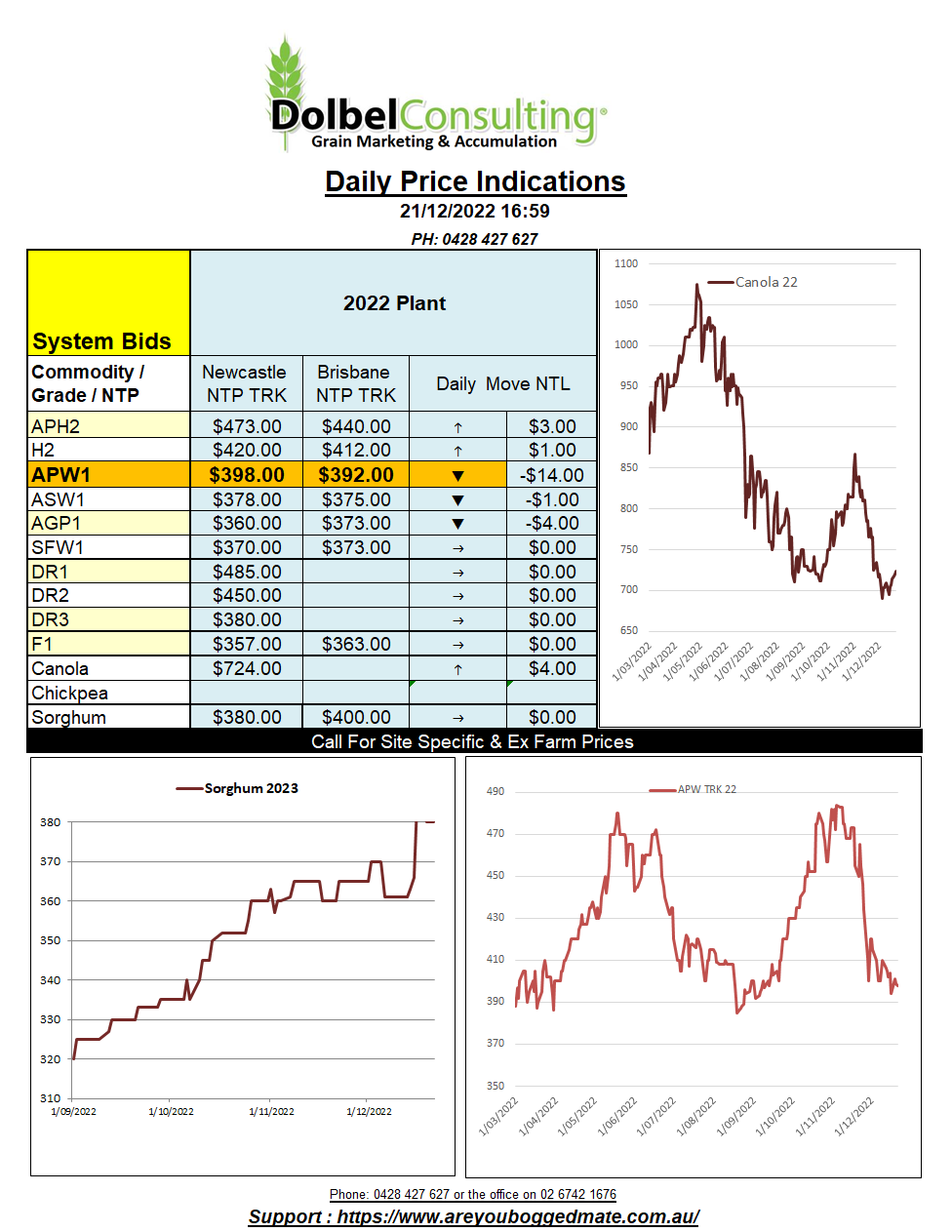

21/12/22 Prices

Winnipeg canola futures found some support from a rebound in Chicago soybean futures. CME beans closed +17.75c/bu on the nearby, about AUD$9.80 per tonne. By the close ICE canola was up C$6.00 on the January slot. The stronger finish was not reflected in the Paris rapeseed contract. Paris closed lower across rapeseed, milling wheat, corn and the London feed wheat contract was even a touch lower. The movement in the AUD should counter the lower close in Paris rapeseed futures though. In Aussie dollar term FOB Rouen values out of France actually convert to a rally of about AUD$7.00 overnight. The cash market and the futures market moving in opposite direction….. shock, horror.

In the US Pacific Northwest white wheat values were flat while hard red winter and spring wheat were generally AUD$5.00 to AUD$7.00 higher when considering the move in the AUD. Cash bids for 1CWRS13.5 milling wheat out of SE Sask were also firmer. The Feb pickup slot averaged C$421.91 per tonne, an increase of about C$3.47 over the previous day. Canadian basis can be difficult to estimate this time of year but according the latest SaskWheat report it is roughly C$75 to FOB, so the 1CWRS13.5 number XF SE Sask would come in somewhere around C$497 to C$505 on a boat ready to head to Japan or China (US$401 C&F China).

Using China as an end point and converting the Canadian number back to a rough equivalent XF price LPP we come up with a number around AUD$490. At the moment APH2 into the Newcastle market is trading at an equivalent XF LPP price closer to AUD$420 – AUD$430.

On the track APH2 delivered Gunnedah is bid roughly AUD$422 at the site. To execute this, FOB it and land it at China, it would be equivalent to a US price of about US$50 under the Canadian bid to the grower. This represents a good buy to the Chinese, no wonder they are topping the import board.