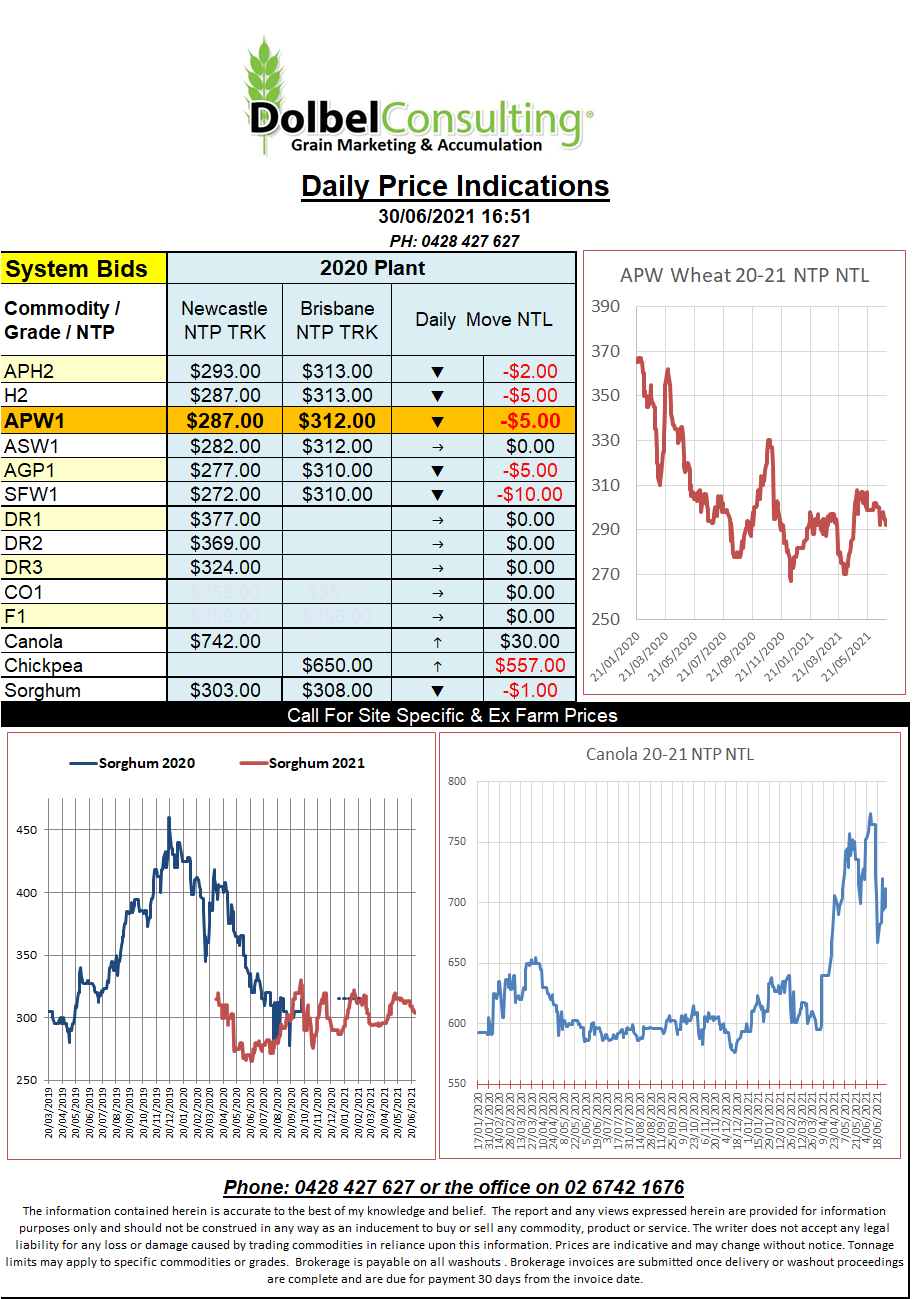

30/6/21 Prices

US spring wheat and hard red winter wheat futures succumb to some profit taking overnight. Looking at spring wheat cash bids in the USA they did not move in unison with the futures market. While MGEX spring wheat futures slipped 22.5c/bu the cash market there actually rallied 26c/bu. This may indicate that the slippage in futures is a short term correction and not an emerging trend. As stated yesterday the weekly USDA crop condition report for US spring wheat was certainly not bearish.

Heading north of the US border into SE Saskatchewan we see nearby spring wheat cash bids did follow the futures market lower right through until a December lift which rallied some C$9.79 / tonne to C$323.54 / tonne, now C$5.00 under 1CWAD13 durum for pickup in the same period.

The June 29th Stats Canada report confirmed Canadian farmers have sown 23.4 million acres of wheat, down 6.5% year on year. Spring wheat area declined 8.1% to 16.5 million acres. Durum area was also lower at 5.5 million acres, a 2.8% deduction. Winter wheat was pegged at 1.3 million acres back just 1.4% year on year. Reductions in area were reported for all three wheat types in both Alberta and Saskatchewan.

The same report stated that 22.5 million acres of canola was sown. This is a year on year increase of 8.2%.

Barley acres were also higher, with Saskatchewan sowing 3.7 million acres, total Canadian acres are 8.3 million. A year on year increase of 9.7%. Chickpea area is significantly lower at 185.5kac, back from just under 300kac last year and the lowest area since 2017.