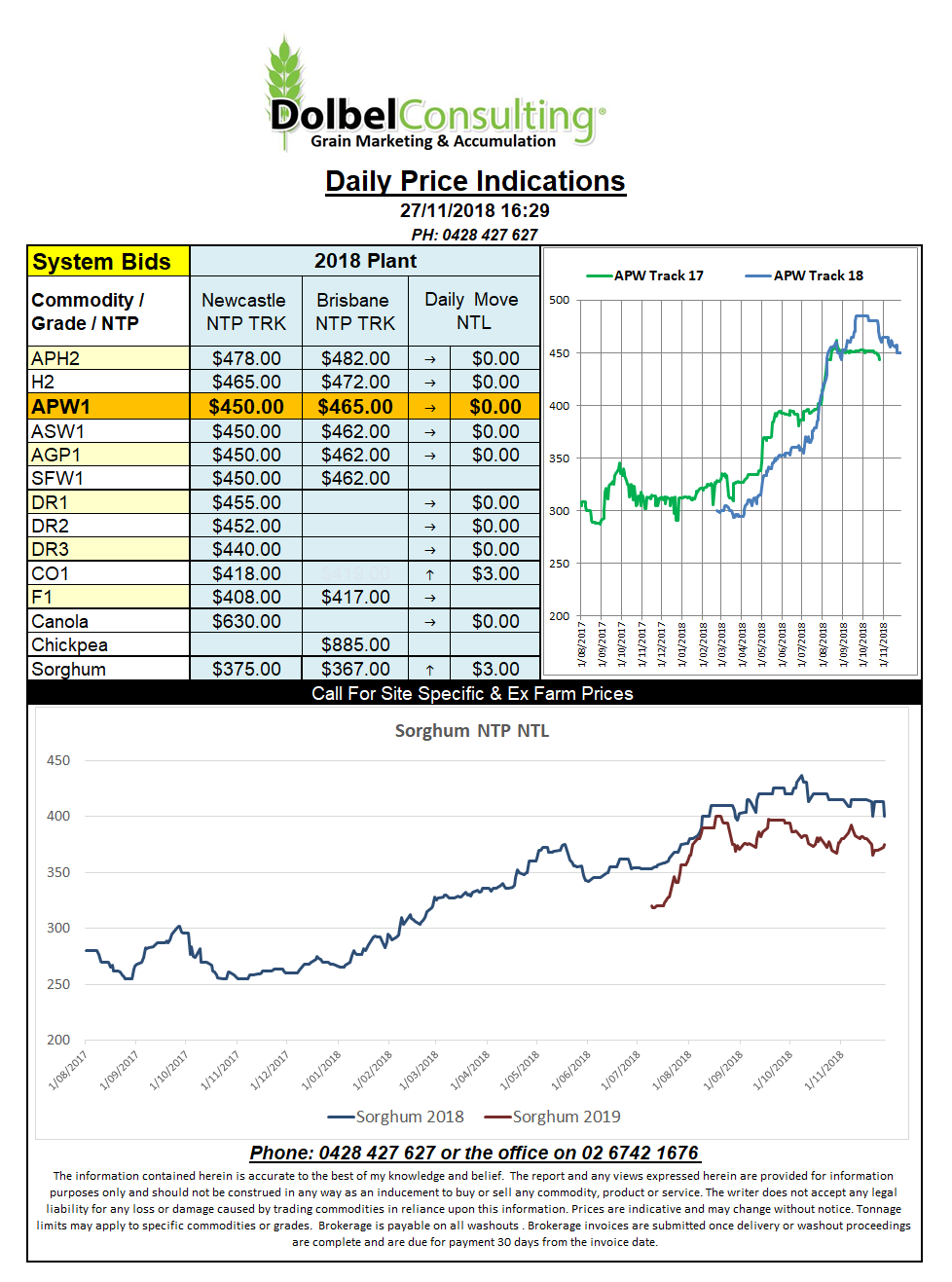

Prices 27/11/18

Wheat futures in the US managed to keep clear of the negativity in the soybeans pit at Chicago. Soybean futures dropped 18.75c/bu (AUD$9.50/t) on the nearby contract. As usual this weakness rippled across oilseeds in general resulting in lower closes for both ICE canola and Paris rapeseed futures. The weakness in crude oil and palm oil is also hurting oilseed values.

Wheat futures are being helped by fund liquidation in the December contract which has a first notice day of the 30th of November. Any punters not wishing to be called to deliver physical grain need to have cleared their positions prior to this date.

Tension between the Ukraine and Russia over access to the Sea of Azov through the Kerch Straight has also created some speculation of a possible slowing of exports from that region or if nothing else a freight risk premium to be added to Ukraine and Russian sales from eastern ports in the Sea of Azov, the gate way to the Black Sea for eastern Ukraine and parts of southern Russia.

Many punters are hanging a lot of weight on the results of the G20 summit at the end of the week. There is expected to be some kind of trade agreement declared between China and the USA but at this stage there appears to be little evidence this will occur. To show how little interest China has in dealing with the USA they are actually loading wheat from France at present.