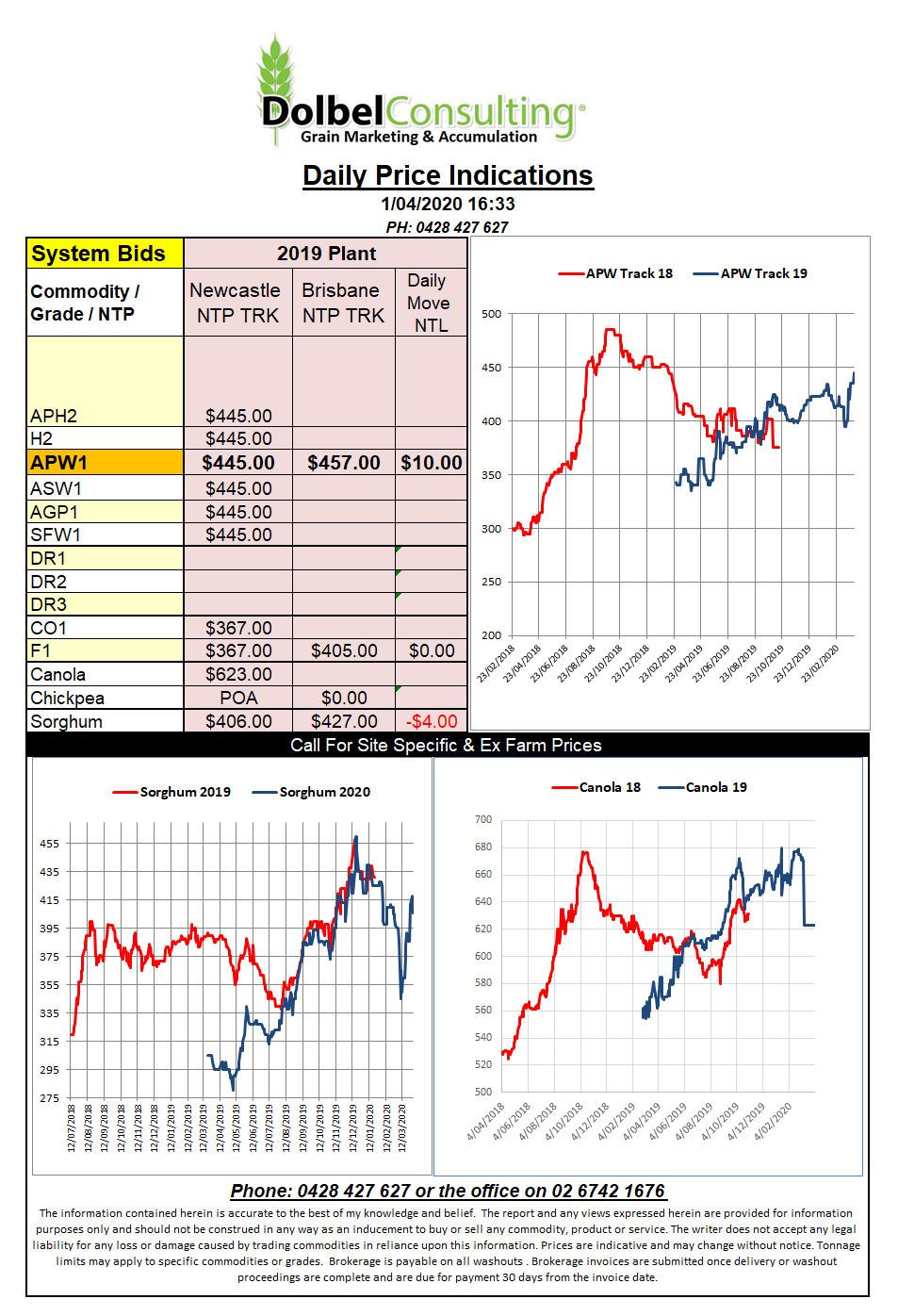

1/4/20 Prices

There wasn’t a lot of good news for corn out of the USA last night. The market had been waiting for the prospective acres report which was released early in the day. The punters were expecting to see increases in US corn area but none expected an increase as large as what the USDA presented to them. At 96.99 million acres it could potentially be the biggest corn crop since 2012 and the third largest on record. Just to add a bit of fuel to the fire the USDA also reported US corn ending stocks higher than the trade had been expecting to see. The lack of demand for US corn in the biofuel market is also hurting as more and more smaller plants decide to shut up shop until demand picks up.

Wheat in the States was basically the opposite of corn. lower stocks than trade estimates and an all-time low area according to the prospective plantings report. With the 2020 area pegged at 44.655 million acres it comes in just below the 2019 area of 45.158 million acres. Hard red winter wheat was estimated at 21.7 million acres and spring wheat at 12.6 million acres.

In international trade Algeria picked up 240kt of milling wheat, Tunisia picked up 75kt of durum wheat. In Canada we see the price of durum wheat ex farm SW Saskatchewan is a little firmer for the old crop but drops away C$15.00 after harvest. This leaves Nov / Dec 1CWAD13 bid at roughly C$244 XF. This would be equivalent to a FOB Aussie number roughly the same as current FOB APW and equates to an ex farm LPP price for DR1 of roughly equivalent to $360.