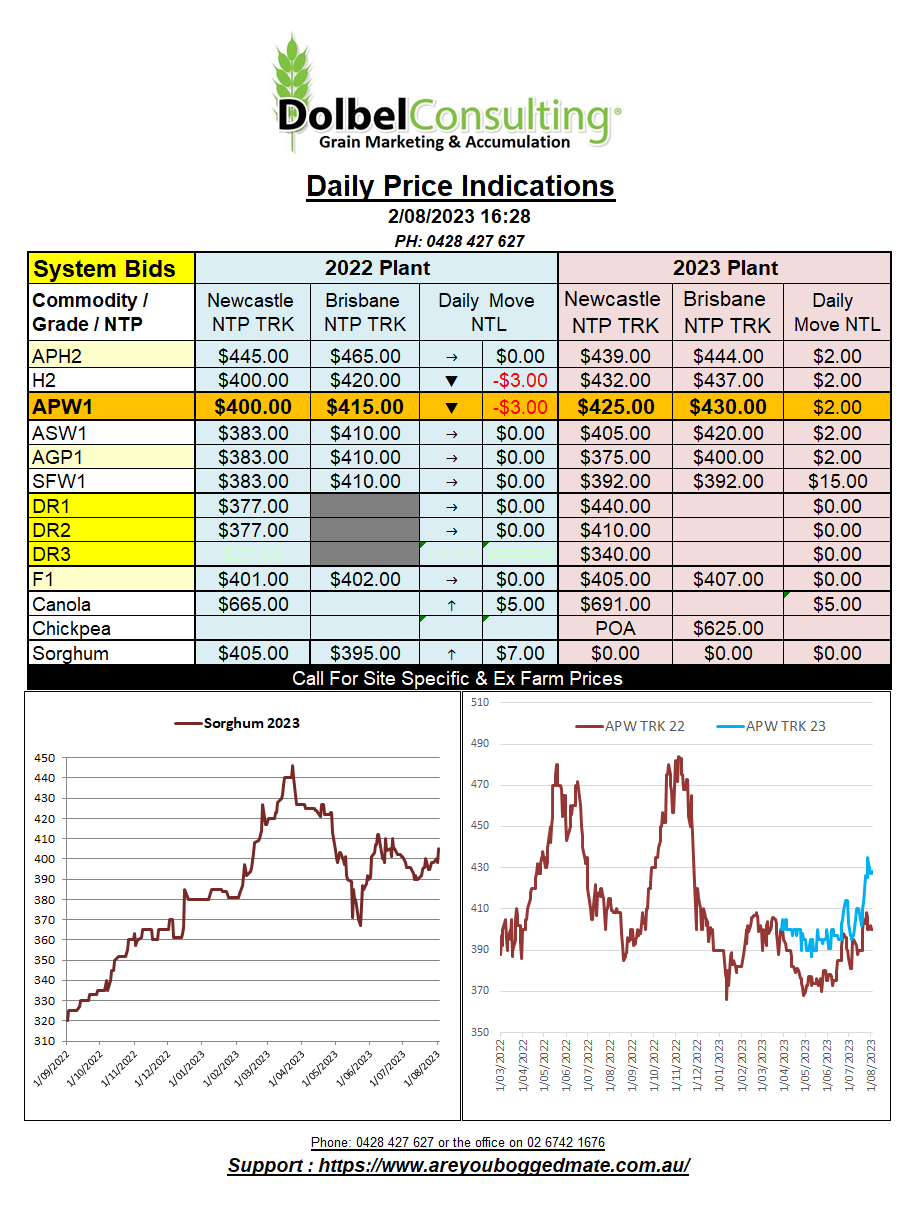

2/8/23 Prices

| International Commentary | ||||||||||||||

| The premium grade wheat held on better than the SRWW and HRW in last nights session in the US. The Chicago SRWW contract led the market lower, shedding more value than corn and soybeans. Soybeans actually found some support last night, Chicago bean futures closing in the green, up 12c/bu in the Jan24 slot. Both rapeseed futures at Paris and Winnipeg canola futures ignored the small correction in Chicago soybeans and continued lower. The Feb 24 slot at Paris shedding E2.00 and Winnipeg back C$3.80 in the Jan24 slot.

With the RBA holding the official rate at 4.1% and not following the US FED by increasing rates, it has allowed for some downside in the AUD against the greenback. Overnight the AUD fell against the US dollar by 1.55%. The AUD was also weaker against all the majors. This has turned potential downside in local canola prices here today to potential upside. The weaker dollar more than countering the lower futures at Paris. The net plausible gain, given a flat basis, is somewhere around AUD$16.00 in the new crop. The move in the AUD should go a long way to countering any weakness being exerted over the physical market by Chicago wheat futures too. There won’t need to be much of an improvement in basis to cover the possible $7.50 loss when converting the move to AUD at today’s exchange rate, the weaker AUD countering by about AUD$5.61/t. Russian wheat harvest passes the 31% mark, in total 37.4mt of wheat has been harvested. Wet conditions should start to withdraw later this week. |

||||||||||||||