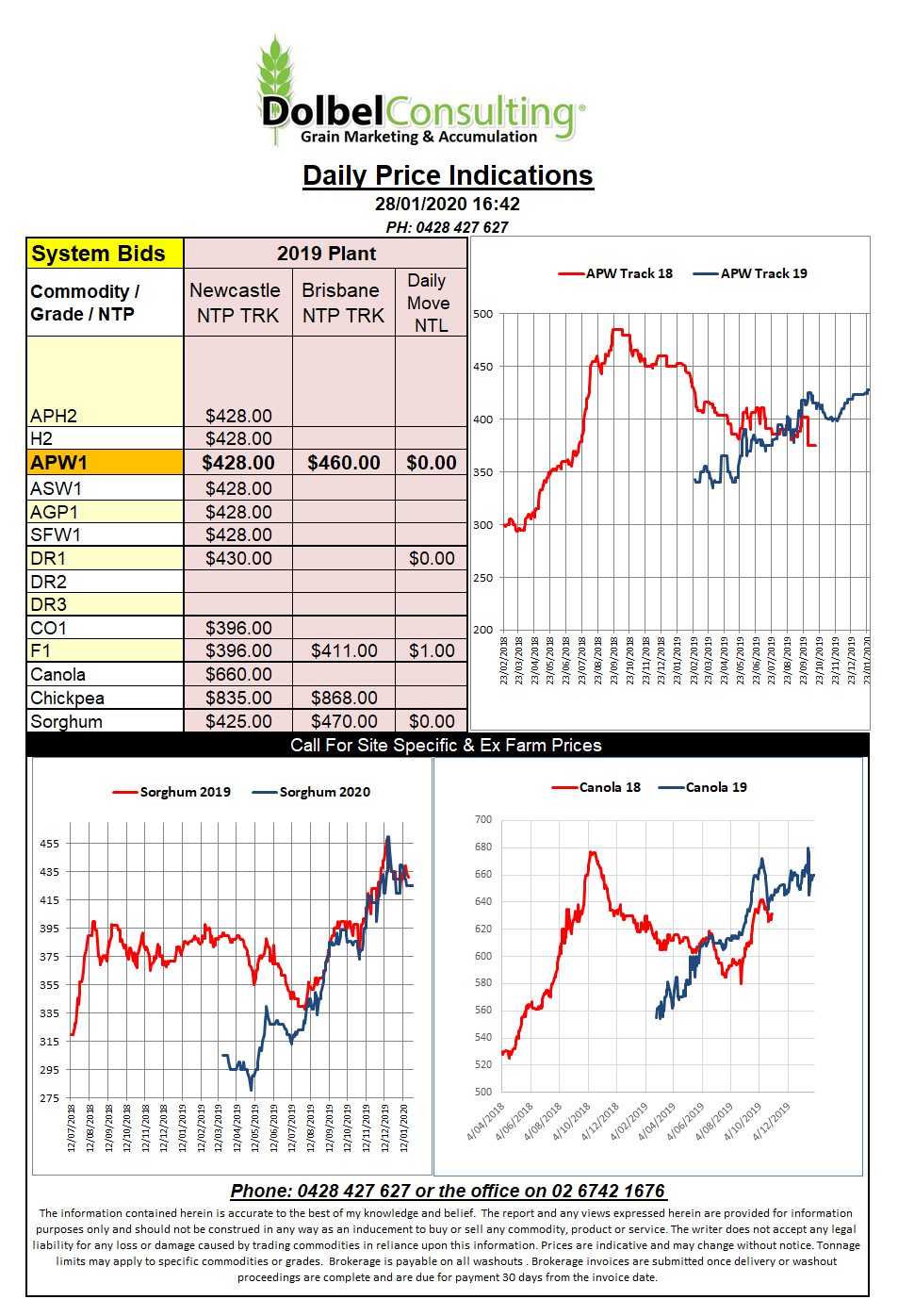

Prices 28/1/20

25/1/20

Even some solid export sales numbers out of the USA couldn’t stop the sell-off in wheat futures last night. Posting weekly sales of almost 700kt of old crop and a total of 749kt it was towards the top end of expectations but the weight came from corn. Like wheat corn saw healthy export sales of over 1mt, just a little under the top end of estimates but technically corn couldn’t hang on and profit taking across a number of commodities took the market by surprise and pushed values lower.

The lack of a confirmation of vast purchases by China seems to be the main issue. The fact the punters have more to gain if they react to news of Chinese buying from a lower starting point when China does come to the plate may also be a driver.

Canola futures were again lower. Nearby ICE futures have shed C$11.50 (AUD$12.83) this week. The January 2021 slot is also back C$6.90 (AUD$7.69) . Paris rapeseed futures faired a little better with slippage on the nearby at just E1.25 and just half a euro for the Feb21 slot. Canadian canola exports are running about 9% behind last year at 4.6mt. Considering the problems they have been experiencing with China this is probably a good result but may see carry-over stocks increase this year.

Still in Canada we see durum wheat exports at 2.3mt, this is 46% ahead of last year’s efforts. Good demand from N.Africa and Italy saw Canadian exports pick up a lot from late Q3 last year.

Cash bids in SW Saskatchewan have slipped though, back C$10 nearby to C$264 ex farm.

28/1/20

US grain futures were generally lower with corn leading the way. Soft red winter wheat at Chicago done well to hang on finishing the session with minimal losses while hard red winter wheat actually finished in the black for the 2020 months. Spring wheat futures at Minneapolis were a tad softer nearby and a tad stronger on the outer months.

Soybeans were caught up in the selling and closed lower. The stumble in oilseeds rolled over into canola and rapeseed futures. Canola was smashed, shedding C$8.00 (AUD$8.98) on the nearby. Paris rapeseed was not hit as hard but still slipped AUD$4.48 / tonne by the close. Paris rapeseed did find some support from higher than expected weekly EU imports. Demand remains strong.

With US weekly wheat export inspections at just 224kt it was interesting to see losses limited in wheat. The volume was almost half the lowest trade estimate prior to the release of the report. Year to date inspecting are still running ahead of last year though at 16.2mt to date.

There is some speculation that the virus outbreak in China may impact on trade. Trying to cut through the media hype on 2019 nCov is like trying to find a sports channel without a Kobe Bryant memorial special (too soon). Its genetic similarities to SARS is what is keeping the WHO on its toes. SARS had a 10% mortality rate. 2019 nCov is considered to have a 4% mortality rate. The rate one person can distribute the infection is key to understanding the possibilities. SARS had an infection rate of 2 – 5 while something like measles is 12 – 18. 2019 nCov is probably somewhere around 1.5 – 3.