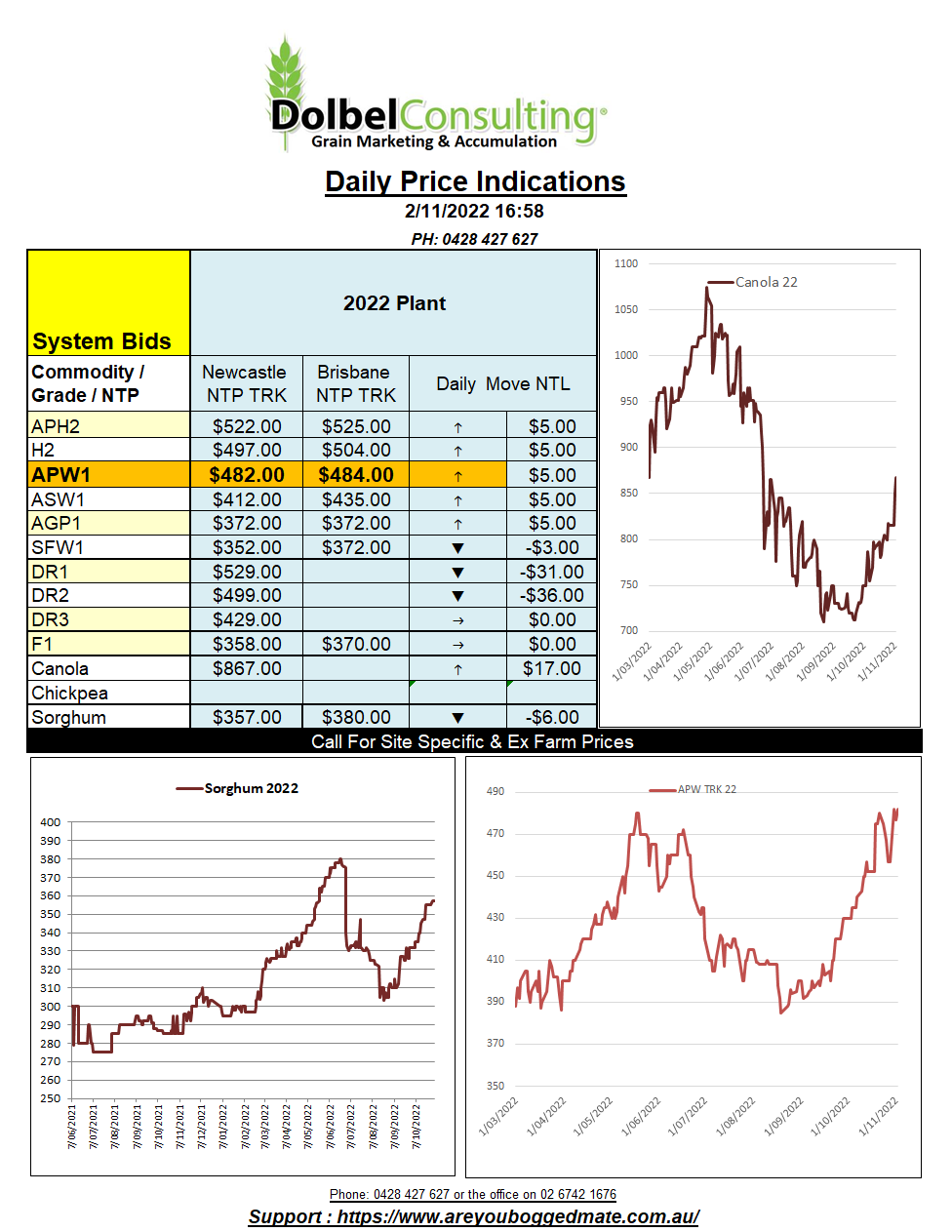

2/11/22 Prices

Corn, wheat and soybean futures at Chicago all closed higher. Corn was technically a follower of soybeans and wheat. Wheat is finding continued support from the Ukraine / Russia war. The protest by truckers in Brazil over recent election results have some punters thinking that soybean exports may in turn be hampered, not the case so far. The oilseed complex as a whole is also benefiting from the absence of Ukrainian sunseed oil of any volume.

News that the Pakistan government is to import wheat from Russia was also supportive. While on Russia the 2022 wheat crop is still being estimated at 101mt but preliminary estimates for the 2023 crop are lower, at 87mt, closer to the average.

Around 87% of the US winter wheat crop is now sown, just a smidge above the average for now of 85%. The major concern for the new crop wheat in the USA is the current crop condition rating. Just 28% of the crop is rated Good / Excellent and a massive 35% is rated Poor / very Poor. This is the worst opening lower end crop rating for this time of year of any winter wheat crop in the US for many years. Since planting there has been some rainfall across the eastern parts of the US wheat belt. The major HRWW states and the NW winter wheat regions remain very dry. Wheat that was sown into dry soil in the east is expected to benefit greatly from the recent and predicted rainfall over the weekend, but western wheat country is expected to remain very dry. Basically, it’s looking like the US winter wheat crop will go into the winter in poor condition, less than ideal, but the crop is made in spring when it comes out of dormancy.

Much of eastern China remains abnormally dry, the SE is very dry. The major winter wheat regions of China are showing between 20% and 40% of average rainfall for this time of year. South Korea picked up 63kt of US feed wheat, yet to confirm pricing. Iraq 50k buy Romanian wheat at US$469 C&F.