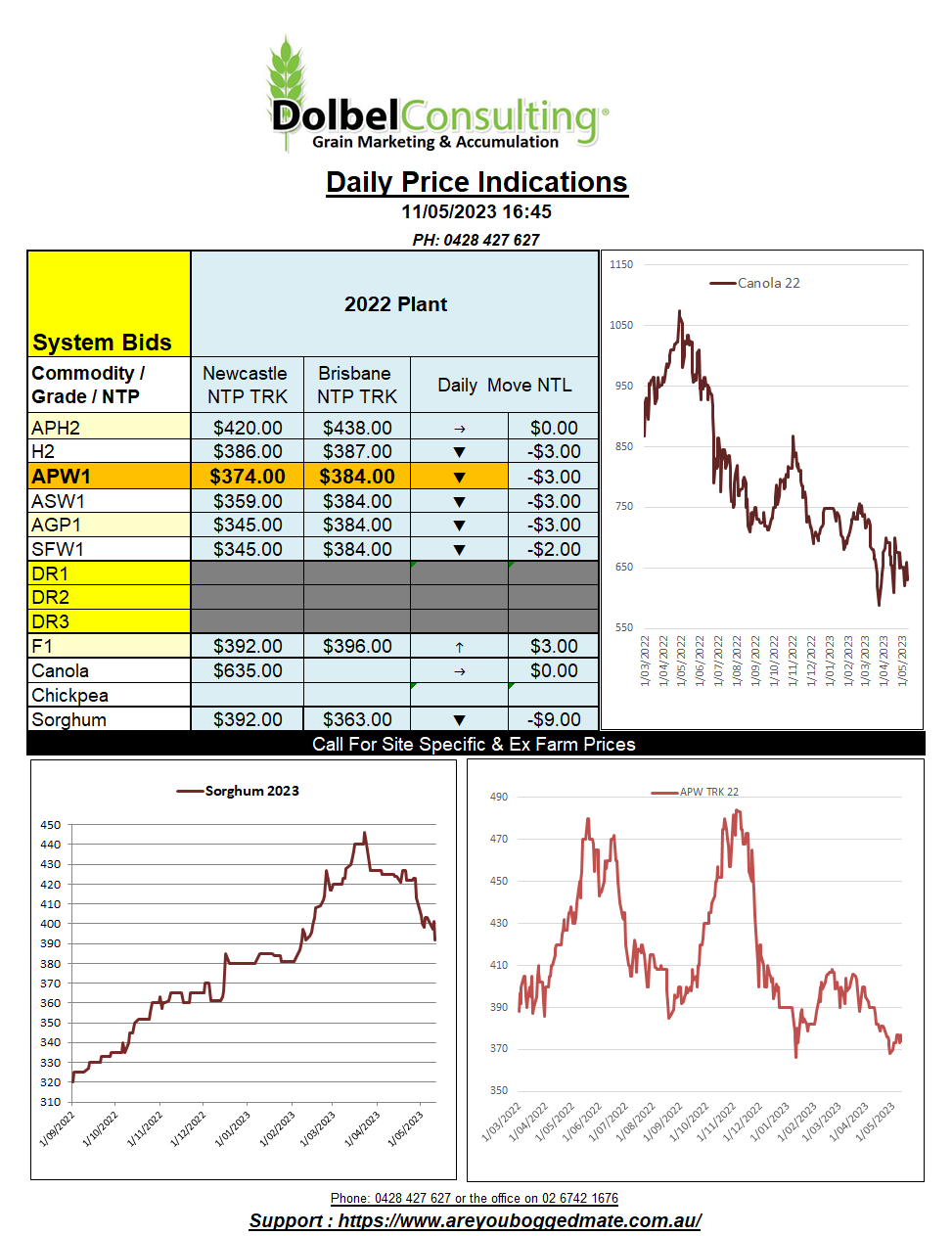

11/5/23 Prices

International futures markets were a sea of red again last night. Chicago corn one of the few contracts with a green finish. Paris rapeseed futures were mostly higher, the new crop contract Feb 24 was up E1.75 by the close. Taking the futures move, and the variation in the AUD / Euro into account, it could still be reflected as a move higher in local values here today of roughly AUD$2.60, if basis was to remain flat.

At Chicago, soft red winter wheat and hard red winter wheat were lower by the close. The prospect of rain in the US said to be the main negative influence. What an inch of rain will do to help the US HRW crop now is pretty speculative. An improvement in the G/E rating of 5% would still make it a terrible HRW crop in Kansas at best.

Saskatchewan remains dry, the 7-day forecast not offering much in way of rainfall predictions either. It’s not a major concern as yet, the late winter supplied good sowing moisture but keep an eye on conditions as we move through June. The dry weather, if it persists, will influence the value of canola and spring wheat (milling and durum) and potentially barley as we move into July. The prospect of good falls across the US spring wheat belt may counter the dry in Sask in terms of market sentiment in the short term.

Jordan was said to have picked up 50kt of feed barley for October at US$257.50. On the back of an envelope this would equate to something close to AUD$250-60 ex farm LPP. That’s pretty cheap, probably Black Sea product.

US financial markets are secure according to every political subject in the US. There are also talks of stopping short selling on bank stocks. So, which is it. The US track records for safe and effective hasn’t been great over the last couple of years. Do we see further banking industry consolidation in 2023.