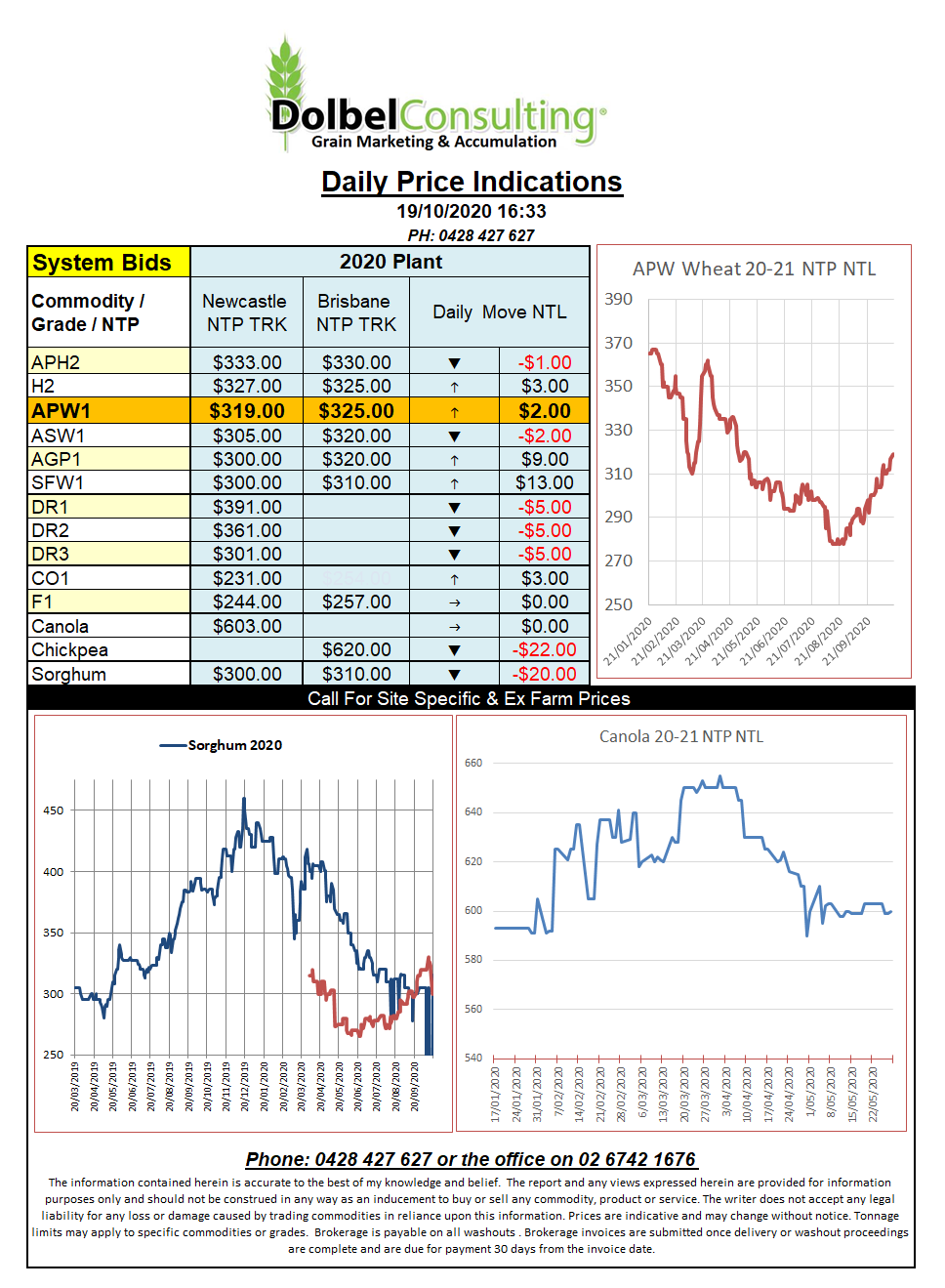

19/10/20 Prices

Dry weather in the USA, Argentina and Russia continues to be the fundamental driving force behind a further rally in Chicago SRWW futures overnight. Weekly US export sales volume was also viewed as supportive, landing on the high side of trade estimates prior to the report’s release.

Pakistan picked up 340kt of optional origin wheat (read Russian) at US$284. The latest purchase should help Pakistan sure up its reserves, taking import orders up to 1.5mt. This grain will be distributed through three government entities to ensure it gets to where it needs to go.

Although Pakistan harvested 25.2mt of wheat this year domestic consumption was expected to rise to 25.5mt. Pakistan has one of the highest wheat consumption rates per head of population of any country in the world.

Even on the back of an envelope and not knowing the full details of this tender values converted to an equivalent AUD per tonne number off the plains will be difficult to determine but would roughly be about AUD$326 port, so not far off where we are currently bid.

White wheat bids out of the Pacific Northwest of the USA were unchanged overnight and continue to indicate that Australian APW1 numbers into SE Asia remain very competitive but may face a little competition into Japan. Hard red winter wheat out of the PNW was firmer in price and continue to indicate that H2 bids in NSW are likely to firm before falling.

Durum out of SW Saskatchewan was relatively flat with a December lift converting to roughly AUD$413 per tonne Newcastle port.