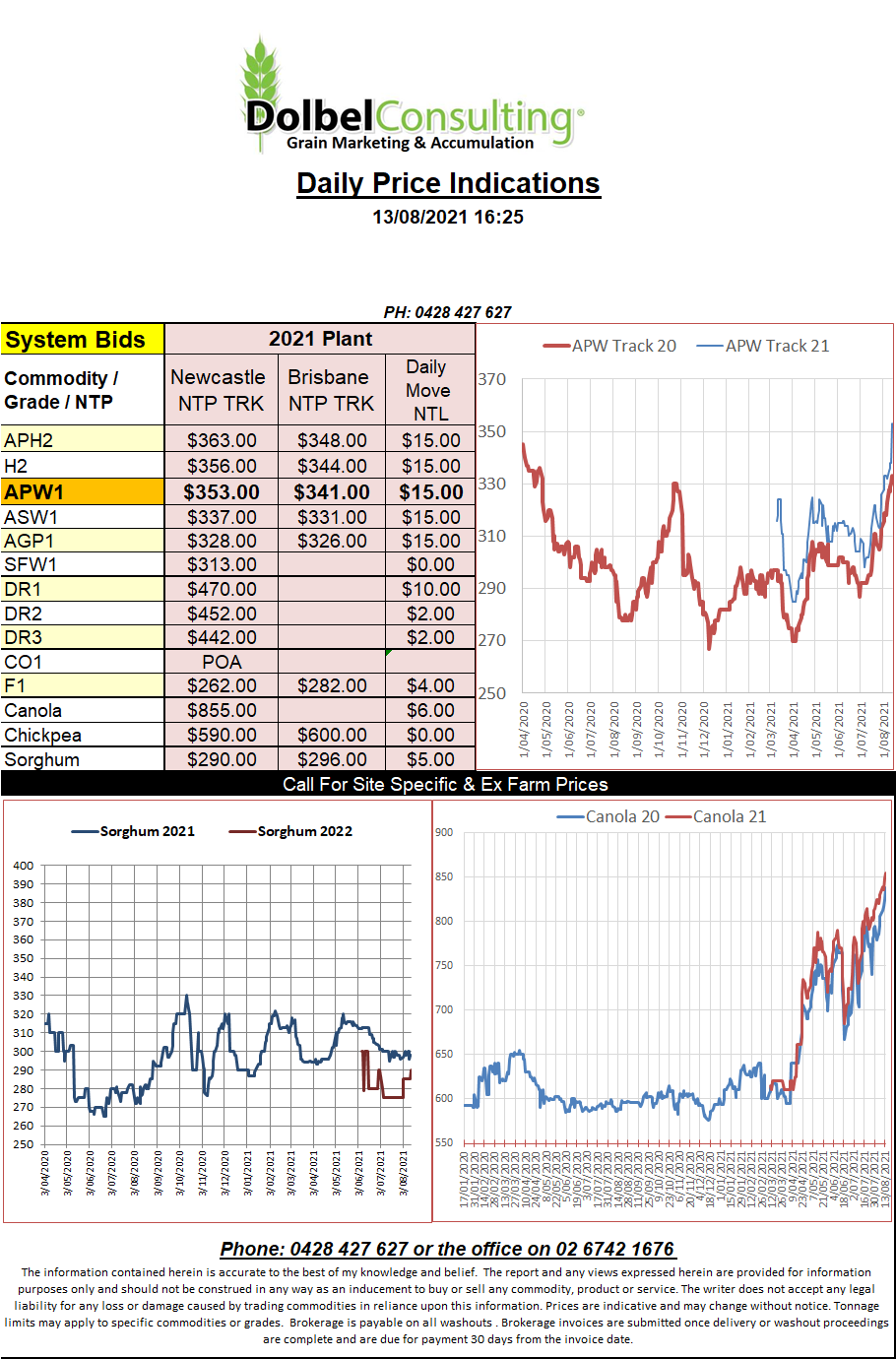

13/8/21 Prices

USDA WASDE report was out last night. It was a good one for producers.

A quick look reveals reductions in wheat, world carry in stock were lowered 1.35mt to 288.83mt, world productions was lowered 15.49mt (less than a few had expected) to 776.91mt. Demand shrunk with reduction in imports / exports (questionable) and domestic usage. The net result was a drop in ending stocks of a hefty 12.62mt to 279.06mt.

It’s good to see but it still represents a stocks to use ratio of over 35%, this really needs to be under 30% to get us to the next level in global prices.

Drilling down into the report we see reductions in wheat production in Canada 24mt (31.5mt), Russia 72.5mt (85mt), Kazakhstan 12.5mt (13mt), USA 46.18mt (47.52mt). There were no adjustments to Argentina, 20.5mt or China 136mt. There were a number of questionable increases. Australia was increased to 30mt (28.5mt), Ukraine 33mt (30mt), Brazil 7.7mt (6.9mt) and the EU was raised 400kt to 138.6mt. As good as this report is it could have been better. It does leave the door open for further reductions in S.America and Australia in the spring. Canada may also need some fettling as we move through September.

World corn production was reduced 8.68mt to 1186.12mt. Ending stocks back 6.55mt to 284.63mt. The questionable number for corn is the reduction in demand. Possibly a little hard to justify given the higher wheat prices and possible increases in feed demand in China. According to the USDA Chinese corn demand will actually be lower than expected in July’s report ???