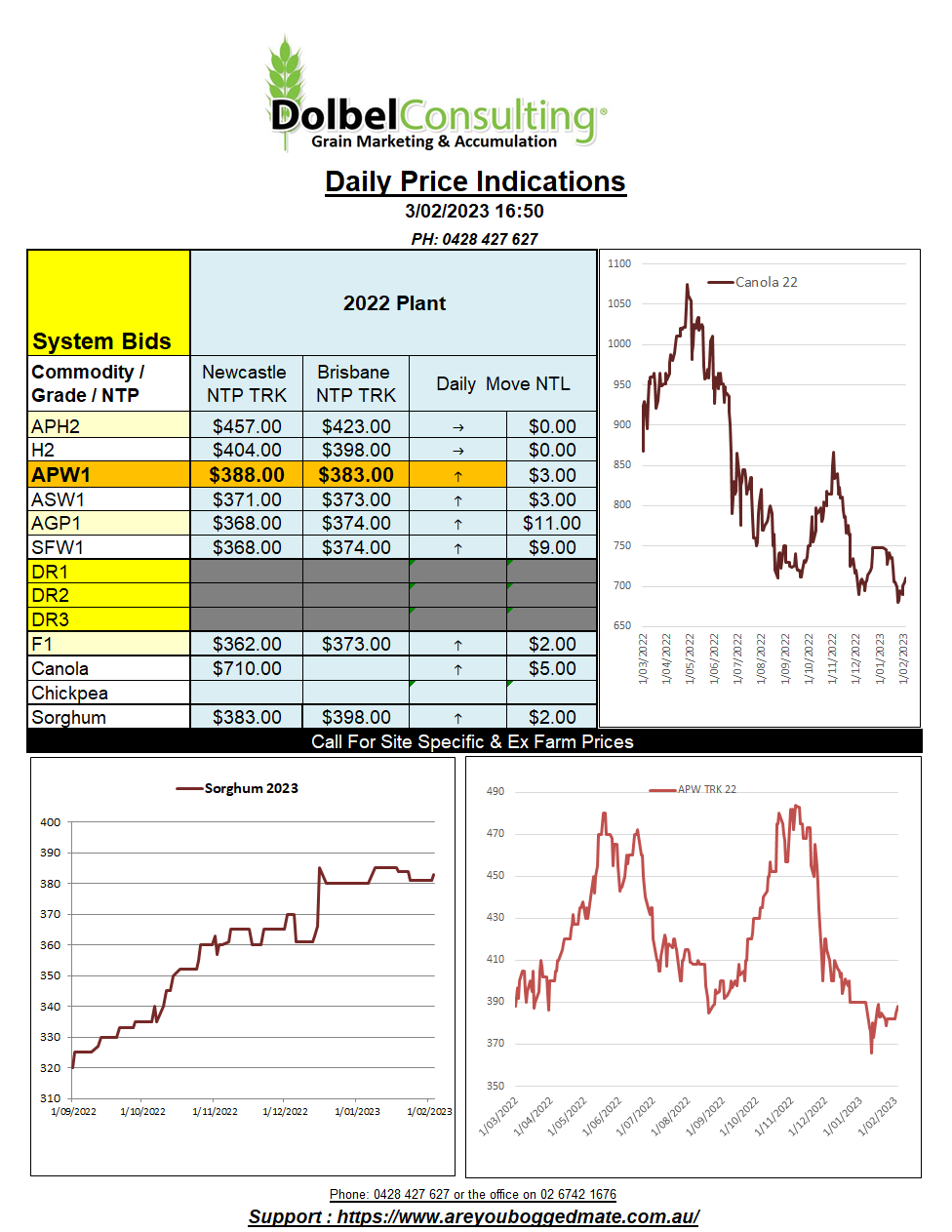

3/2/23 Prices

Egypt, GASC, is seeing wheat offers for their latest tender coming in between US$353.75 and US$322.80 per tonne. If Australia was to try and compete into this market accumulation would need to occur at something close to $315 XFLPP, that’s not going to happen, especially for milling wheat. Russian wheat was the cheapest on offer filling the top 6 cheapest slots for the March leg of the supply. Of the 20 offers, well over half were Russian origin. Russian offers were lower than their previous tender, the cheaper ocean rates also resulting in CiF values falling further than expected.

Jordan also announced the purchase of 60kt of milling wheat, most assume Romanian, but the tender is optional origin.

The US futures markets for wheat were flat to lower, the reduction coming in the better milling grades. The weaker close in both HRW and spring wheat did roll across to lower FOB values out of the Pacific Northwest. HRW out of the PNW converts to an XF LPP equivalent price of over AUD$450 though. so still not very bearish local basis. White wheat values out of the PNW are equivalent to roughly $390 XF LPP. That’s a big spread between APW and APH2 type wheat but is being mostly reflected in local values now.

Some central European states have raised concern with the EU that the sudden influx of cheap Ukraine wheat flooding their markets has drastically dropped their local price hurting the income potential of local farmers. Hand me a tissue, this is really cutting me up, fancy having to compete with unsubsidised wheat. Imagine if the EU recommended import tariffs, I buy a box of popcorn to watch that one be explained.

The 7-day rainfall forecast for Argentina has turned dry again after good rain fell week. Temps into high 30’s low 40s for the week ahead there too.