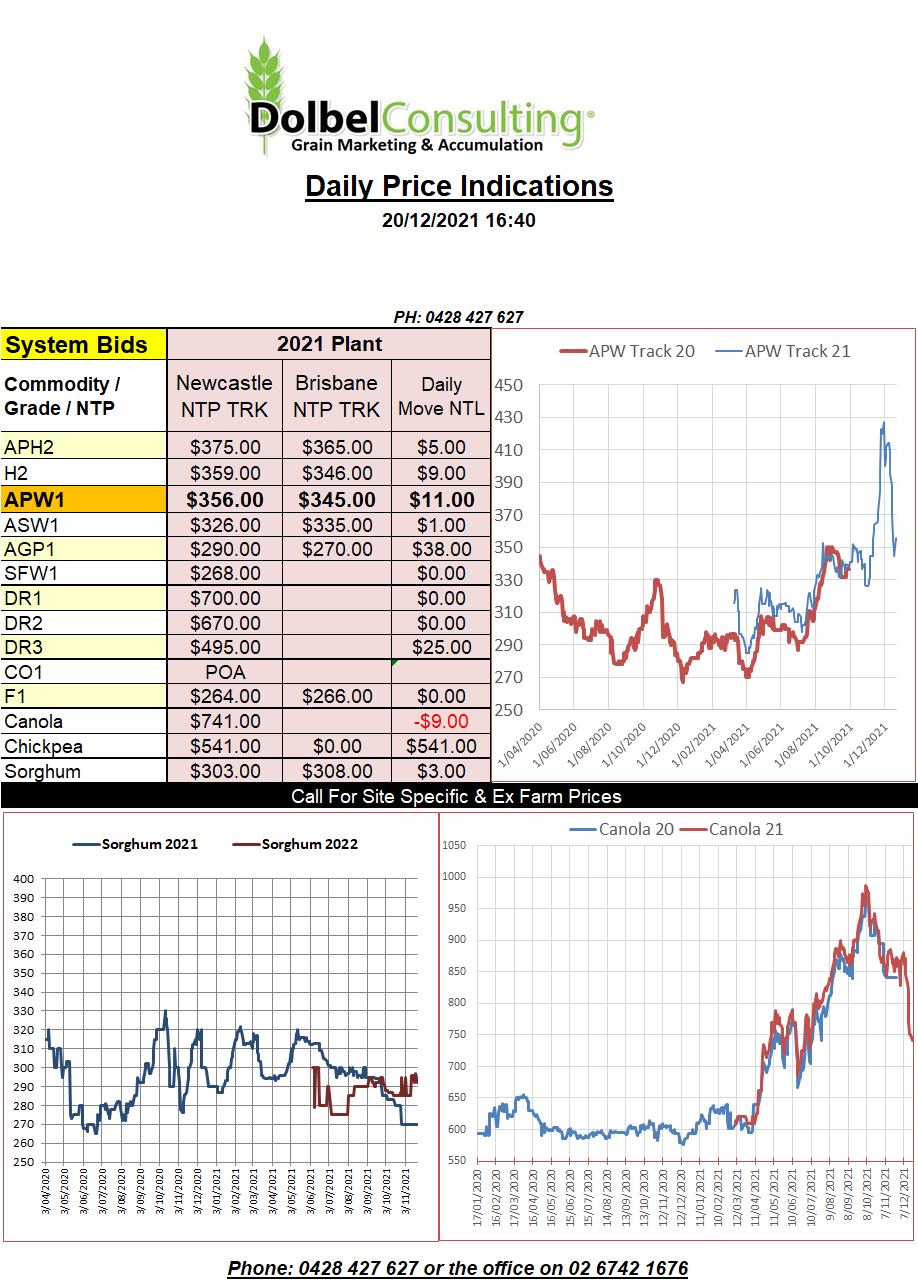

20/12/21 Prices

Both the Paris rapeseed market and the ICE canola market closed higher on the nearby in overnight trade. Paris was up E6.50 on the Feb22 contract but slipped E0.25 on the May22 contract.

The difference in price between the Feb and May contract at Paris is E59.75 or around AUD$94.20. This still indicates local basis under May is close to AUD$300 under, you couldn’t buy better basis as a trader unless you had a deregulated monopoly.

At Chicago wheat, corn and soybean futures all closed in the green, not huge moves higher but continuing the trend started after the big fall on Wednesday. Week on week we see the SRW contract for March closing down 7c/bu (AUD$3.60), corn up 3.25c/bu and soybeans are up about 40c/bu for the week.

Wheat continued to find support from the dry weather in the US and damage from the recent strong winds that pushed across the central Midwest. Good international demand for wheat was also seen as supportive.

Russia’s wheat export tax is now set at US$94.00 per tonne, milling wheat with a protein of 12.5% is priced at US$334 FOB Black Sea. Increasing wheat values may see the formula for calculating the export tax adjusted once FOB values go past US$375.

French and Canadian durum values were higher at the port yesterday. Internal values for Canadian durum have been flat for weeks.