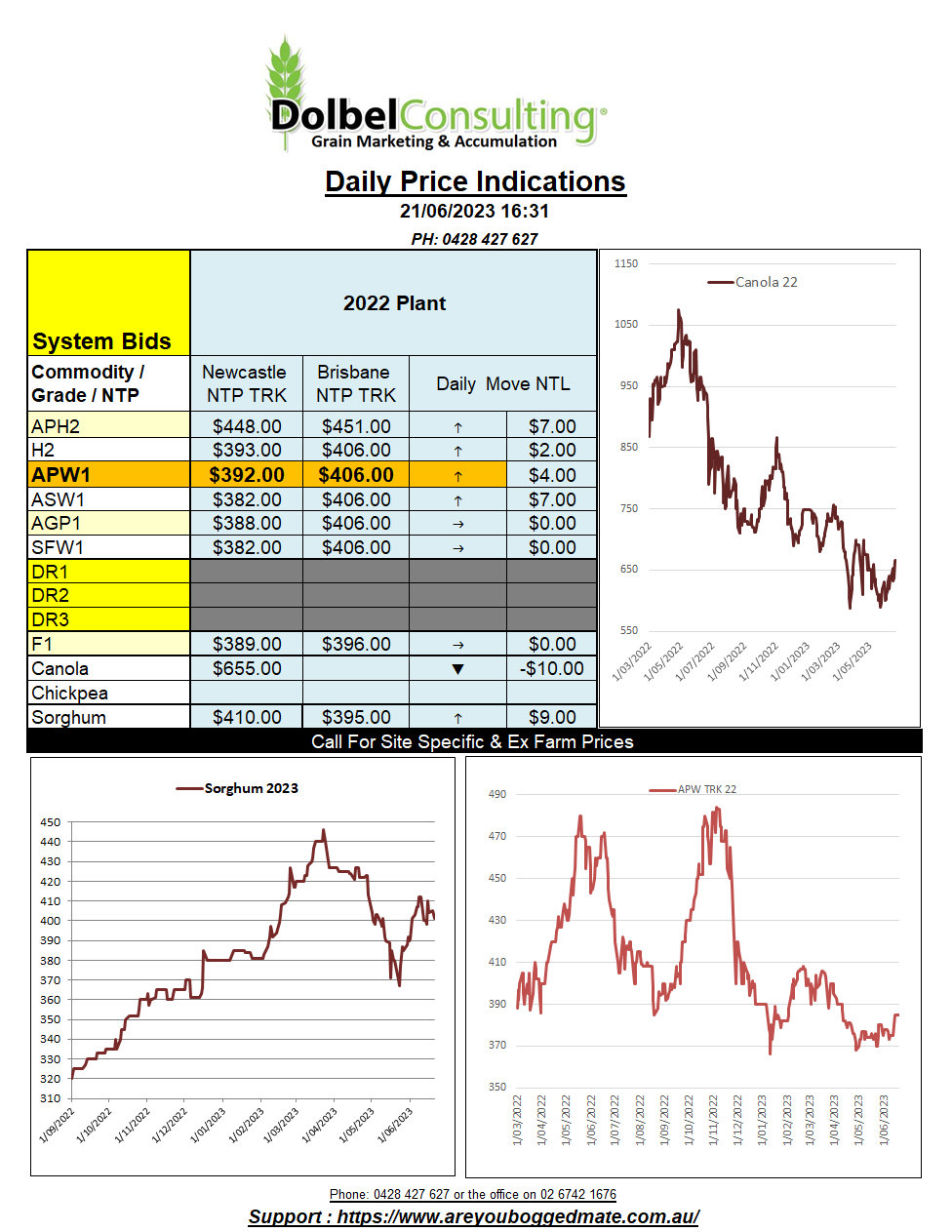

21/6/23 Prices

It’s interesting in the US grain futures at the moment for two reasons. Funds were short futures, very short, up until the recent rally in wheat, corn, and soybeans. Weather condition in the US central corn belt deteriorated quickly. This prompted a bit of a rush for the door, a reversal of their short positions. In the process we’ve seen soft red winter wheat rally significantly, partly on the back of corn and beans.

This is interesting as soft red winter wheat production in the US isn’t under any threat at all. In fact, SRWW production should be good, some producers stating the best they have ever harvested. Meanwhile the crop condition rating for corn, almost in the same region as the good SRWW crops, continues to crash. Some SRWW producers in the upper Midwest may well be wondering how they have managed to see great yields and rising prices at the same time. Well, it’s not often I say this, but they may need to thank a fund manager. But I guess, with all things funds related the million dollar question will be how sustainable is the rally and where are the caps and floors.

As for spillover strength into the Australian markets, we’ve not exactly reflected the move here, basis over SRWW futures at Chicago blew out last week. FOB basis slipping from a high of +79c/bu on the 15th to be just +32c yesterday.

The spread between HRWW, the wheat that really has issues, and the SRWW contracts at Chicago is still 110c/bu (AUD$59.55) maybe we are just seeing a narrowing of that spread, as we probably should be.

US corn condition rating fell further than trade expectations week on week. Last week 61% of the crop was rated G/E, this week just 55% is rated G/E. Focusing on the “I” sates, we see Iowa rated 59%, Illinois just 36% and Indiana 56%, further west Nebraska is only 59% G/E. Soybeans also noted a decline of 5% in the G/E rating, now just 54% G/E. The “I” states have little prospect for rain over the next 7 days according to the GFS model.