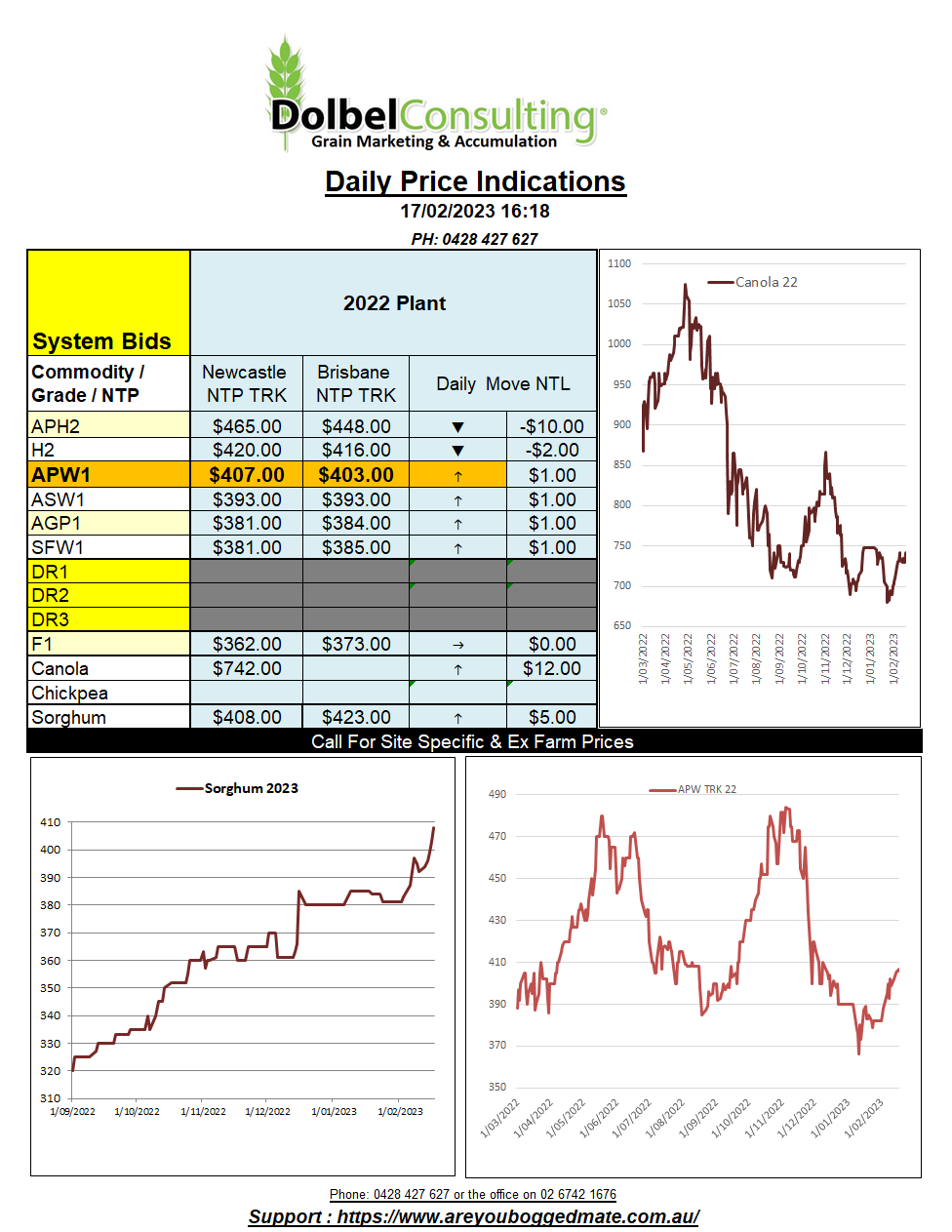

17/2/23 Prices

US wheat futures closed the session mixed. Soft red winter wheat closed a little lower while the higher-grade wheat, hard red winter and spring wheat both closed higher at their respective exchanges. Cash prices out of the Pacific Northwest were, in Aussie dollar terms, also mixed. HRW falling a couple of dollars while spring wheat gained less than a dollar. White wheat offers out of the PNW were a little lower, shedding about AUD$3.97.

Using Japan as a consumer, US values for white wheat out of the PNW convert to a number equivalent to somewhere around AUD$400 XF LPP. Currently we are seeing APW into the Newcastle port bid roughly $440 – $450, so local prices are somewhat comparable to US values for that product and into that location.

Paris rapeseed closed in the green, gaining E3.00 on the nearby and that or better across the outer months. The AUD was a fraction lower; the combination puts local prices in a good position to take back yesterday losses. There is not a lot of negative news to push global canola / rapeseed prices lower at present. Obviously, there’s a little pressure from the huge Brazilian soybean crop but that is being countered somewhat by the reduction in Argentine beans. The drop in Argie beans is not going to have a huge impact though. Argie beans could fall 10mt YoY and the extra Brazilian beans would easily cover it. The Brazilian bean crop may not be as big as expected a month ago though.

The currently inelastic demand for rapeseed / canola oil is ongoing, well for the time being. Germany continues to work towards banning food grain-based biodiesel production by 2030, that could hurt a little in the long run, until the oilseed guys figure out what to grow at least.

The International Grains Council lowered world soybean production 7mt to 378mt, the drought in Argentina the major cause for the reduction from January.