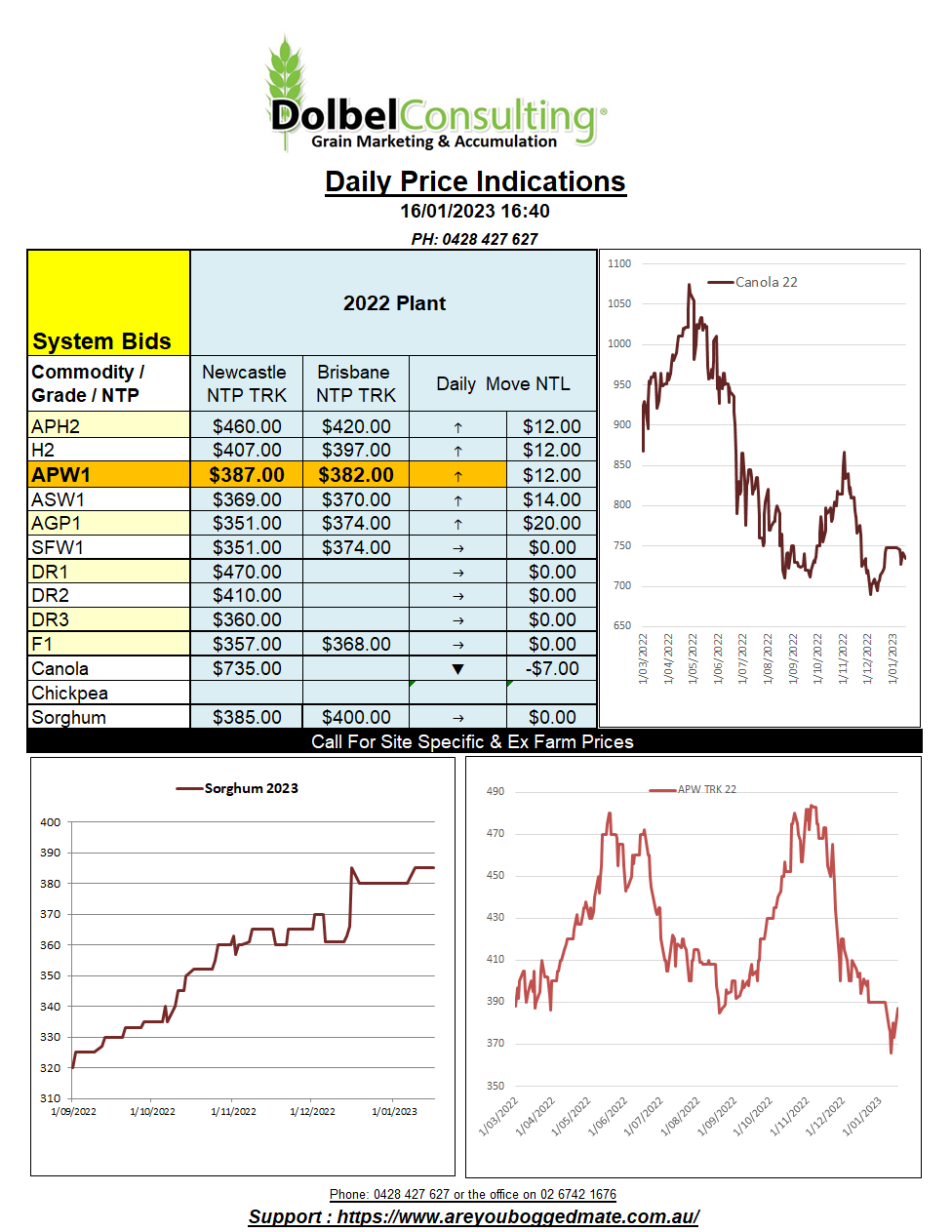

16/1/23 Prices

The prospect of a little rain across Kansas next week didn’t dampen the rally in HRWW futures at Chicago. Even cash prices out of the Pacific Northwest were higher by just under AUD$3.00 at the FOB level. The forecast remains poor for much of Oklahoma and Texas though. With nothing in the forecast and parts of southern Kansas right through to Texas seeing just 20-40% of normal rain over the last 2 to 4 weeks the US HRW market should continue to find good support, if not at an international perspective, at least at the domestic level.

Looking at Europe the winter weather is fairly neutral in Germany and France. 30day precipitation is about average if not a little above average in the north and across Poland. Cold weather is predicted across the south of France over the next couple of weeks.

Russia has seen good moisture in the north but recent warm weather has seen little snow fall. This may become an issue as cold weather mixed with little snow cover can result in winter kill. The north / central winter wheat regions have seen exactly this with temperatures plunging 15 to 20C below normal. Some locations seeing the mercury drop below -20C. Apart from the potential winter kill, which can’t really be confirmed until the spring, the Russian winter wheat crop has most other fundamentals in its favour and could potentially give the 2022 record a run for its money.

Canadian milling wheat prices were firmer. The average cash price ex farm SE Saskatchewan for 13.5% 1CWRS wheat was up C$5.54 to C$411.10 per tonne. The discount to 1CWRS 11.5% milling wheat was on average C$22.05. The current spread from 1CWAD13 durum to 11.5 CWAD1 was just C$5.51 per tonne. Average ex farm Canola prices across SE Saskatchewan were also higher, spot values increased by C$10.23 per tonne to C$817.22. Costs to port have increased as winter slows logistics. Wheat costs about C$70 from SE Sask to FOB PNW, but some grains are over C$100 now.