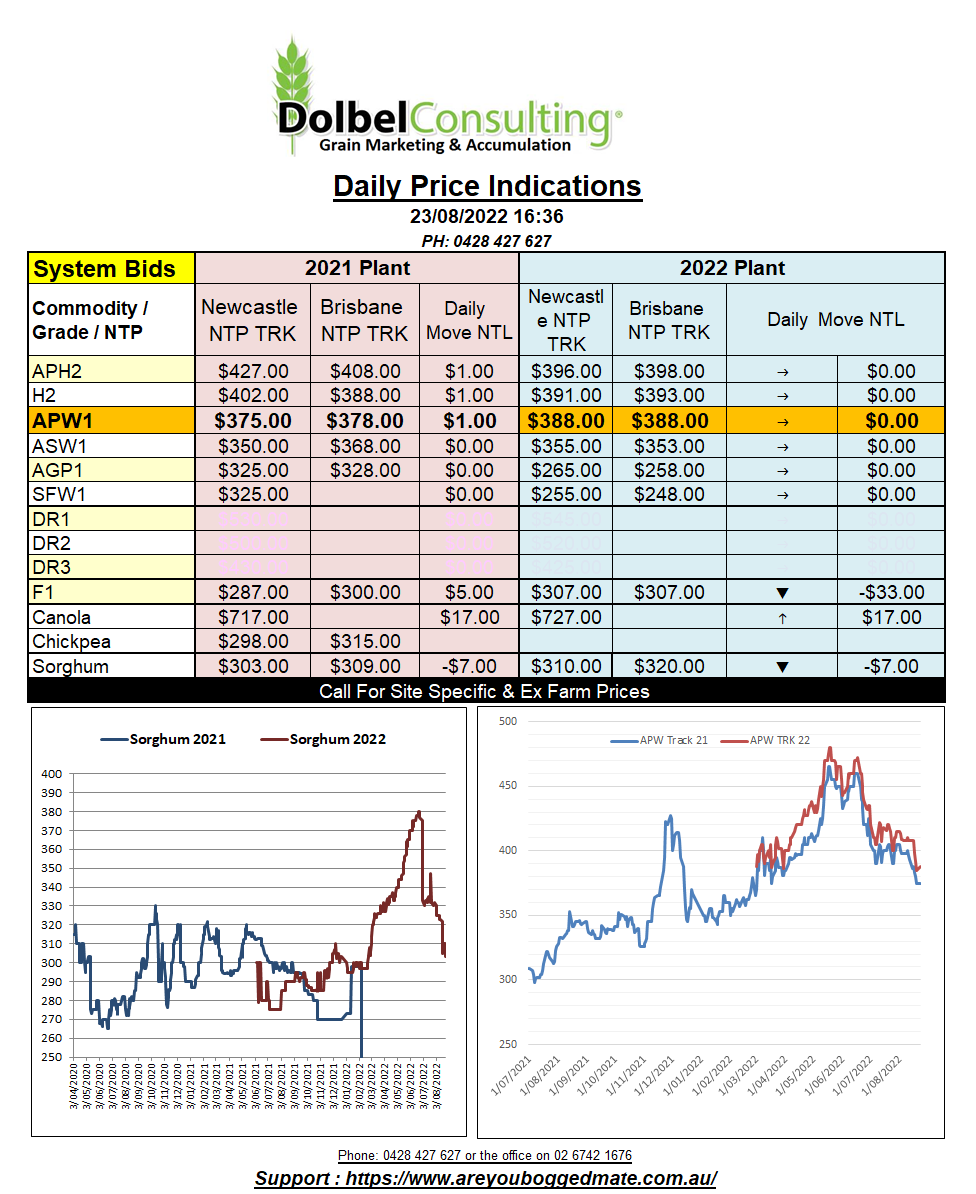

23/8/22 Prices

Grain futures in the USA were higher, bucking the trend lower in oil and fuel and moving against a firmer USD. A dry weather outlook supplied some positive sentiment for the row crops. Soybean futures at Chicago seeing moves of 30c+ through to the Aug23 contract. The strength in Chicago beans spilt over into the canola and rapeseed markets. Winnipeg seeing +C28.40 (AUD$31.65) in the Jan23 slot and Paris recording a gain of E19.75 (AUD$28.56) in the Feb slot.

Wheat futures in the US saw double digit gains for all three grades. The strength in futures also rolling through to a rally in cash prices both at the port and ex farm. PNW export values were AUD$7.00 to AUD$11.00 higher while white wheat stumbled, not tracking the improved returns for red wheat. In SE Saskatchewan, the 1CWRS13.5 milling wheat price improved proportionally to the futures market. Durum values were flat though, a Dec22 lift gaining just C$0.41c/tonne. The spread between 1CWAD13 durum and 1CWRS13.5 spring wheat ex farm SE Sask is now at C$50.45, in favour of durum.

Paris milling wheat futures were also firmer, the Dec22 slot putting on E6.75 to close at E316.75.

Russian 12.5% milling wheat out of the Black Sea for Dec was indicated at US$342 – US$348, Ukraine wheat for Dec was indicated at US$340.

USDA weekly crop progress report was out after the close. The US corn crop has all but finished flowering, 75% dough stage, 31% dented. The G/E rating fell another 2% to 55%, the % of Poor / V Poor increased 2% to 18%. The US soybean rating slipped 1% in the G/E rating to 57%. Cotton fell 3%, now just rated 31% G/E. Sorghum also fell to 25% G/E, 67% of the Texas crop now mature. Texas sorghum rated just 17% G/E and Kansas 26%.

Winter wheat harvest is 95% complete, spring wheat harvest is 33% complete. Spring wheat rating unchanged at 64% G/E.