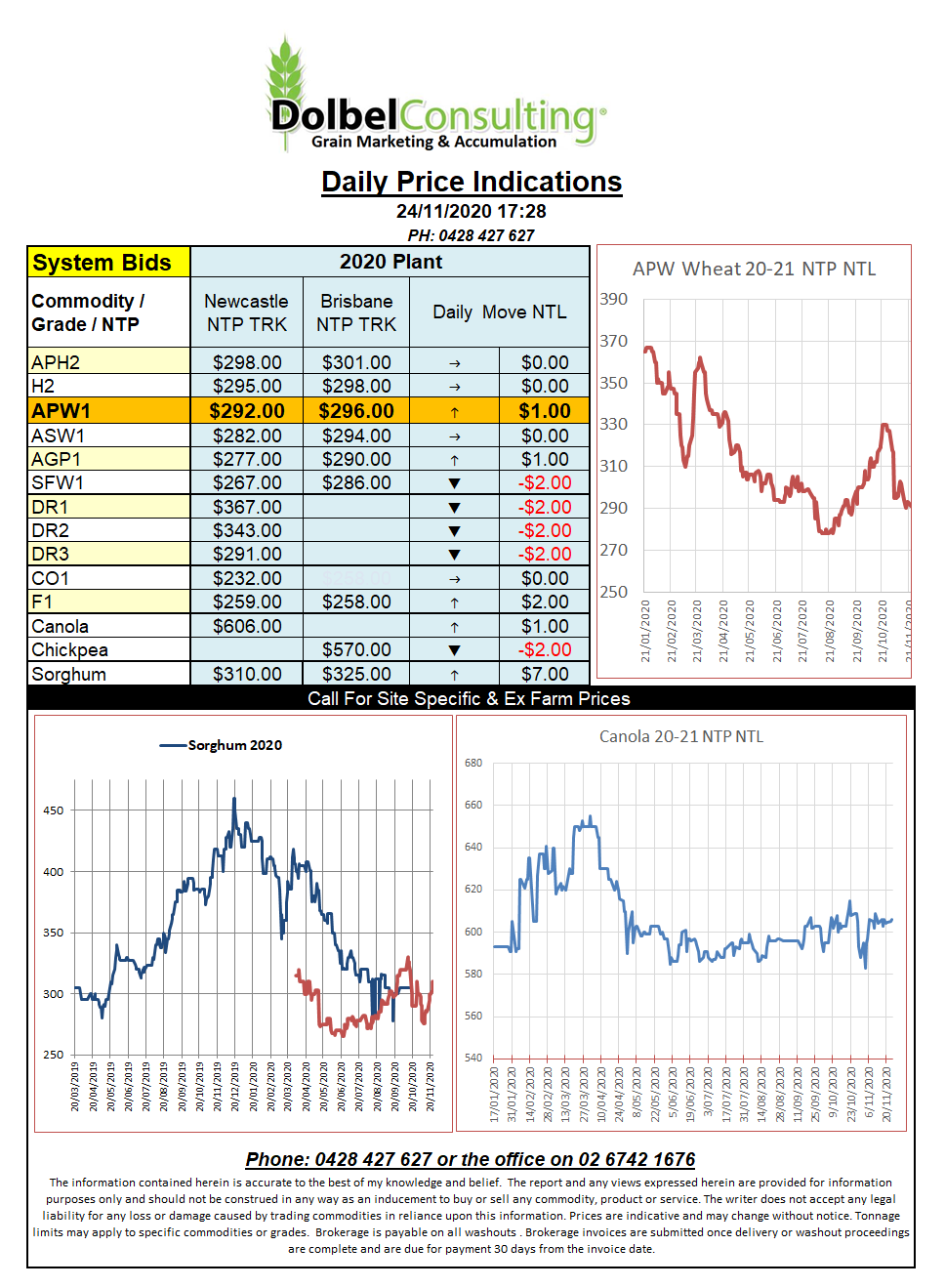

24/11/20 Prices

Category: Pulses News

| With this week being the Thanks Giving holiday week in the US, markets there are not overly active as most punters will make a short week of it by taking Friday off as well as the public holiday on Thursday. Technically we see corn futures at Chicago over bought in both the December and March contracts but volume is decreasing in the December slot as the punters move onto March. There continues to be a lot of variation in official and unofficial corn import numbers for China. The USDA appear to be on the low side of these estimates with China pencilled in for just 13mt of US corn. I’ve seen some reports as high as 30mt. The main hurdle for either estimate is the corn quota tariff that China applies to purchases above their import quota volume, which is set at just 7mt this year. Any excess to quota attracts a 65% import duty. The punters have, for a while now, expected China to lift there import quota to 20mt, but there are more people in the USA talking about this increase than there are in China. Another factor that may or may not influence the US corn outlook and assist in keeping the 400c/bu number intact is the risk of another COVID lockdown. The impact this would have on ethanol demand is large enough to force corn values in the US lower. Last week saw most US FOB wheat offers creep lower except white wheat out of the PNW that moved higher. HRW out of the Gulf was priced at US$270 FOB for 11.5%, while PNW HRW was bid at US$284. Continuing to confirm the cheapness of Aussie wheat.

Let’s see if the good rally in ICE canola futures is reflected in local cash bids today. |