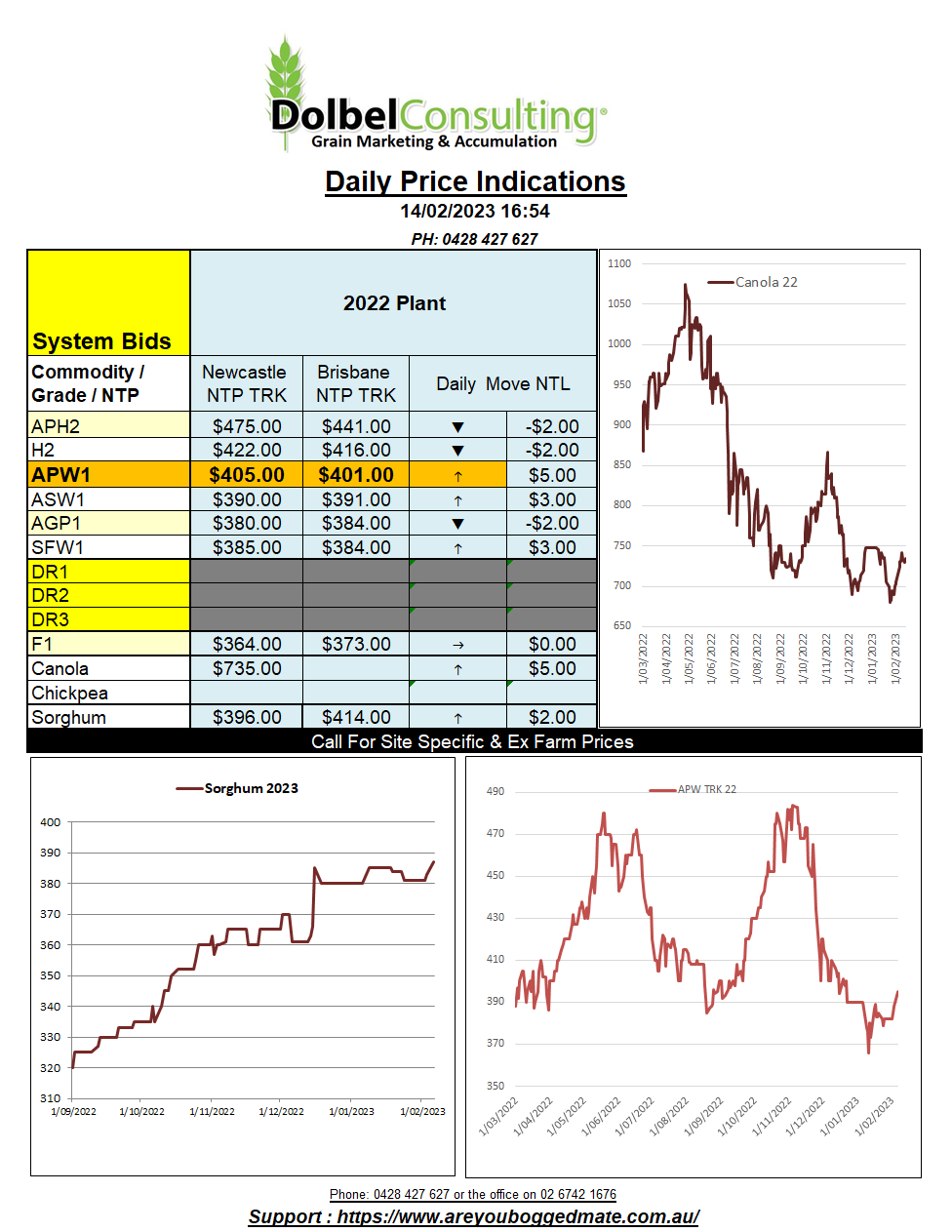

14/2/23 Prices

Wheat, soybean, and corn futures all held onto Friday night gains. Wheat managed to climb a little but the increase in value of the AUD against the US dollar will likely counter the move in SRW futures.

Philippines booked 110kt of what most traders think was Aussie feed wheat on Friday. There is some speculation that the wheat could be from the US but prices out of the PNW do not appear to be competitive with Australian values at present. We’ve seen the US win a couple of tenders with prices much higher than other suppliers though. Good to see the US haven’t forgotten how to grease the wheels of industry in a level playing field.

Values for the feed wheat sale into the Philippines was said to be around US$332 C&F for one boat and US$335 C&F for another. The lesser value roughly equates to an XF LPP price of something close to AUD$380. That’s close to where current delivered port bids are trading.

The merchants were said to be CBH and ETG, so there’s a good chance this will be supplied from WA, probably as ASW.

China cleared the decks again with their latest domestic wheat tender. There was 139.15kt offered and sold. China continues to sell wheat onto their domestic market in an attempt to reduce prices to the consumer.

The war in Ukraine & accusations of Russia deliberately slowing the pace of Ukraine exports by taking forever to do their part of the inspection process as the Ukraine grains moves through the Bosphorus continues to be the main driver in wheat. Severe heat in Argentina also supported corn and soybeans.