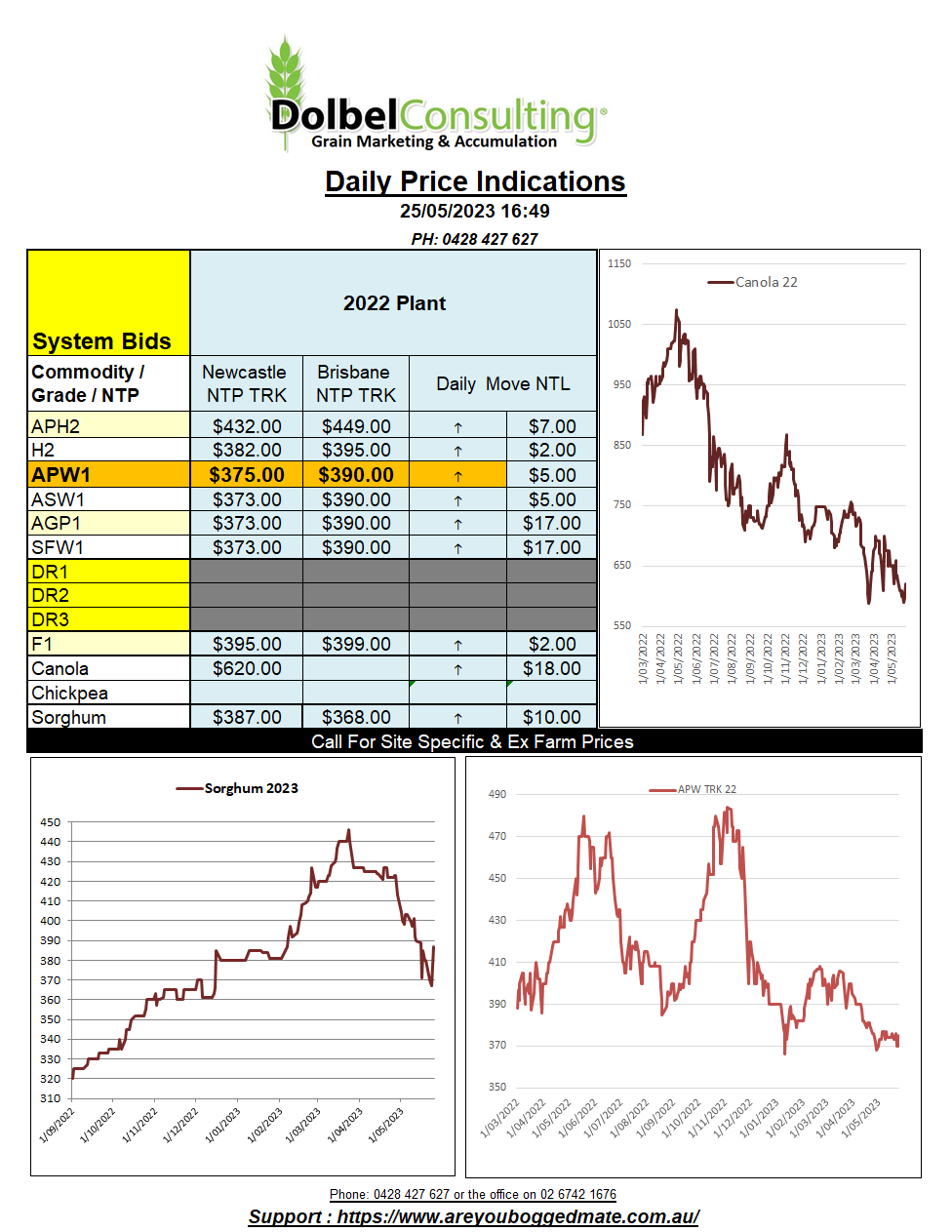

25/5/23 Prices

Paris rapeseed futures traded higher overnight, new, and old crop futures, making some good ground against the trend in Chicago soybeans. Winnipeg canola futures were softer. Some good rain in parts of Alberta were viewed as favourable for the Canadian crop.

Local, new and old crop markets, have generally been tracking the moves in Paris futures of late. Sometimes not dollar for dollar, and the trade have also been showing an improvement in basis. The weaker AUD may combat further improvements in basis today, but combined with the move in futures there’s a good chance both new and old crop contracts could see around AUD$10 to AUD$15 upside, more so in the old crop.

The AUD was back sharply overnight after hinting at a collapse late yesterday. Currently the AUD is steady at a number not far off the overnight low of 65.32. Talk of another 25-50 points rise in US interest rates and most punters expecting not to see rate hike here in June is probably the key to this. There’s of plenty of talk around the US debt ceiling but realistically I don’t think there are too many punters out there that would expect to see a US default, seriously, politicians are going to fail to pay themselves, really.

Most punters appear to be ready to kick the AUD down the stairs, good for exports, if we can find anyone with money to sell the stuff too. Not so great for importing, not that imports are flowing into our ports are breakneck speed anyway. How long is the wait for a new tractor now, 6 – 8 – 12 months or more.

It appears that the government is still happy to kill supply driven inflation by killing what little demand there was left by simply absorbing any free cash left circulating by increasing living costs. If you every needed to write a book on how to push a prosperous world into depression, you have a 4-year draft in the history books already to go.