15/11/22 Prices

The big news was the Saudi purchase of 1mt of wheat for April / June next year at an average price of US$382.56 per tonne. The wheat is required to be 12.5% protein hard wheat. The tender saw offers from all the major exporters, including Australia.

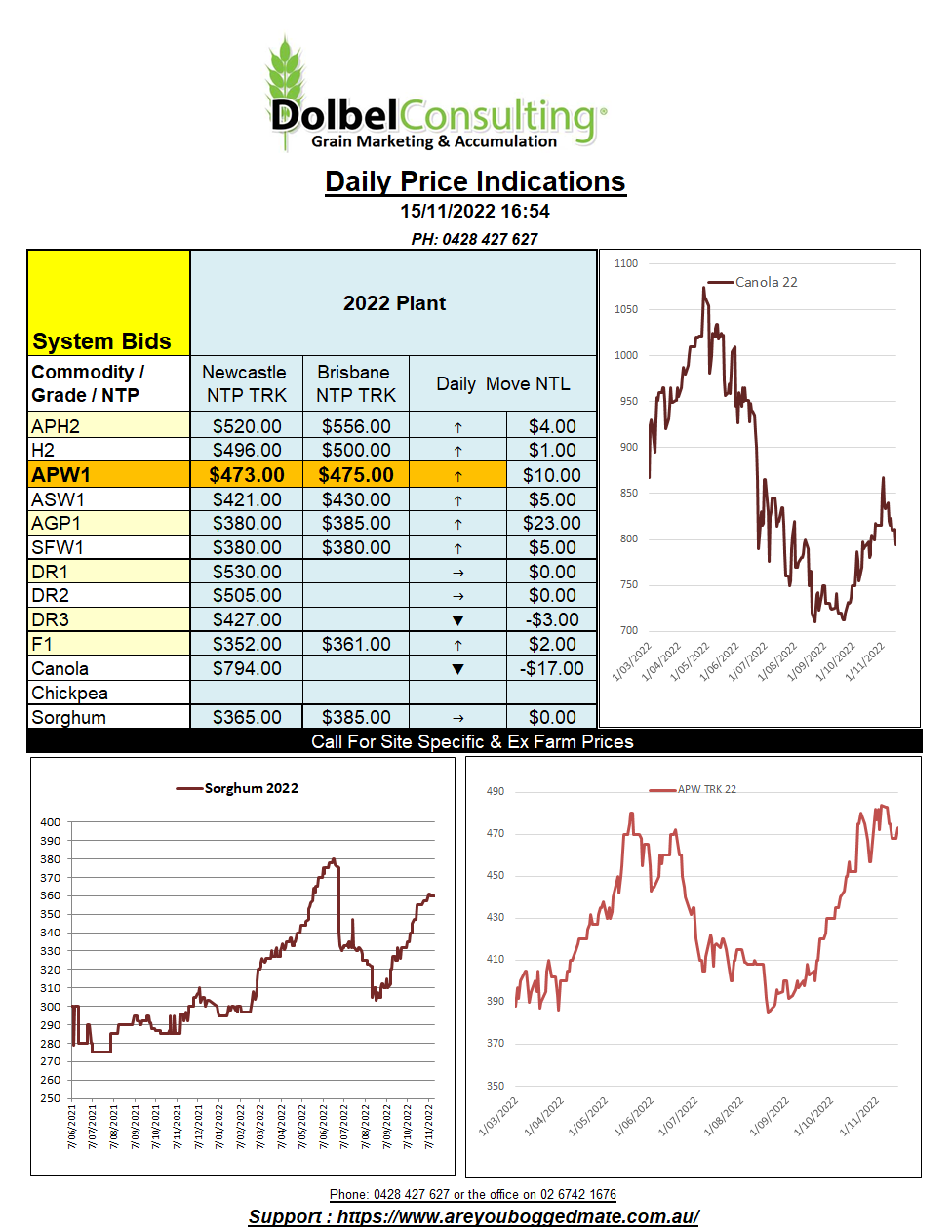

The seller has the option of origin, probably a good thing if considering H2 wheat out of Australia this year. On the back of an envelope the price roughly works back to an XF LPP price comparable to AUD$480 – AUD$490. This compares favourably to current prices which are roughly AUD$472 equivalent.

Projected wheat production out of Argentina continues to decline, estimates now between12.5mt & 11.5mt. The fall in production is also resulting in sharp decreases in their export potential. The latest estimate reducing exports by 2mt to just 7mt. This compares to 14.5mt exported last year.

The decline of 7mt starts to make more of an impact when you combine it with wheat export reductions from Ukraine, Australia and potentially the USA and Russia in 2022-23. Yes, you read that right, Russia.

Currently Russia is experiencing delays in grain exports as logistics fail to move grain at the required pace. This is a combination of both the weather and the war. We also see Putin placing an export tax, and possibly an export cap, on wheat in the short to midterm. With Russia said to have harvested 100mt of wheat this year this adds up to just one thing. Increased ending stocks for 2023.

The big question is will the reductions from Argentina and Australia counter an increase in world stocks. Both Argie and Aussie carry out is already projected to be very low. One might expect to see further reductions in export potential to at least sustain current carry out for both countries in coming weeks. This may not be as bullish price as it would normally be, but it may well stabilise a market that could have sustained a sharper decline.