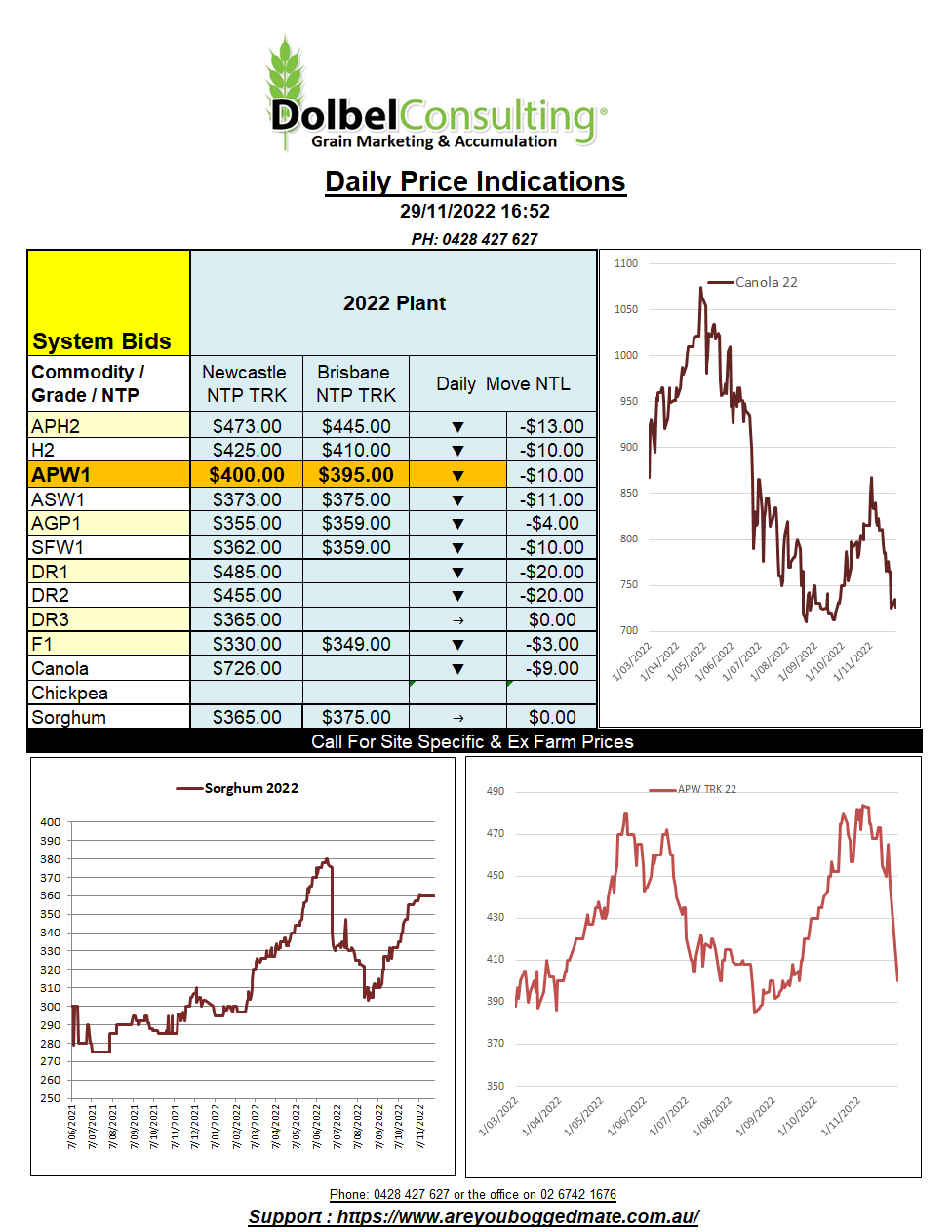

29/11/22 Prices

Chicago wheat futures hit a three month low overnight. The market looks to blame the Chinese lockdowns and the demonstrations there. A big Russian crop is not helping either. Russian wheat is expected to feature in a number of tenders closing this week. Turkey is seeking 455kt, Pakistan 500kt and Jordon may or may not buy 120kt.

Algeria also announced a tender for 50kt for Dec / Jan. As a rule Algeria buys more than the 50kt minimum offer. Most traders expected to see Algeria confirm about 500kt before the end of November and most expect to see Russia wheat feature on the order.

The Chinese protests are a major distraction at present. The last time an uprising of this magnitude was reported 10,000 people died as the communist party flexed. Yesterday China held a 40kt wheat auction and it was 100% sold. China continue to feature on European wheat export sheets as well.

Chicago SRW wheat futures were down AUD$10.36 in overnight trade, hard red winter wheat not far behind. The stochastic shows wheat in the March slot is relatively neutral after this sell off. The December slot is starting to see lower volume as the punters roll there profitable short positions to March and May. It may take a few more days to kill this roll and see a bounce.

Chicago soybeans closed firmer, the strength rolling across to the Winnipeg canola contracts, which gained C$11.80 in the March slot. Paris rapeseed futures did not reflect the stronger close in either beans of canola, instead closing lower, shedding E5.75 on the nearby.

The turmoil in China did equate to some weakness in the AUD overnight. The weaker AUD could counter about 30% of the move in CME SRWW.