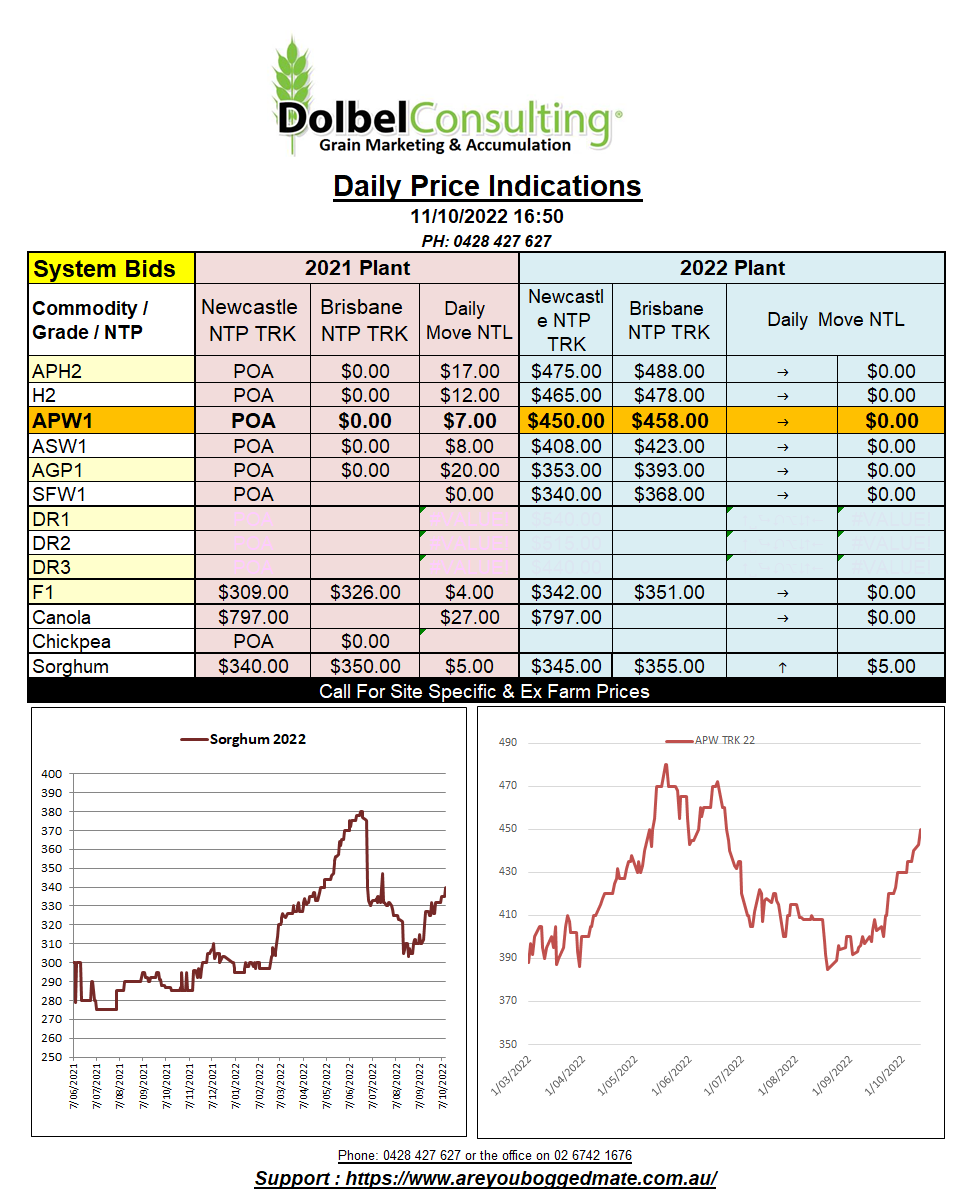

11/10/22 Prices

What a market, you can be 100% bearish in the morning and then 100% bullish by the afternoon, and you don’t even need to be wrong to have that change in sentiment. Whenever politics is in control of something you can bet on one thing, volatility.

The markets took the developments in the Russia / Ukraine conflict as bullish. The Russian use of missiles into Kyiv in retaliation to the possible sabotage of the recently completed Kerch bridge was seen as a potential undoing of recent progress in regard to the grain export corridor out of Odessa.

Combine these developments with the sharp increase in time it now takes for the inspections of these vessels, and we are now seeing more and more punters expecting to see the failure of the grain corridor agreement before Nov 19th, let alone being extended past this date.

Chicago wheat futures were sharply higher on the developments in the Black Sea. The US, and other exporting nations, stand to benefit in the short term from delays to exports of wheat out of the Black Sea and any production setbacks, be they natural or manmade.

Ukraine and Russia were responsible for 27.6% of world wheat exports in 2020-21 and according to the September USDA WASDE are projected to make up 25.4% of world wheat exports in 2022-23, a number many now find less than achievable. It will be interesting to see what adjustments the USDA will make to these estimates in the October WASDE, due out on the 12th.

Argentina remains very dry, 30-day totals across much of the Pampas and Cordoba were below 15mm, around 40% of average. SE China too remains very dry, while much of the Nth China Plain has seen some better falls. China sows there winter wheat in September / October, rain now is ideal.