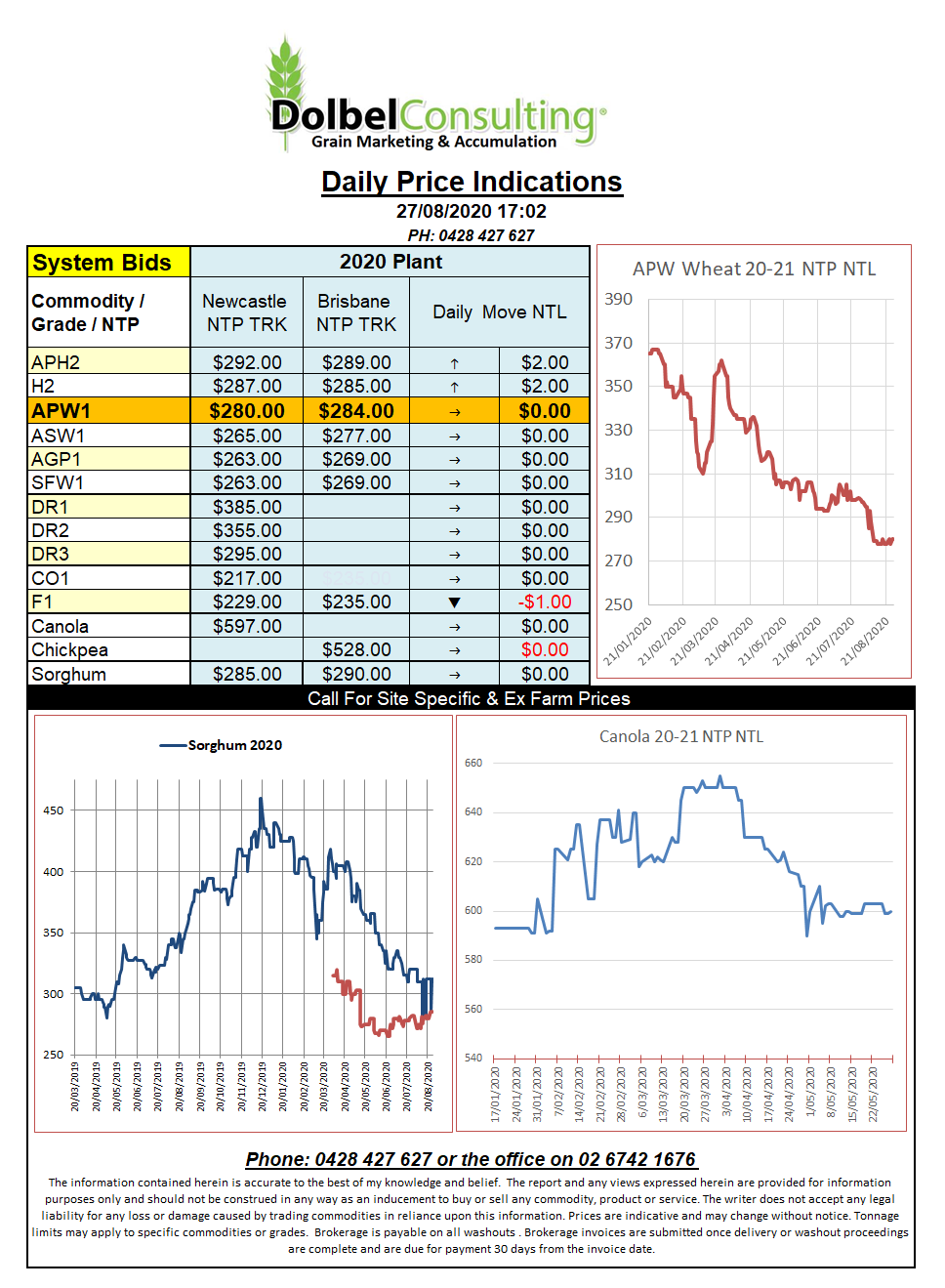

27/8/20 Prices

As is often the case in a drought year cold conditions are now hurting wheat production prospects in Argentina.

Although much of the crop is still not far enough advanced to be a concern recent temperatures, some 6C lower than average, have been reported. This has caused irreversible damage to a portion of the early planted crop that was already doing it tough from the drought. Central and northern Cordoba appear to be the hardest hit regions.

The drought has already seen area estimates shrink from 7mha to 6.5mha. Yield estimates are now shrinking too, some say the drought combined with the recent cold weather will reduce the crop by another 1.6mt by the end of August. Over 1/3 of the wheat crop is now rated as fair to poor.

There was confirmation of a number of export tenders overnight with Egypt, Turkey, Taiwan and Jordan making purchases of wheat. Pakistan were also actively seeking wheat to sure up local supplies after a smaller crop.

Egypt picked up 530kt of Russian wheat at around US$6.00 above their previous tender value. This is the biggest single purchase of wheat by Egypt in some time. A couple of weeks ago Egypt picked up 415kt of Russian wheat at around US$223 CnF.

Turkey picked up 390kt of optional origin wheat, most likely Black Sea, at a value of US$221.60 per tonne CFR.

Jordan finally closed a tender and booked 60kt of hard wheat at US$237.50 C&F. Ukraine trader Nibulon closed the deal with Jordan beating offers from Glencore and Russian food giant Aston.