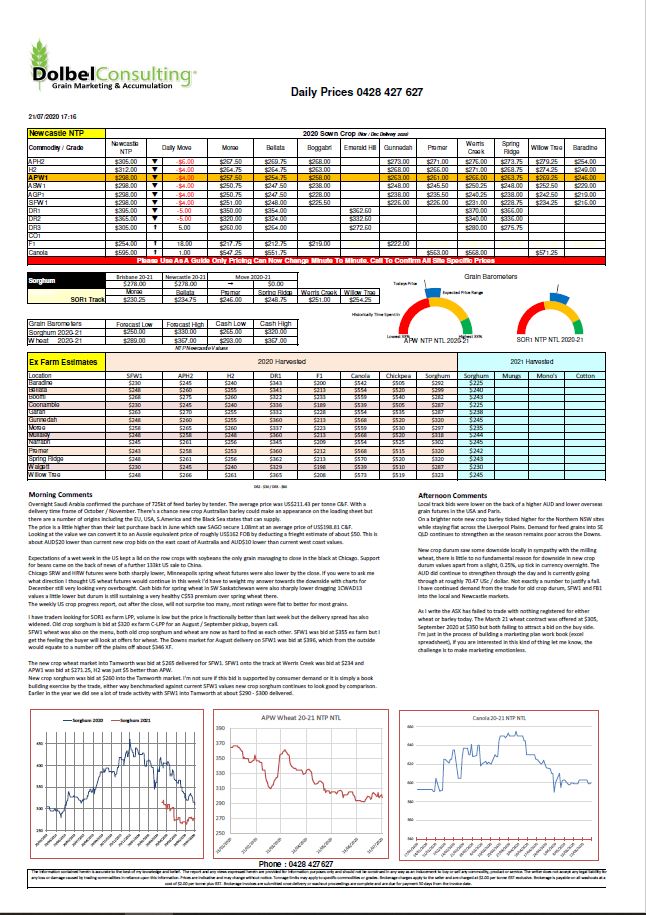

21/7/20 Prices

Overnight Saudi Arabia confirmed the purchase of 725kt of feed barley by tender. The average price was US$211.43 per tonne C&F. With a delivery time frame of October / November. There’s a chance new crop Australian barley could make an appearance on the loading sheet but there are a number of origins including the EU, USA, S.America and the Black Sea states that can supply.

The price is a little higher than their last purchase back in June which saw SAGO secure 1.08mt at an average price of US$198.81 C&F.

Looking at the value we can convert it to an Aussie equivalent price of roughly US$162 FOB by deducting a frieght estimate of about $50. This is about AUD$20 lower than current new crop bids on the east coast of Australia and AUD$10 lower than current west coast values.

Expectations of a wet week in the US kept a lid on the row crops with soybeans the only grain managing to close in the black at Chicago. Support for beans came on the back of news of a further 133kt US sale to China.

Chicago SRW and HRW futures were both sharply lower, Minneapolis spring wheat futures were also lower by the close. If you were to ask me what direction I thought US wheat futures would continue in this week I’d have to weight my answer towards the downside with charts for December still very looking very overbought. Cash bids for spring wheat in SW Saskatchewan were also sharply lower dragging 1CWAD13 values a little lower but durum is still sustaining a very healthy C$53 premium over spring wheat there.

The weekly US crop progress report, out after the close, will not surprise too many, most ratings were flat to better for most grains.