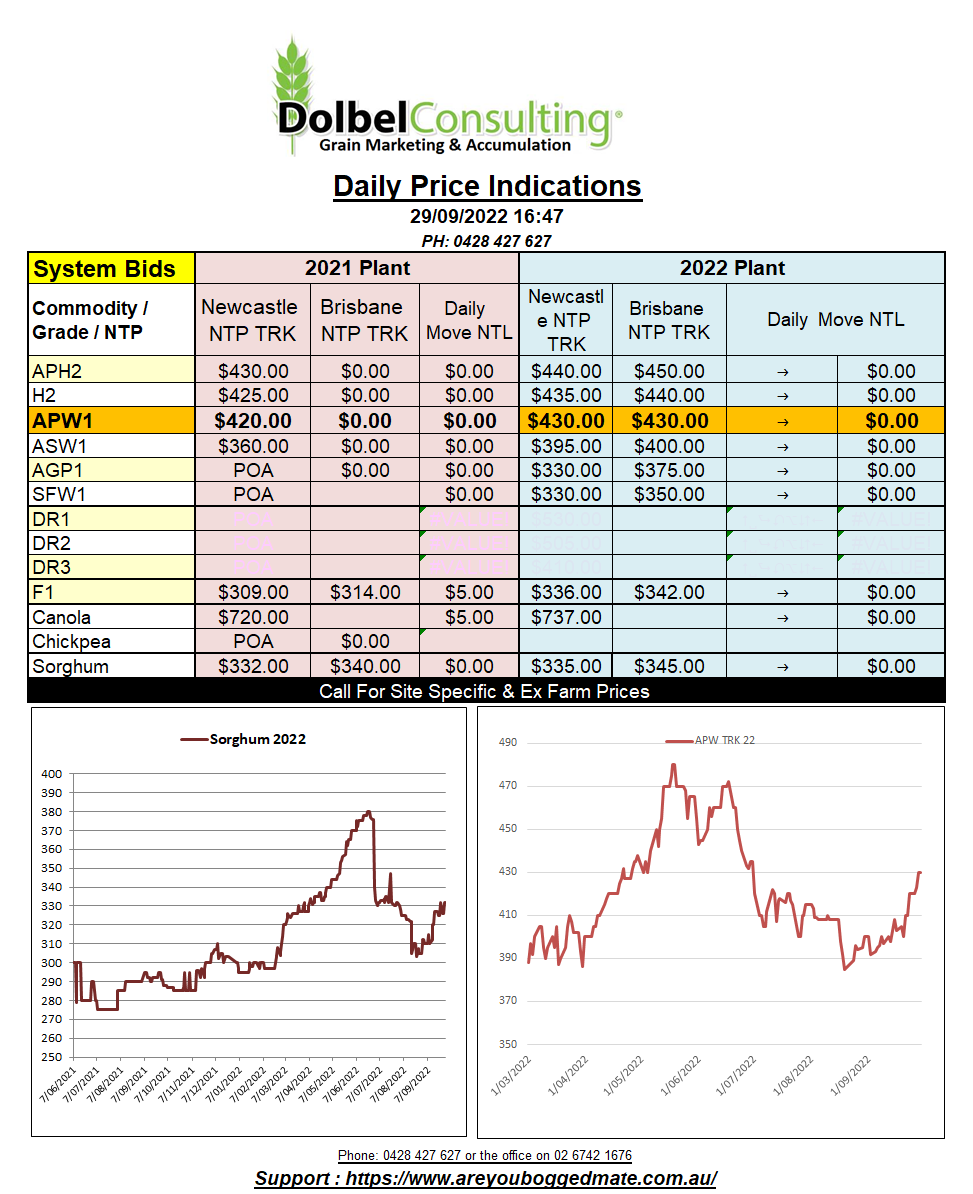

29/9/22 Prices

US wheat futures continue to push along in the same volatile nature they have exhibited for some time now.

Once again the catalyst for the surge higher in US wheat futures is tension in the Black Sea. Most of the punters seem to think there is more of a chance of an escalation in the Ukraine / Russia conflict than there is the chance for a resolution. It’s always been such a peaceful region.

We’ve all seen the videos of conscripted Russian “soldiers” being told they need to bring their own first aid kits, sleeping bags etc. Images of the new troops in total dismay, preferring to surrender than fight. We’ve seen the 30km long traffic jams at border crossings as people flee Russia. One tends to get the feeling this is all going very pear shaped, as if it didn’t always have the appearance of a crushed mango for Putin.

Who will win, well, it’s unlikely to be your average European, Ukrainian, or Russian that’s a given. With the gas lines from the north to Europe suffering some “unexpected damage” yesterday it may well be an alternative energy supplier that comes up shiny from all of this, surprised yet.

Back to the grain markets and the strength in wheat did manage to drag corn and soybeans higher. The spill over from beans into the oilseed market was good to see and pushed both ICE canola futures at Winnipeg and Paris rapeseed futures higher.

The Philippines are tendering for 50kt feed wheat and 60kt of feed barley. Russian feed wheat is valued at roughly US$266 N/D/J FOB Black Sea. On the back of an envelope this could land C&F into the Philippines for roughly US$340 – US$350ish. This would be much cheaper than both US or Argentine wheat. Australian feed wheat is being shown at about US$229 FOB Aust, ASW about US$260. Ocean freight will be about US$25+/-, so less than US$300 C&F. Indicating that Australian wheat into the Asian markets is still a very cheap option.