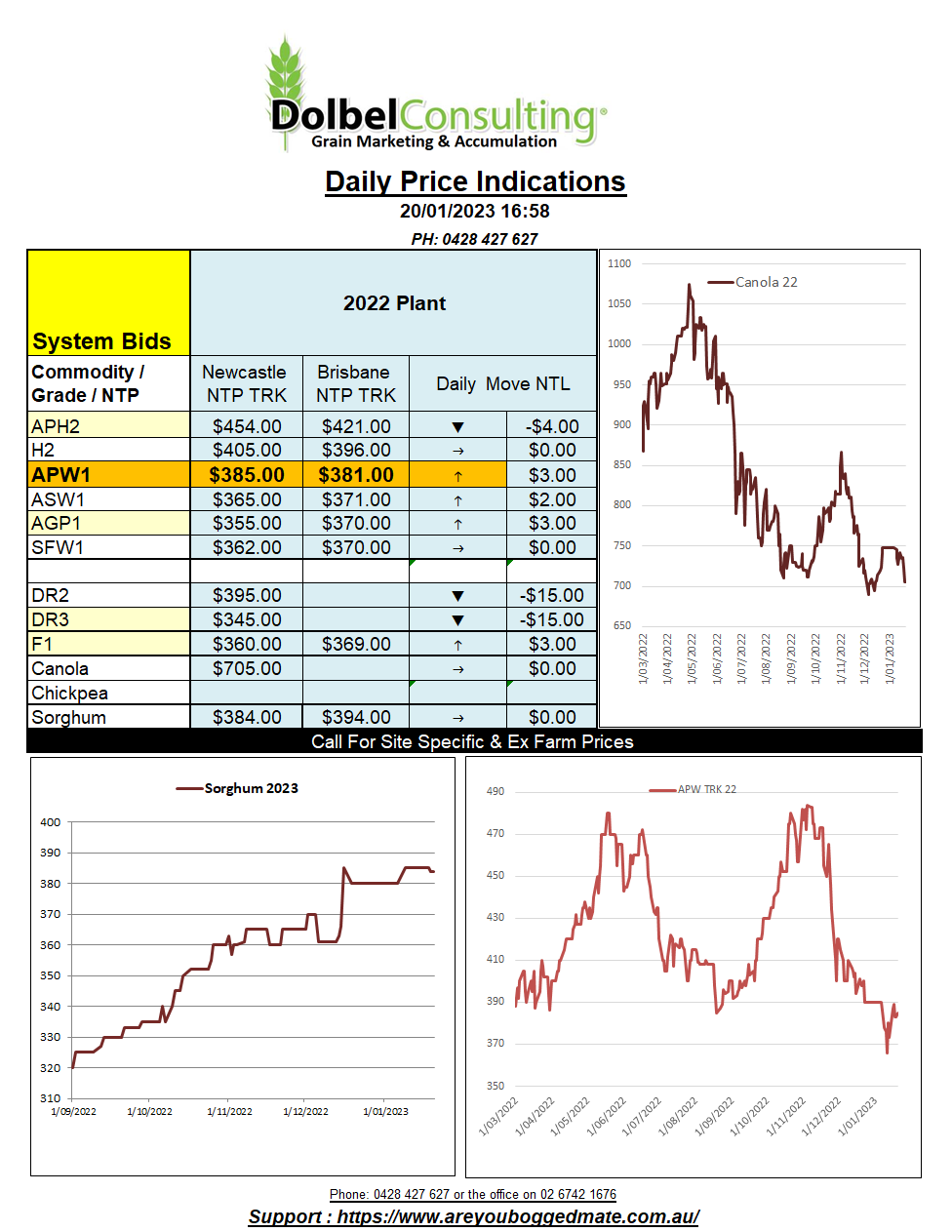

20/1/23 Prices

Tunisia picked up 125kt of durum for Feb – April delivery at US$492.40. The majority was purchased from Italian trading house Casillo with one boat load coming from Viterra and Amber. Tunisia’s economy has suffered a number of economic and political setbacks in recent times, 3 years of drought has compounded the hardship. This has created both cash flow issues and production issues, a recent loan from the European Bank is helping.

On the back of an envelope this sale value would convert roughly to a number ex farm Liverpool Plains close to AUD$540 and is less than a previous purchase but is well above current cash prices for DR1. The tender price compares favourably to current Canadian values and indicates that French values may still be too high to win larger tenders into N.Africa.

Domestic wheat prices in India and Pakistan continue to move higher as futures contracts at Chicago and Paris push lower. The Indian government is considering measures to curb domestic prices. Importing wheat could be considered. Remind me, wasn’t India going to save the world and fill the export void left when Ukraine exports became limited after the Russian invasion…. Anyway, back in the real world, this month’s USDA report indicated that Indian carry out wheat stocks were expected to increase 350kt from the December estimate, up to 12.63mt. Carry in was estimated at 19.5mt, could both estimates actually be a little lower than the USDA report suggests. We are not even considering quality.

In Pakistan there was a lot of talk that many grain reserves were washed away or inundated by water during the record floods in October. India and Pakistan sow wheat between September – December, harvest starts around March – April.

Philippines picked up 110kt of Aussie feed wheat overnight. Thailand picked up 110kt of feed wheat at US$326 CFR this week.