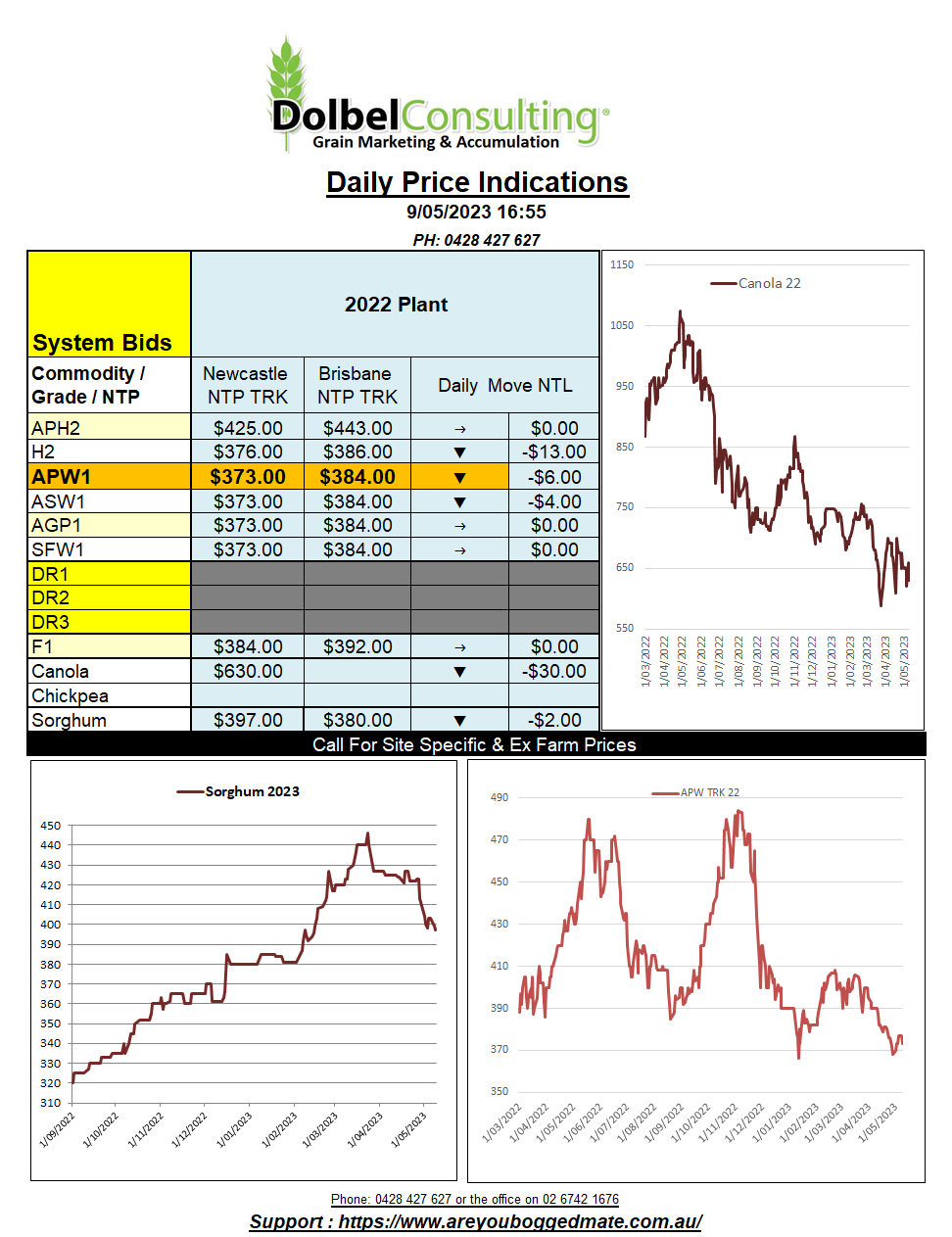

9/5/23 Prices

Paris rapeseed futures were hit hard last night. The nearby contract closed E19.50 lower, the Feb 24 slot was also lower, shedding E19.00 per tonne by the close. The weakness in the European market was felt in the Canadian market to a lesser extent. Canadian prices were pressured from increases in sowing pace in Canada and reductions in the Malaysian palm oil market. The biggest influence in the oilseed complex continues to be the huge Brazilian crop which more than countered any reduction to Argentine supply.

The US crop progress report was out after the close of the US session. The corn planting pace improved a lot, now at 49% sown vs the 42% 5-year avg. The “I ” states are still lagging behind the average pace a little but there is currently no concern, and the crop looks like it will go in on time.

The rapid pace of the US soybean planting will also have a negative influence on oilseed prices through the rest of the week. Pegged at 35% sown that is well above the 21% 5-year average for this time of year. Rain later this week may slow that down. Sorghum sowing is bang on the 5-year average at 24% sown, Texas now at 73% complete.

32% of the Kansas wheat crop is in head and rated at just 11% G/E with a massive 68% P/VP. Overall, the US winter wheat crop improved 1% in the G/E field, now rated at 29% G/E. Spring wheat sowing progressed, finally. Minnesota is still lagging after some very late cold weather delays, MN pegged at just 7% sown, against the 5-year average of 34%. Overall, the US spring wheat crop is estimated at 34% sown against the 5-year avg of 38%.

In summary summer crop sowing progress is good while spring wheat and durum sowing remains slow but picking up. Rain is forecast for much of the spring wheat belt in the US later this week so we could see further delays in next week’s report.