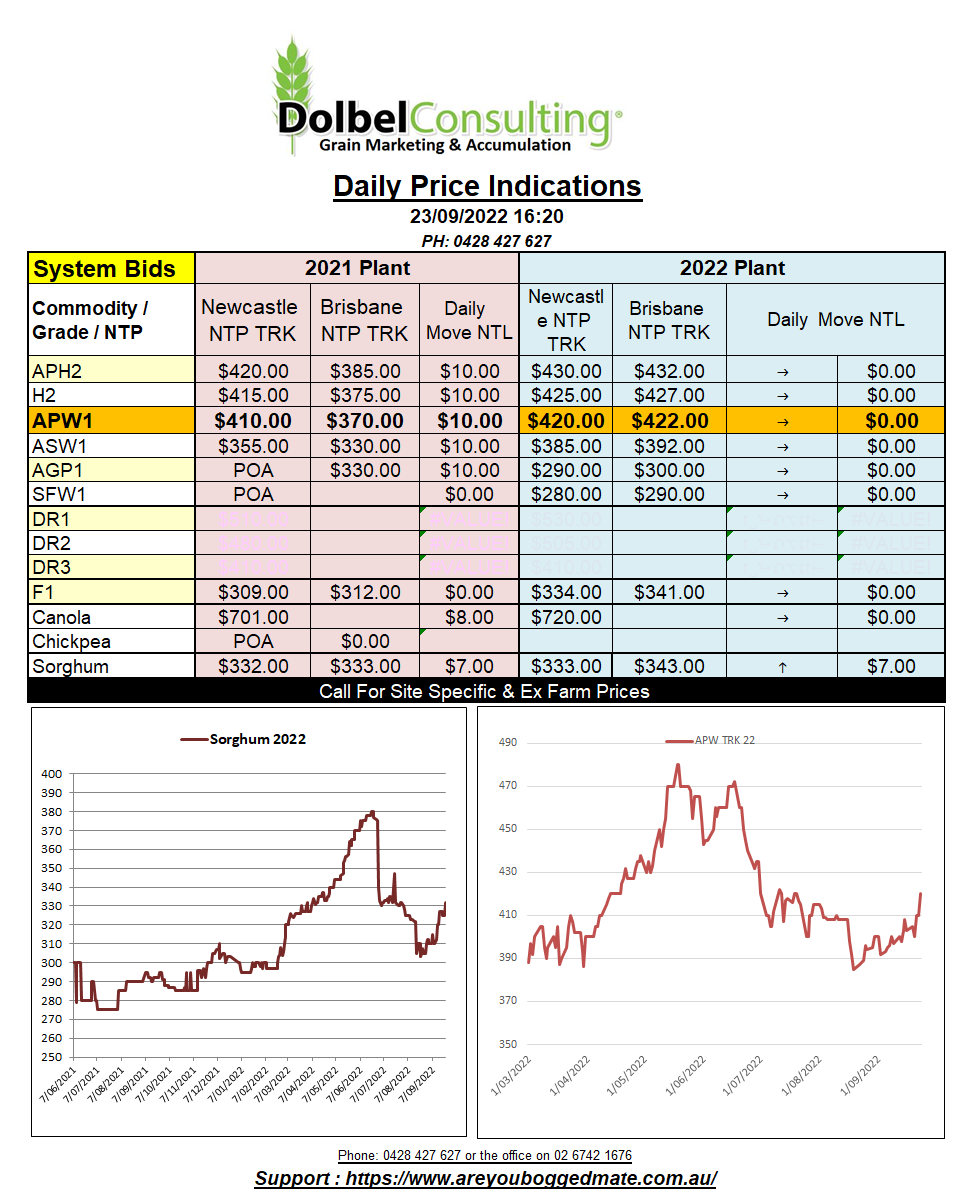

23/9/22 Prices

Lots of sabre rattling between Russia and the west over the last couple of days. The water continues to be muddied by political influences across the globe. We haven’t seen the world simmering like this for some time. Russian airports are packed, border crossings cues, up the 35km long at Finland, mobilisation (conscription) of the male population between 18 – 65. Then we need to weigh up the impact that the covid responses are having on the economic environment, the debasing of currencies. It is really making fundamental analysis difficult, but in the end the fundamentals are what we need to stay aware of.

The International Grains Council increased world wheat production month on month by 14mt, that’s a big jump. Increases in Russian wheat production is making up a large part of that. The 792mt wheat crop is now 6mt larger than last year’s crop. World consumption was only increased by 2mt, thus carry over stock was sharply higher, now estimated by the IGC at 286mt, a stocks to use ratio of over 36%. Not the perfect argument for +900c/bu wheat from a fundamental perspective is it.

Drilling down into the IGC report we see Australian wheat production estimated at 32.2mt (36.3mt last year), Aussie exports are expected to be just 1.5mt under last year, at 25mt, leaving a smaller carryout this season of just 3.7mt. Canadian productions was estimated at 34.7mt, Russia 93.4mt.

Indian production was estimated at 106.8mt, back slightly. Indian ending stocks are estimated at 16.8mt, with consumption there pegged at 104.5mt. The lower ending stocks represents a stocks to use ratio of just 16%, so India are not about to solve the “world food crisis”.

World corn ending stocks were estimated to fall by 22.6mt to 262.1mt, a stocks to use ratio of 22%, not excessively tight but enough to be interesting.